I promised to do a follow-up article on the economics book I was reading last week, but I was far too optimistic about my ability to sit around reading with a five-year-old doing home schooling (if you can call it that…).

So, I’m going to leap to the other end of the spectrum and tell you about a very high-risk stock that is looking interesting on the charts and has a heavy hitter as its major shareholder.

If you haven’t heard about De Grey Mining Ltd [ASX:DEG], they are a gold exploration company that hit it big in the Pilbara uncovering a new mining district.

Their share price has rocketed from 5 cents to $1.18 since February and the rally doesn’t look finished yet.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

De Grey launches into orbit

|

|

| Source: CQG Integrated client |

A little-known gold stock is currently drilling just up the road from the Hemi discovery and its major shareholder is the famous resource investor Mark Creasy, who holds nearly 50% of the issue.

It’s currently trading at 1.4 cents, but there are 2.7 billion shares on issue, so the market cap is around $38 million.

I don’t usually go near the penny dreadfuls and I’m usually wary of stocks with more than a billion shares on issue, but with Mark Creasy as the major shareholder, I reckon it’s worth a look.

The technical set-up is the thing that has my ears pricked up.

I like to look for stocks that are changing direction after having a large retracement of a major wave.

Coziron Resources Ltd [ASX:CZR] has ticked a lot of boxes for me technically, so I thought it would be a good opportunity to show you the set-up and explain why it is compelling.

Coziron building momentum

|

|

| Source: CQG Integrated client |

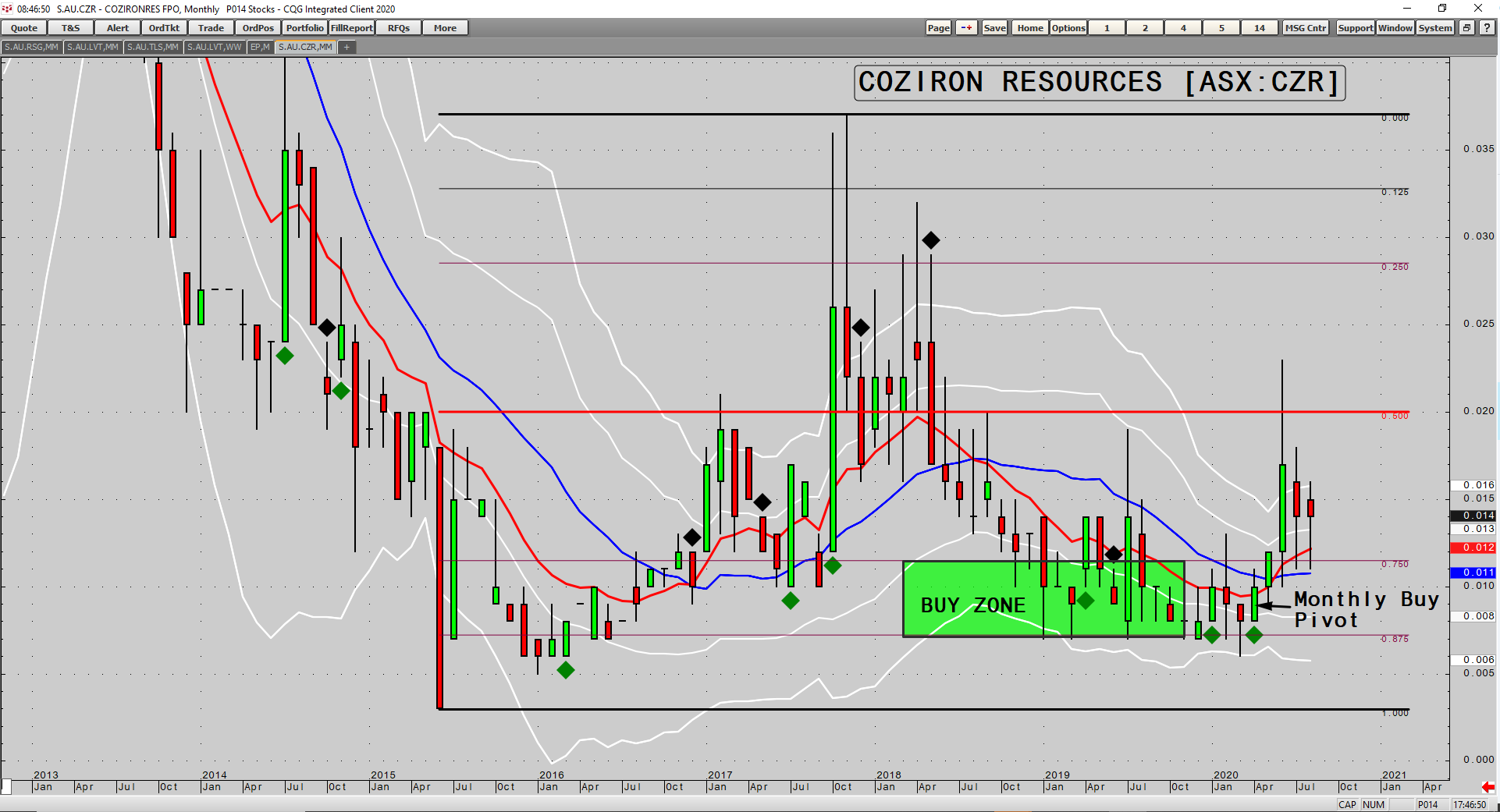

The chart above is a monthly chart showing trading since 2013. You can see the large rally that took place from 2015 to 2018. Prices then fell back to Earth, retracing all the way back to what I call the buy zone.

That’s the 75–87.5% retracement of the previous wave.

When I see signs of prices turning back up solidly from that area, I get interested in looking for trading opportunities.

The first signs of life are when a monthly buy pivot is confirmed. That’s when prices close on a monthly basis above the high of the lowest price candle. It’s what needs to happen before a stock can start trending to the upside again.

There have been a few monthly buy pivots over the last year from the buy zone, but they ignited fresh selling which pushed prices back to the bottom of the buy zone.

But you can see prices were always well supported at the bottom of the buy zone.

The most recent rally from the lows has had legs and has managed to shift the long-term trend based on moving averages.

I use the 10-month exponential moving average versus the 20-month simple moving average to define the long-term trend.

Once the long-term trend has shifted I like to see a retest of the moving averages, which usually gives you your best entry if prices are going to continue trending.

You will notice in the above chart that the last time the long-term trend turned up prices initially blasted off to the upside. But then a few months later prices sold off back to retest the 20-month moving average and that was your chance to get on for the next leg higher — which was a massive rally.

We are in a similar situation now, and the fact they are currently in the middle of a drilling campaign just up the road from a major discovery should see some buying interest build in the stock.

They are currently drilling at the top camp of the Croydon gold project, where they have already had some promising results with the best being 8m at 10.2g/t from 135m. Later drilling will move to the bottom camp prospect where priority targets have been identified.

I want to make the point that I’m not telling you to go out and buy this stock today. It is just a good example of marrying a solid technical set-up with an interesting though very high-risk story.

Trading a stock such as this is so high risk that you need to have a solid trading plan. Just buying it and hoping for the best is one way of approaching it, but my guess is that most of the time it will end in substantial losses.

Why I like to take part profits as soon as I can

The way I like to trade high-risk situations is that I aim to take part profits as soon as I can. Then I adjust the stop-loss on the remainder of the position to a point where I will breakeven on the whole trade.

Using the CZR example above, I can see that there will be plenty of resistance around 2 cents based on past price action.

2 cents is the midpoint of the range CZR has been trading in for the past five years. It is a good target on the current rally, and I would be keen to take profits around there.

I usually sell a third of my stake at the initial target, but this is such a high-risk situation I would probably sell half of my stake so that my breakeven price was lowered substantially.

If I were to buy at 1.4 cents and then sell half my stake at 2 cents, my breakeven price on the whole trade would be 0.8 cents.

That means once I take my initial profit I can sit back knowing that if prices turn down and hit 0.8 cents, I will walk away with my initial capital intact. But as long as prices stay above there I have a free call option to see what happens next.

I like my breakeven price to be below major support. The low reached in March this year was 0.6 cents, so I would usually prefer to have my breakeven level below there.

But the extreme level of risk and the clear resistance above means that I would trade off the need for a breakeven level below 0.6 cents with my desire to take part profit at resistance above.

Taking on risk when trading little stocks like this doesn’t mean you should throw caution to the wind and risk every cent you put in.

A little planning beforehand can ensure that you give yourself the best chance to expose yourself to massive upside while protecting what you have.

I’m always interested in how other traders tackle the market. My friend and colleague Callum Newman is great at finding interesting stocks and managing risk along the way.

Callum uses techniques some of the richest families throughout history have exploited. He’s running a special broadcast on Thursday called the Medici Event.

If you’re interested to find out more, go here. Callum’s going to reveal one of his current trades too.

Regards,

|

Murray Dawes,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments