Location intelligence company Nearmap [ASX:NEA] posted a ‘record’ March quarter but the market response was muted.

In late afternoon trade, NEA shares were down 1%.

The NEA stock, trading north of $4 in 2019, now exchanges hands for $1.40, down 35% in the last 12 months.

Source: Tradingview.com

Nearmap’s ‘record’ quarter

Nearmap achieved a record quarter for its government portfolio segment in North America.

Nearmap said it exceeded US$2 million in incremental annual contract value (ACV) from its government portfolio in the March quarter.

The ACV was generated from government bodies across 31 US states and two Canadian provinces.

NEA said that its technology is now used by government customers in 42 out of the 50 US states where it offers location data services.

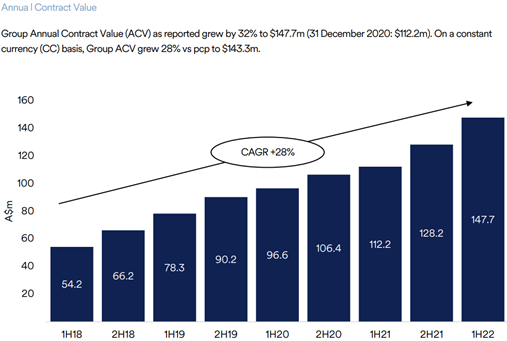

Today’s announcement follows news that in March, Nearmap surpassed $150 million in group ACV.

Nearmap CEO Rob Newman said:

‘Nearmap is attracting new business in North America at a record pace. With momentum already strong across our core verticals, the ability to exceed our target for the government sector in Q3 FY22 by adding more than $2 million in incremental annual contract value shows the underlying strength of our business and proposition.’

North America Portfolio Manager Tony Agresta explained their intelligence caters to all levels of government: urban planning, transport, emergency management, resources, and law.

He said a growing number of North American governments are ‘tasting the secret sauce that helps them to make smarter and better decisions for the communities which they serve’.

Agresta added:

‘Government customers in North America continue to be drawn to the diverse and innovative applications for Nearmap content and solutions. Nearmap has continued to extend our coverage model while delivering new products to market including the only scalable 3D and artificial intelligence data sets in the market. This world-leading capability complements our core vertical and oblique imagery products.’

NEA share price outlook

Nearmap reaffirmed guidance for group ACV portfolio to close FY22 ‘at the upper end of the $150m-$160m guidance range (FY:21: $128.2m).’

Source: Nearmap

The flat response to Nearmap’s record quarter may suggest investors don’t think today’s announcement is all that newsworthy.

In December 2021, NEA reported that its North American ACV portfolio surpassed US$50 million.

So an additional US$2 million secured in the March quarter from the North American government portfolio may have seemed insignificant to investors.

Or at least insignificant enough to rerate the stock.

After all, today’s announcement didn’t trigger a guidance upgrade for Nearmap’s group ACV portfolio; NEA merely reaffirmed it.

We will have to sit back and see how Nearmap’s US government campaign pans out, and whether its technologically motivated aspirations succeed.

Now, Nearmap isn’t the only business with ambitions.

Plenty of stocks are out there that you may not know about, embedded in industries with technological and innovative ideas that could bring in millions.

If you’re interested in finding out what some of these are, then check out this free research report on seven stocks to watch like a hawk.

Regards,

Kiryll Prakapenka,

For Money Morning