Battery materials company Neometals [ASX:NMT] rose 10% on Friday after announcing a cooperation agreement with a subsidiary of automaker Mercedes-Benz.

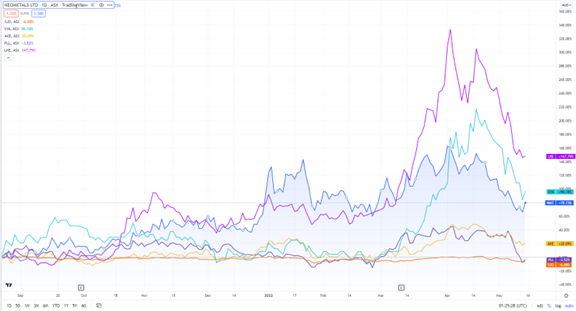

NMT’s strong gain on Friday formed part of a wider upbeat mood.

The Australian share market wasn’t spooked today, despite it being Friday the 13th.

The ASX pared back some of its losses recorded in the last week, with tech stocks leading the way.

The ASX All Technology Index rose as much as 5% on Friday, with the ASX 200 benchmark rising as much as 1.8% in late afternoon trade.

But is the bounce in Aussie shares a blip or a beginning of a recovery?

Source: Tradingview.com

Neometals Confirms Mercedes-Benz Venture

Neometals announced that Primobius — NMT’s joint venture owned 50:50 with SMS Group — entered a conditional, binding agreement with Mercedes-Benz’s wholly-owned subsidiary, LICULAR.

The agreement partnership has been struck for the engineering, supply, and installation of equipment for LICULAR’s recycling lithium-ion automotive battery systems plant.

Mercedes-Benz established LICULAR to ‘develop a holistic and sustainable recycling approach for lithium-ion batteries’.

Once final discussions close, Primobius will be responsible for developing all of the next-gen cell recycling, including licencing, skill-sharing, training, and management.

The plant in question will have the capacity to recycle 2,500 tonnes of lithium-ion a year (10 tonnes a day) and is intended to be built in two stages on royalty-free technology, a licensing courtesy of Primobius.

This agreement currently marks a 31 December 2026 term end-date, open to extension if both parties are happy to do so and provided LICULAR issues its purchase order soon.

NMT share price outlook

NMT Managing Director Chris Reed commented on the announcement:

‘We are delighted to formalise our long-term cooperation agreement with Mercedes-Benz. The R&D collaboration is as important to us as successfully supplying the equipment.

‘We are excited to work together to develop a more holistic recycling solution covering logistics, handling, compliance and sustainability. We are grateful for the opportunity and accept the challenge to futureproof our processing technology.’

As more automakers pivot to a future dominated by EV vehicles, securing needed battery tech materials becomes growingly important.

And securing supply via recycling is a long-term strategy on the part of Mercedes.

Neometals — via its Primobius JV — stands to benefit if it can execute.

As NMT’s Mr Reed noted earlier:

‘Lithium battery recycling supports conservation of resources, decarbonisation and supply chain resilience and we are excited to assist Mercedes in its goal to re-use recovered materials for the manufacture of new cells for Mercedes-EQ vehicle models.’

Now, while the EV revolution seems inevitable, it’s unfolding in a highly volatile world at the moment.

So if you want some ideas on how to structure your portfolio during these turbulent times, check out the latest investment presentation from veteran strategist Jim Rickards.

Jim describes his latest ideas on tackling the current macrocosmic environment as:

‘Geoeconomic diversification for the most unstable market in living memory, with an Australia-centric focus.’

For more information, click here…

Regards,

Kiryll Prakapenka,

For Money Morning