Myer [ASX:MYR] delivered in line with its early August projections for the financial year, posting robust earnings growth, but it encountered a sluggish start to the second half of this year as sales ground to a halt.

Shares of Myer are fluctuating today, with shares down by 5% in this morning trading but recovering to flat by the late afternoon. Shares are currently trading at 63 cents per share as the bulk of the results were released and priced into the early August trading updates, where shareholders’ concerns about economic headwinds resulted in a 14% drop in the share price on 8 August.

Strong performance by the stock earlier in the year has kept much of the pain at bay for Myer, who peaked this year in early March, with shares trading at $1.13 per share. Since June, the share price has moved sideways as consumer sentiment and spending fell off and concerns grew.

So what’s next for the mega-retailer, and is it a barometer for the rest of the sector?

Source: TradingView

Myer full-year results

Myer achieved its FY23 guidance, but mixed results caused shareholder concern and led to morning sell action.

Myer’s net profit after tax tallied up to $71.1 million, marking the highest figure since the 2015 financial year and up from $63.4 million the previous year.

However, operating gross profit only saw a 6.9% uptick to reach $1.224.6 billion.

Myer seemed to struggle to replicate the solid sales in the first half of the year and saw growing challenges that cut into profit margins, which dwindled by 189 basis points to 36.4%.

The retailer attributed the decline to higher shrinkage from an uptick in theft and fluctuations in foreign exchange rates.

Theft rose to 1.8% of sales from 1.3% a year ago. This amounts to a further $16 million in lost stock, taking shrinkage totals to $47 million for the year.

Total sales climbed by 12.5% to slightly surpass the $3.3 billion mark, aligning with the guidance provided in August.

However, second-half sales exhibited a mere 0.4% growth as consumers tightened their purse strings and shifted their spending priorities towards essentials.

This slowdown and a dampened sales growth trajectory in early 2024 contributed to a decline in Myer’s share price, which dropped 14% following the early August update, pricing in much of the reaction that would have been expected today.

Myer’s exiting CEO, John King, expressed his thoughts on the results, saying,

‘In line with our trading update…we are pleased with the strength and quality of our full-year result.

‘Despite a softer trading outcome in Q4 due to current economic conditions, we not only delivered our best full-year sales result since 2005 but also maintained profitability and a strong balance sheet.

‘This provides a solid foundation to pursue our future plans and growth opportunities under our successful Customer First Plan. This year, we distributed $86 million in dividends to our shareholders, demonstrating confidence in the Plan and the Myer business.’

Shareholders are set to receive a final dividend of one cent per share, marking a notable drop from the 2.5 cents per share distributed as the final dividend in the prior fiscal year, 2021–22.

Nevertheless, the full-year dividend payout of 9 cents per share represents a more than two-fold increase compared to the 4 cents per share paid out in 2021–22. This marks the highest dividend payout since 2014, a silver lining for investors.

In another notable development, Solomon Lew, the longtime majority shareholder, is set to acquire a further chunk of the company, bringing his stake in the company to 26%.

Outlook for Myer

Viewing Myer’s results is very much a game of two halves.

If we were just looking at the start of the year, there would be aspects of Myers’s market position that would be enviable to many. Its size and brand awareness command a respectable position where it can operate with economies of scale.

However, the hiccup in sales growth and the dip in profit margins during the latter half of the fiscal year are factors that the company will need to address to sustain and enhance its competitive edge in the market.

The outgoing CEO’s ‘Customer First Plan’ has been in motion for a number of years now and has been an effective turnaround program in consolidating store numbers and reducing sizes in the name of cost-cutting.

These actions and judicious inventory management have left the company with $120 million in cash and in good shape to handle rougher conditions in the coming 12 months.

That could prove significant as macroeconomic headwinds could further suppress slowing sales if we dip into recessionary waters.

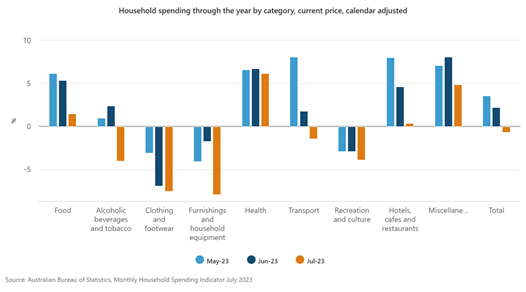

This deceleration is attributed to consumers grappling with the impact of successive interest rate hikes, and their consumption of clothing and household goods has fallen sharply.

Source: ABS

The changing of the guard is also a notable development within Myer’s trajectory.

With CEO John King retiring next year, the company’s board has engaged Egon Zehnder to spearhead the search for a new Chief Executive Officer.

A search for a new CFO is also underway after Nigel Chadwick flagged his departure early next year.

This transition adds a layer of intrigue to Myer’s journey as it navigates both leadership changes and an evolving retail landscape.

As the retail sector remains in a challenging spot, Myer’s could prove a key player to watch in the months ahead to scope the level of pain the wider economy may feel if things continue to slow.

The future is always a challenge to guess, the latest forecasts from bank bosses have tipped Australia for a soft landing.

But things remain uncertain, and so in times like this many retail investors move into more defensive positions

That often means looking for companies that will weather the storm and provide dividends.

Finding dividends that are worth your time

The market has roiled stock investors for the past year — The ASX200 has only gained 2.18% in the year so far.

With things looking uncertain in the stock market, maybe it’s time to change tactics.

Smart investors are focusing on quality stocks that can provide safety and pay dividends.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the smart move.

He calls it the Royal Dividend Portfolio, and he believes it’s the sweet spot between growth and dividends.

If you think you’re overexposed in uncertain times or simply too defensive with cash and bonds, you may want to consider making a smart play.

Click here to learn more about what that looks like.

Regards,

Charles Ormond

For Money Morning