Last week, I was at the office having a chat with our new analyst, Charlie Ormond.

He’s working with me on a new tech-focused concept set for launch in early 2024.

We’re in the planning and research stages and diving deep into various areas of the tech space we think will surge next year.

While we were doing this research, we hit upon an interesting development with lithium-ion batteries.

It could throw a spanner in the works for all the lithium bulls out there.

But first….

A story of changing fortunes

Let’s face it, no matter what happens to markets in the short term, the ark of progress only goes one way when it comes to technology.

Up!

And in my opinion, it’s practically a dead cert that the most valuable companies in the world will continue to be tech companies.

But maybe not the ones that are ruling the roost right now.

The truth is, the story of tech has always been a story of creative destruction.

We always talk about how tech disrupts non-tech companies — Kodak and Blockbuster are the classic examples of that.

But we often forget that tech eats itself too.

Google destroyed Yahoo, Facebook decimated Myspace, VHS beat Beta…and so on and so on it goes.

Even Apple — now the world’s most valuable company at US$2.3 trillion — was once only 90 days away from bankruptcy as sales stalled in the early 90s.

It took the re-instalment of one Steve Jobs in 1997 to turn that ship around. And boy did he do that.

But my point is, leading tech stocks are at just as much risk of being disrupted as leaders in the non-tech arena.

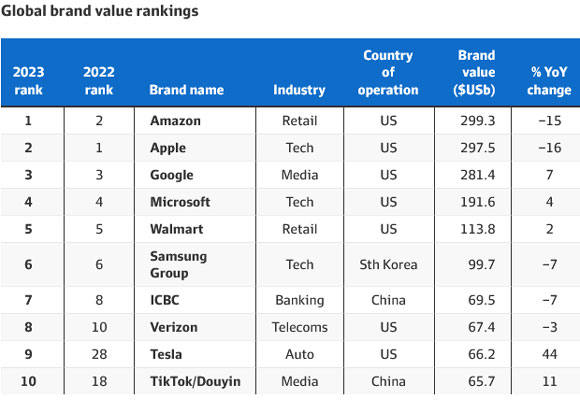

For example, look at how Tik Tok came from nowhere to overtake Facebook as the world’s top social media brand this year:

|

|

| Source: AFR |

But here’s the thing…

Sometimes, even entire technologies are made obsolete virtually overnight.

The discovery of oil and associated petroleum products in the late 1800s for example killed much of the whaling industry — the blubber was used extensively as oil.

Which brings me to a point about lithium…

As common as salt

The lithium market is one of the success stories of the past decade.

Riding the coattails of the electric vehicle trend has created millionaires and even billionaires in Australia as a consequence:

|

|

| Source: The Australian |

The ongoing assumption is that lithium-ion batteries will be the battery of choice for mass produced electric cars.

But what if that’s wrong?

It appears there are some challengers making ground.

Sodium — basically salt! — batteries are making it into Chinese production cars this year.

As per an article in Clean Technica, the advantages of sodium are clear:

‘Lithium is abundant, but difficult to extract and purify for use in batteries. Last year, the price of lithium carbonate peaked at over $80,000 per ton, although it has come down considerably since then.

‘Sodium is also abundant, but unlike lithium, is readily available. For instance, the price of sodium carbonate is around $300 per ton today. Sodium — one of the primary components of table salt — is chemically similar to lithium, and thanks to the explosion in lithium carbonate prices, many companies are researching ways to use it to replace lithium in the batteries for electric vehicles.’

There are some technical challenges to overcome with sodium, but it appears Chinese car companies are forging ahead.

Big battery makers CATL and BYD have both already put sodium/lithium hybrid battery packs into commercial cars.

And of the 20 sodium battery factories planned or under construction, 16 are in China.

But sodium isn’t the only lithium alternative the Chinese players are looking into…

Never seen before ore!

As the headline two days ago read:

|

|

| Source: Independent |

It appears the Chinese have just discovered an unusual rare earth ore in North China’s Inner Mongolia region.

The rare earth niobium was found inside a new ore called niobobaotite.

Niobium can be used to make more advanced lithium-ion batteries.

But it can also be used to make game changing niobium-graphene batteries too.

Researchers say these batteries last 10 times longer than traditional lithium-ion batteries and the niobium ore body found by China would make them self-sufficient in this key ingredient.

As Dr Neto, a director at Singapore’s National University for Advanced 2D Materials said:

‘We have made significant progress in our development of niobium-graphene batteries which are proving to be a game changer in safety, efficiency, and sustainability,’

This isn’t just pie in the sky.

So what does all this mean for lithium investors?

Opportunity or value trap?

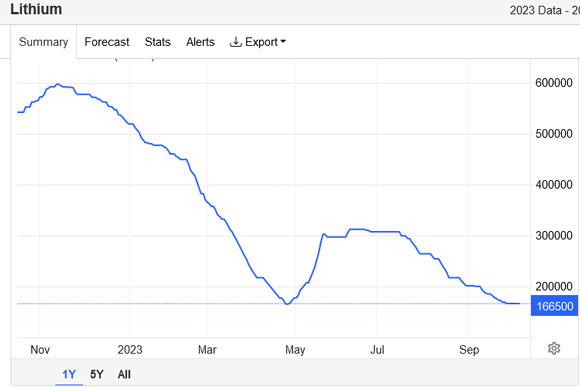

With the price of lithium down 70% this year, it’s clear something is weighing on the minds of lithium investors:

|

|

| Source: Trading Economics |

Is it the growing threat posed by substitutes like sodium and niobium?

Or is it just a bout of short-term negativity brought about by challenging markets?

If you can work that out fast, then you can work out whether the downturn in lithium stocks is an opportunity or a value trap.

For our part, Charlie and I haven’t decided which it is yet.

But if lithium isn’t the go-to battery metal people presumed, there could opportunities to jump on the ‘next lithium’ soon.

It’s the kind of opportunity we’ll be following closely in our new tech venture.

Because we do know one thing…

Electric cars, battery technology, and various advanced materials are set to be exponential tech themes for investors all through the 2020s.

Good investing,

|

Ryan Dinse,

Editor, Money Morning