American news and publications group News Corporation [ASX:NWS] and leading Australian real estate advertising agency REA Group [ASX:REA] have both shared thoughts on the housing market in unleashing results for Q3 FY23.

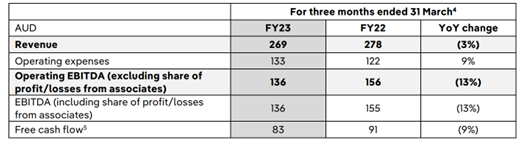

REA Group was falling slightly in the trading charts this morning after revealing its property revenue had declined by 3% to $269 million, blaming challenging economic conditions.

NewsCorp reiterated REA’s sentiments, its revenue also slipping 2% to $2.45 billion, dragged down by its real estate services. This also reflected a loss of $98 million, or 4%, impact from currency fluctuations.

Even so, shares for NWS were rallying higher at a 5% incline earlier on Friday, trading for $26.06 apiece.

REA, though still worth a hefty $137.34 a share, had slipped by 1% around the same time:

Source: TradingView

News Corp shares fly despite revenue dip

Net income was down to $59 million from $104 million gained the prior year, and EBITDA dropped 11% to $320 million, compared to $358 million in the prior year.

In Q3, NWS said it brought in $2.45 billion in revenue, claiming housing market volatility in both the US and Australia, which had bogged its Digital Real Estate Services revenue.

NWS struggled throughout the quarter in a tough advertising market as advertising revenues for the quarter declined 5%.

Ongoing pressures from rising costs and decreasing property prices also played their part.

But it wasn’t all bad news. For the group’s Dow Jones segment, revenues grew by 38% from the prior year, reflecting two acquisitions and continued double-digit revenue growth at Risk & Compliance. Total subscriptions to its consumer products crossed 5.1 million.

The Foxtel Group grew subscribers by over 3 million, and the group’s book publishing segment rose by 2% in adjusted revenues.

The corporation declared earnings per share of 9 cents each — a dismal fall on the 14 cents declared the quarter before.

Looking ahead, NSW says it should gain around $160 million in annualised savings via an upcoming reduction to its workforce.

REA Group experiences 3% quarterly revenue decline

Property advertising business and operator of residential and commercial property websites, realestate.com.au and realcommercial.com.au, had fallen in share price after revealing a decline of 3% in revenue, delivering $269 million.

The group said this came even despite a strong revenue growth in India.

However, looking over the past nine months, revenue had risen by 2% through to March year-on-year with $887 million.

Earnings had fallen by 13% to $136 million in the quarter, and by 5% in the nine months to $495 million — excluding associates.

Like NWS, REA also reported lower property-related earnings that had resulted from a challenging environment in Australia.

REA says it anticipates further losses in the mid-teen territory for its core business (from associates) throughout the financial year.

This is off the back of the aforementioned housing market conditions as well as investments in India, which will cut into earning losses and raised operating costs.

CEO of REA Owen Wilson acknowledged continuing uncertainty in the Australian property market. However, he believes conditions will improve with stabilisation of house prices and returning vendors in the near future.

Source: REA

Australia is set for some big change

Australia’s 30 years of abundant, robust trade has been broken.

Global supply chains have changed and aren’t the same as what existed years ago.

Clues are everywhere…have you noticed any of them?

Jim Rickards, one of the world’s top financial and geopolitical analysts, has.

He says no one is talking about how the Australian economy as we know it will end…and it could happen soon.

If you want to know more click here.

Regards,

Mahlia Stewart

For The Daily Reckoning Australia