The Myer Holdings Ltd [ASX:MYR] share price is climbing after a FY21 trading update.

At time of writing, MYR shares are trading at 52.5 cents, up 11.7%. This marks a new 52-week high for the Aussie retailer.

After a protracted fall since the $3 high of 2013, the Myer stock is rebounding this year as it pivots to online.

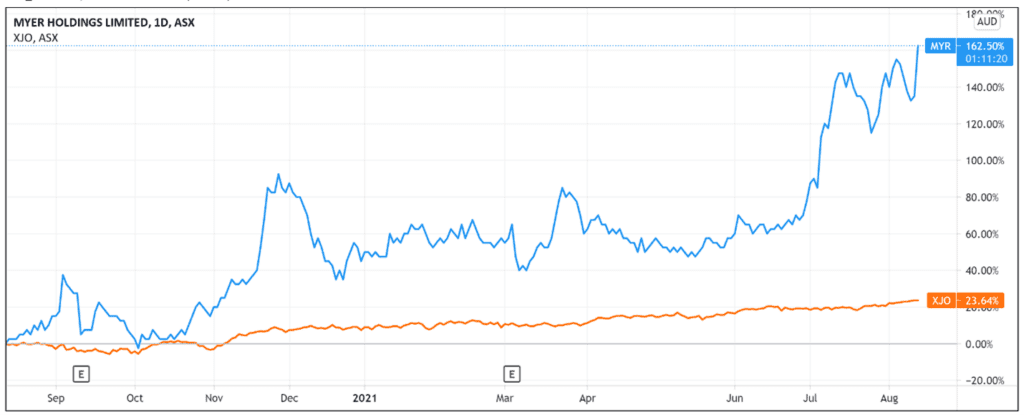

Over the last 12 months, Myer gained 155%.

Myer FY21 trading update

Myer shares are rising today after the retailer released a solid trading update based on preliminary, unaudited results for the 53 weeks to 31 July 2021.

The Aussie department store chain is expected to return to second half NPAT (net profit after tax) for the first time since 2H FY17 despite significant COVID-19 disruptions.

Note, these results are preliminary and yet to be audited.

Myer also reported total sales grew 5.5% compared to FY20, reaching $2.66 billion, with 2H FY21 total sales growing 38.3% compared to 2H FY20.

Importantly — and in a metric likely to be closely monitored by investors — Myer’s group online sales rose 27.7% to $539.5 million.

MYR’s online sales now make up 20.3% of the retailer’s total sales.

Myer’s EBITDA is ranging between $174 million and $179 million compared to $93.5 million in FY20 and $160.1 million in FY19.

2H FY21 NPAT is expected to come in between $4 million and $7 million.

Overall NPAT is expected to be between $47 million and $50 million compared to a net loss after tax of $11.3 million in FY20 and NPAT of $33.2 million in FY19.

Again, a sign the company is turning its fortunes around.

Myer ended FY21 with a positive net cash position of around $112 million. This compares to $8 million at the end of FY20.

Myer CEO John King shared his thoughts on the strong results:

‘Our Customer First Strategy continues to gain momentum, delivering a significantly improved full year profit result, despite the ongoing COVID impacts in FY21.

‘We will provide further detailed commentary at our audited results announcement in September.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

National distribution centre to boost Myer’s stores & online fulfillment

Myer also announced that it has bagged a 10-year lease on a new 40,000 square metre facility in Victoria, which will act as a National Distribution Centre (NDC) for both stores and online fulfillment.

NDC will also tackle the next phase of the Supply Chain ‘Factory to Customer’ initiative.

This will also target Myer’s Customer First strategy, which was followed by improvements to online operations that were undertaken last year and changes to international freight arrangements earlier this year.

So, how will Myer manage all these goals?

The answer is the NDC itself.

Located in Victoria, the NDC will be a state-of-art facility holding more than 100,000 SKU’s, with widespread customer benefits.

This will lead to a greater efficiency for both the stores and online businesses, and will be achieved through automation solutions.

King shared his two cents on the announcement:

‘Today’s announcement is another important step in our Customer First Plan.

‘It will deliver an enhanced experience in store and online for our customers but also significant efficiencies for the business through significant benefits from factory to customer.’

MYR share price outlook

Investors were impressed by Myer’s preliminary FY21 results as the iconic retailer shows signs of improvement.

So much so that the retail stock hit its 52-week high in afternoon trade.

There could be a few reasons.

One, Myer’s H2 FY21 total sales rose 38.3% despite state lockdowns and several periods of store closures.

Two, online sales grew 27.7% in FY21 but only account for 20.3% of Myer’s sales mix.

Bullish investors could argue Myer’s online sales are only set to grow — giving Myer more protection against lockdowns and easing its reliance on premium brick-and-mortar stores.

Over the course of one year, the MYR stock has returned more than 150%, trading in an uptrend.

The market may be thinking today’s news shows the momentum is still with Myer as it sets sights on bettering its performance in FY22 when — presumably — Australia will be more vaccinated.

Now, the chart for Myer is looking healthy, especially with the stock breaching a 52-week high.

If reading charts isn’t something you are used to but you’re thinking of getting better at, we have a great resource from our own resident technical analysis expert Murray.

So I suggest you have a look through his report on technical analysis to find out more.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.