Today’s Fat Tail Daily starts with a pleasant observation: retail sales just surprised to the upside!

And, hey, here’s something even more notable: furniture retailer Nick Scali [ASX:NCK] is in 52-week highs.

What’s going on?

Let’s get some context around this.

Yesterday, the Australian Bureau of Statistics released the latest data on this. Sales were up 2% for the month.

This kind of short-term data release is tricky to interpret.

Was it because of Black Friday and the Christmas boost? Is it simply because immigration is so high? Will it reverse as rates keep biting?

I don’t know…but I generally take it as a positive. And here’s the important bit…relative to what the market has priced into retail stocks…

The market became very bearish around this sector late last year.

Contrarians take note.

My small-cap advisory service is Australian Small-Cap Investigator.

Last year, I recommended my subscribers pick up Beacon Lighting Group [ASX:BLX].

I put a caveat on it. You had to be willing to hold 2–3 years.

Why?

Retail is cyclical.

I didn’t know when the shares would come back into fashion, nor how long the share market would stay in its (then) funk.

What I did know was that Beacon was a credible, successful operation with multiple growth angles — in Australia and overseas. What the idea needed was time and patience.

It’s working so far, and quicker than I thought. We’re up about 30% already.

As above, we know Nick Scali is pumping up recently.

Jun Bei Liu at Tribeca sums up why the fund managers are likely chasing the sector now:

‘Despite an expected weaker first half, underlying earnings should begin to reflect economic reality while heading into a better environment within six months or so.’

Where else can we look for an unexpected move like this?

My ‘dog of the ASX’ opportunity for 2024

If you’ve been around the market for a while, you’ll recognise the ‘Dogs of the Dow’ strategy I’m channelling here.

The gist is to look at the worst performers in one day with the idea that one or two could rebound strongly in the new year ahead.

The ASX 200 returned about 7% last year. The index always obscures the wide variation across individual stocks.

My sector is the small-cap sector. Here’s an example.

My best-performing recommendation last year was Tuas [ASX:TUA].

It rose more than 150%.

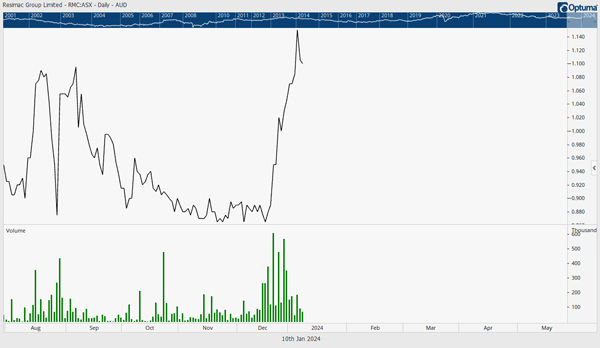

In August, I recommended subscribers buy mortgage lender Resimac [ASX:RMC].

We’re only mildly positive on it as of now.

Frankly, the stock was mired with low volume and lack of interest, as were the other ‘non-banks’.

However, I’m noticing a lot more volume come into the stock in recent trade.

See for yourself…

| |

| Source: Optuma |

You’ll notice the stock has lifted quite strongly in the last month.

Be aware that is has low liquidity, so it doesn’t take much buying to really pull the price up.

However, I suspect small-cap fund managers are nibbling here. Fellow stocks in the sector AFG, Pepper Money, and Liberty Financial are also modestly rising.

Why so?

Resimac, for one, is an established and profitable lender. Its main division is mortgage lending but it’s also building out its asset finance sector as well.

Non-bank stocks have been carted since 2021. We had rising rates, a property slow down, and even a regulatory headwind.

The big banks were (are) pinching their customers with cash back offers and heavy mortgage discounting.

They were able to do this, in part, thanks to cheap RBA funding firms like RMC don’t have access to.

However, that rolls off mid-year.

We also know property is rising again, car sales are strong, and mortgage growth modest but positive.

Non-banks can also service niche borrowers that banks don’t want. They also seem to be pivoting toward commercial property while residential mortgages are subdued.

In other words, non-banks, like retail, are heavily discounted for a very bearish economic outcome that hasn’t materialised as bad as feared.

Granted, it’s not a clear blue sky ahead…but again, like retail…patience and time is key here (2–3 years), I’d be very surprised if they didn’t come out ahead.

This is an example of how much value is latent across the Australian small-cap sector.

Resimac is still down about 60% off its all-time high. I like the idea a lot.

And don’t forget to ask me in January 2025 how my Dog Trade went.

Best wishes,

|

Callum Newman,

Editor, Fat Tail Daily

Comments