- Move over Tesla. It’s Ford coming up on the right-hand lane to overtake you.

I don’t mean in terms of sales.

I mean in positioning to lock-up supply of future battery metals…and in Australia, no less.

Did you see what happened last week?

Ford sent out a news release sketching out multiple deals with Australian resource stocks.

Ford has plans in place with Syrah Resources [ASX:SYR], Ioneer [ASX:INR], BHP Group [ASX:BHP], and Rio Tinto [ASX:RIO].

Here’s how The Australian reported it:

‘Automotive giant Ford has stepped up its efforts to secure its future supply chain in the electric vehicle space, with the company’s eyes firmly set on Australian-listed partners to secure essential minerals needed for its giant factories.

‘The deals are part of a $US50bn plan by Ford to produce more than 2 million electric vehicles by 2026.

‘Ford is only one among many carmakers planning a rapid expansion into the electric vehicle market, which has promoted warnings that the supply of essential battery materials such as lithium, graphite, nickel and cobalt might struggle to keep up with the automotive industry’s manufacturing plans.’

Hello!

I’ve been banging the drum that the big auto firms would go shopping in Australia. You can see all the details in this recent presentation.

It’s not as if Ford is the only company with this need. Most of the European firms need to get moving here. And don’t forget the biggest EV market is in China.

My colleague and friend Murray Dawes referred me to an excellent discussion around the switch to the green economy last week.

The scale of the demand for battery minerals is staggering.

It’s so staggering that the analysts in this video don’t think it can happen in the 2030 time frame.

It’s not just the logistics of finding, permitting, and extracting the deposits.

It’s because so many known deposits are located in problematic areas…like Russia, for example.

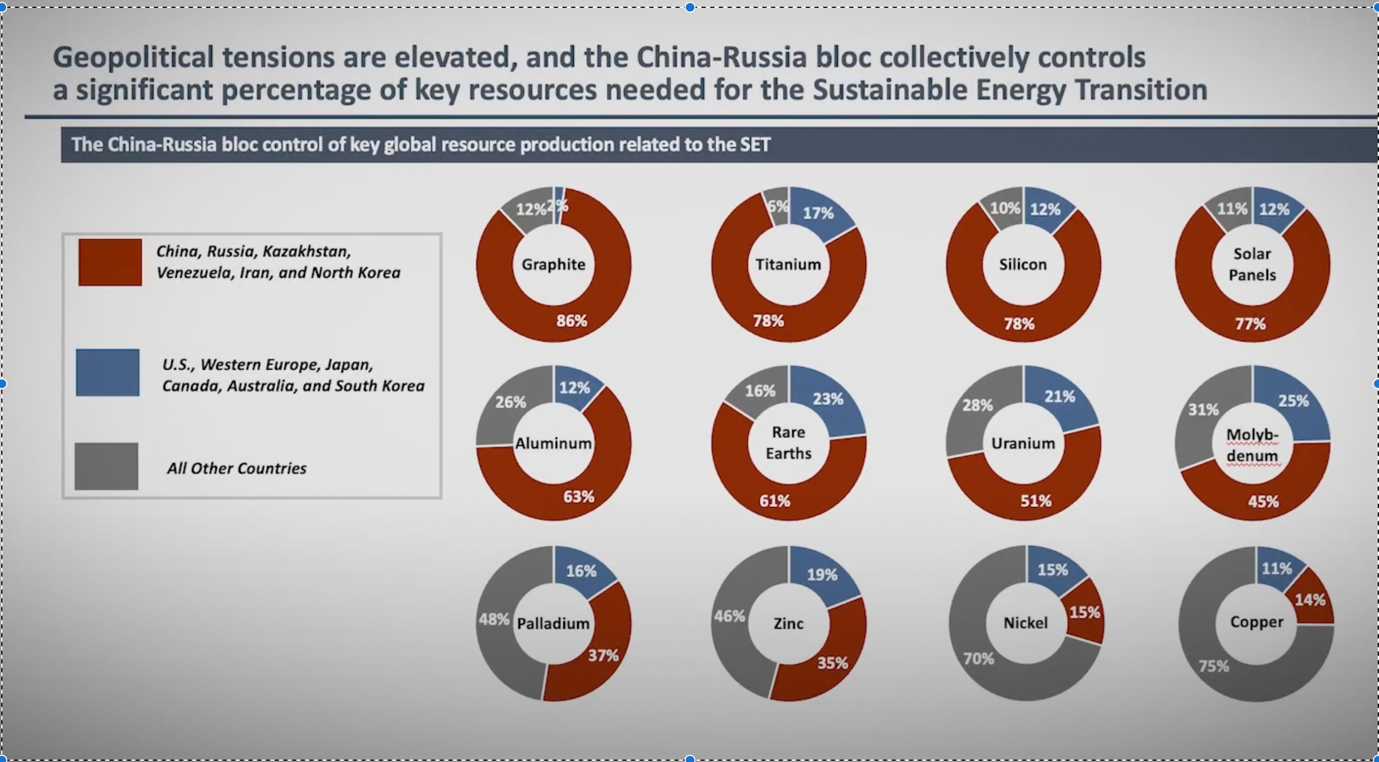

As an example, check out this chart:

|

|

| Source: USGS, Statista |

You can take the simple color code as red = problematic and blue/grey = lower sovereign risk.

What’s even more fascinating right now is that the generalised global concerns are driving down commodity prices and therefore tanking commodity stocks.

Here’s fund manager Jacob Mitchell clued into the opportunity and cited in the Australian Financial Review (AFR) today:

‘Mitchell is also bullish on companies positioned to profit from the world’s mandated transition to renewable energy sources over the decades ahead.

‘He says the recent fall in the copper price to near $US7600 a tonne, versus highs above $US10,000 a tonne earlier in the year may be an opportunity given long-term demand for the metal should be fuelled by the energy transition.

‘We wouldn’t be against the idea of a super-cycle [in copper and decarbonisation] over the next 20 years…’

‘But you’ve got to be very mindful of your entry point. I think you’re getting a more reasonable entry point now, because of the sell-off you’ve had.’

Again, it’s time to go shopping for these types of stocks.

The lead times on mining firms are so long that by the time they’re pumping out earnings in 2024 and 2025, none of us will remember whatever is driving the market right now.

I’ve got three favourite stocks on this theme. Again, you can check them out here.

2) I went to see my accountant last week. Lovely chap. Around 70. He runs his own super like me.

When I say he runs it, I mean he bought some stocks about 15 years ago and apparently never bought or changed anything since. You know the list: banks, BHP, Telstra…that kind of thing.

He mentioned he thought it might be time to go shopping with the market sell-off.

I agreed and said he might like to look at the Real Estate Investment Trusts (REITs).

‘What’s that?’ he asked.

‘They own property’, I replied. ‘And pay out the income.’

He’s the second man I’ve mentioned REITs too…and neither, not being active in the market, knew what they were.

There’s potentially good buying here.

REITs have had a tough 12 months because inflation and bond rates have yanked them down.

The sector is beginning to trend up again — though it’s still early days.

There was article on this theme in today’s AFR:

‘While the REIT sector has underperformed the broader market by 10.3 per cent this calendar year, much of that weakness occurred between March to June, when the 10-year bond yield jumped from 1.7 per cent to 4.2 per cent. Over July, as bond yields eased back to 3.4 per cent, the sector has outperformed.

‘With the outlook for the global economy weakening, Macquarie expects the US 10-year note yield to fall to 2.25 per cent by the end of next year, with the yield on the Australian 10-year treasury easing down to 2.5 per cent.

‘“Provided a recessionary event does not coincide with a material widening of credit spreads, this should result in a reduction in borrowing costs, aiding the performance of the real asset classes such as REITs, in our view,” Macquarie analysts wrote.’

I agree. I just tipped a REIT for readers of my service, Australian Small-Cap Investigator. If you’re looking for income, REITs are a great place to go looking. You can check out my latest issue by clicking here.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Don’t forget to check out my podcast here on Spotify. So much material…and it’s all FREE.