Locally-owned lithium-ion battery recycling group Neometals [ASX:NMT] has confirmed an improvement to NPV (net present value) for its latest Preliminary Feasibility Study (PFS) to recover vanadium in Finland.

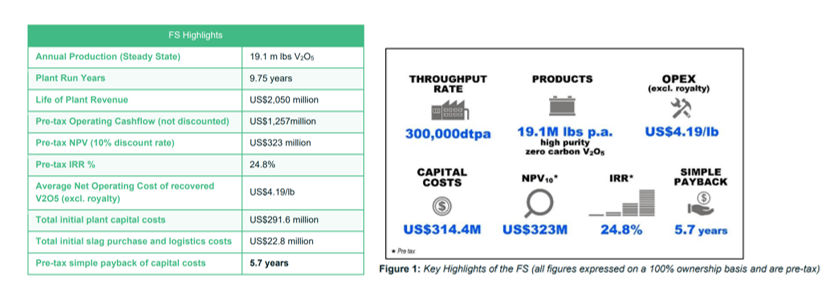

The PFS revealed a 40% increase in pre-tax NPV to US$323 million compared with the previous preliminary study, and confirmed a strategic average annual production of 19.1 million pounds a year (8,655 tonnes).

NMT dropped more than 3% this morning to 70 cents a share. The critical battery materials recycling firm has been battered by 20% in the last week and 48% in the year.

In both its sector and the S&P 200, NMT is trading down around 50%:

Source: TradingView

Neometals completes Vanadium recovery PFS

The sustainable battery materials producer has announced its success in completing an advancement and cost engineering feasibility study to assess the recovery of high-purity vanadium pentoxide (VO) from high-grade steel by-products.

Completed with Nordic engineering company Sweco Finland, the study confirmed an improvement to NPV — a 40% increase in pre-tax NPV, to US$323 million — and a pre-tax IRR of 24.8% on a 100% ownership basis (NMT has a 50% stake).

The study has allowed the company to pinpoint a strategic average annual production of 19.1 million pounds a year — or 8,655 tonnes a year — of carbon-negative high-purity VO, stemming from its 10-year supply agreement with Scandinavian steelmakers SSAB.

The FS assumes an average selling price of US$9.82 per pound VO plus a purity ‘premium’ and total capital costs for relevant infrastructure, slag purchases, and transport are expected to come to around US$314.4 million.

Neometals’ Managing Director, Chris Reed, said:

‘Neometals is encouraged by the outcomes of the FS. Importantly, increased evaluation detail and cost accuracy has not seen a significant departure from prior cost studies. VRP1 remains in the first quartile of the operating cost curve and since the historical PFS, the sector tailwinds behind this project have increased markedly. With our newly expanded 300ktpa feed rate and some updated data since the last cost study, the FS highlights the significant opportunity that exists. Specifically, that opportunity is to deliver some of the highest-grade, lowest-cost vanadium chemicals globally with a carbon-negative footprint. Security of supply is a key issue globally, particularly so in the EU where battery material resilience is the topic du jour.’

Under a binding feedstock supply contract with steel producers SSAB, the partners are to receive a supply of 2 million tonnes of slag with first rights to purchase additional tonnes.

The partners hope to produce high-purity, carbon-negative VO without the need to build a mine and a concentrator, setting them apart from primary producers, and thanks to Neometals’ wholly owned subsidiary Avanti Materials, they have an exclusive processing method to do it.

Pilot Plant testing resulted in product purities greater than 99.5% VO with maximum vanadium recoveries exceeding 75%.

Recently, the CRU Vanadium Market Study showed prices for VO with 98% purity could reach an average of US$9.82 a pound, plus a US$1.84-pound premium for 99.5% purity from 2027 onwards. The group’s planned production level in 2027 is expected to represent approximately 3% of global production, and its carbon-free product could also generate valuable credits.

Australia’s economy is changing…

Australia has had years of abundant, robust trade…but it’s broken.

The change is all around us — but it’s just the beginning.

There are plenty of signs, but most Australians won’t understand them.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has.

He says some events could end the Australian economy as we know it as soon as within the next 12 months.

And it will change the way we all live.

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime click here to learn more.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia