A few years ago, an Australian researcher at the Geologian Tutkimuskeskus (the Geological Survey of Finland) decided to ponder a rather important question: what would the world look like if we actually tried to reach Net Zero?

This may seem like the sort of thing governments, companies, think tanks, energy agencies, intergovernmental panels and other institutions would have researched in great detail before committing the world to said Net Zero.

But, it turns out, they didn’t actually do the maths…not on a grand scale, anyway. And without considering certain key details.

And so, as an experiment, Simon Michaux decided to recreate our world as it was in 2018 on paper, but with the constraint of Net Zero. In other words, he calculated our energy demand assuming the electrification of what emits carbon, and he calculated the amount of clean energy needed to meet this demand.

But what happened next didn’t go so well. Because Simon also decided to calculate what we would need to do to achieve both these objectives — electrification of energy demand and building a clean energy system. He came to the conclusion that it’s just not possible. For a variety of reasons.

The key constraint is resources. Both electrification and renewable energy require a lot of resources, to put it very mildly. But there are many other constraints, including manpower, cost, and time. Today we consider another problem which gets assumed away by most researchers: space.

How much space does a Net Zero energy system require if we electrify our energy demand (meaning EVs replace combustion engine cars, for example)?

The answer is, of course, that it depends what forms of energy you use. But it’s pretty tough to squeeze enough energy in with renewables, however you try to do it…

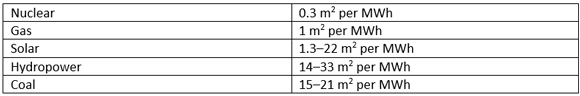

Our World in Data provides the hotly debated figures on how much space different forms of energy require:

|

|

Before you laugh too hard, a few things to notice about these figures…

For some reason, the mining footprint is included in the amount of space coal requires, but not for the others. Which is extraordinarily dodgy given the resource intensity of renewable energy greatly exceeds coal by many multiples, depending on how you do those maths. But, as you’ll have heard from Greg Canavan, picking and choosing figures is how the whole renewables story of Net Zero survives at all.

Adjust coal’s footprint for the mining and you’d get a much smaller figure. Crucially, the location for coal’s energy production is of our choosing and therefore near the demand source for power, requiring much less transmission line capacity in between. Even more crucially, coal’s energy system exists today, so the additional footprint of space needed is tiny relative to building a whole new green grid.

Second, I’ve only summarised the original chart based on averages. Solar power has a wildly wide range of figures depending on whether you install it on your home, or with a concentrating tower, or something in between. The same goes for hydropower, although the rare situation in which it can be used is prohibitive as a large scale solution anyway.

But here’s my favourite manipulation of the lot. You might’ve noticed that wind power didn’t make it onto the chart. That’s because it is literally and figuratively off the chart in the original version, with numbers of up to 247 m2 per MWh.

What about the minimum for onshore wind? According to the graph, 0.4 m2 per MWh…yes, almost as energy dense as nuclear. Which may seem just a bit dodgy. But, as the Our World in Data chart says, this doesn’t include the space between the turbines! Because land between turbines can be put to other uses.

Do you see how easy it is to play games with these figures?

But some renewable energy and Net Zero advocates like being expansive — the bigger the challenge the better, because it gives them more attention and (hopefully) more power over the rest of us.

Professor Jesse Jenkins at Princeton University put it like this in Mother Jones magazine:

‘We’ll have to build as much new clean generation by 2035 as the total electricity produced by all sources today, then build the same amount again by 2050.

‘This could ultimately require utility-scale solar projects that cover the size of Massachusetts, Rhode Island, and Connecticut combined, and wind farms that span an area equal to that of Illinois, Indiana, Ohio, Kentucky and Tennessee.

‘Building new wind and solar at this clip also means building new power lines more than twice as fast as we have over the past decade. If we’re going to plug in millions of new electric vehicles and heat pumps and tap into the best areas to generate wind and solar power, we’re simply going to need a bigger grid—up to 75,000 miles of new high-voltage lines by 2035, enough to run the distance from Los Angeles to New York City and back 15 times, or circle the Earth three times.’

That’s a lot of space taken up by renewable energy and related infrastructure! As one energy consultant put it, ‘It’s hundreds of thousands of acres if not millions for transmissions alone.’

Bloomberg did some similar analysis too:

‘Expanding wind and solar by 10% annually until 2030 would require a chunk of land equal to the state of South Dakota, according to Princeton University estimates and an analysis by Bloomberg News. By 2050, when Biden wants the entire economy to be carbon free, the U.S. would need up to four additional South Dakotas to develop enough clean power to run all the electric vehicles, factories and more.’

We’re talking 250 million acres of new wind farms alone…

Consulting firm McKinsey considered the scale of the space challenge too:

‘Additional solar panels and onshore wind turbines will need land—and a lot of it. Utility-scale solar and wind farms require at least 10 times as much space per unit of power as coal- or natural gas–fired power plants, including the land used to produce and transport the fossil fuels. Wind turbines are often placed half a mile apart, while large solar farms span thousands of acres.

‘The implications of this are daunting. Developers need to continuously identify new sites with increasing speed at a time when the availability of suitable, economically desirable land is getting tighter. Solar farms require flat, dry, sunny locations, while the best sites for onshore wind turbines are the tops of smooth, rounded hills, open plains, and mountain gaps that funnel and intensify wind. Many of the most attractive of these locations are already taken.’

That last point may prove crucial because renewable energy is already notorious for its intermittency. More importantly, the more renewables we build, the more correlated the performance of those renewables becomes because they are less far apart. They are more likely to be more intermittent at the same time.

My real point is that, just as voters are beginning to baulk at the cost of Net Zero, they will soon get uppity about the amount of space it takes up. And then it will get spaced out.

Regards,

|

Nick Hubble,

Guest contributor, Fat Tail Commodities

PS: Watch NOT ZERO now…Discover three energy stocks poised to rocket up…as net zero comes crashing down. STREAM THE VIDEO HERE…

Comments