The Magnis Energy Technologies Ltd [ASX:MNS] shares are on the rise after iM3NY signs additional sales contracts worth US$74 million.

MNS shares gained as much as 7% in early trade, peaking at 30 cents a share.

MNS is not the only lithium stock on the up. A whole swarth of lithium producers are gaining today.

At time of writing, Vulcan Energy Resources Ltd [ASX:VUL] was up 11%.

EcoGraf Ltd [ASX:EGR] was up 9%.

Core Lithium Ltd [ASX:CXO] was up 9%.

And Lake Resources NL [ASX:LKE] was up 7%.

Magnis adds more binding sales agreements

MNS announced today that its New York battery plant — iM3NY — secured another binding sales agreement.

The agreement is for US$74 million over four years with an unnamed US government supplier.

This adds to the US$655 million in binding sales the plant secured and announced on 3 May 2021.

That means iM3NY now has a minimum total of binding sales agreements worth US$729 million — or just under AU$1 billion.

New York plant 17.85% complete

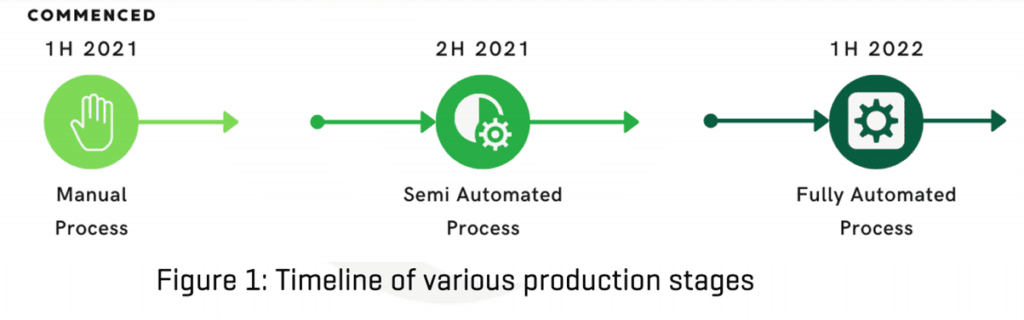

Magnis also updated the market on the construction status of its New York battery plant, which it said was nearly 18% complete.

Magnis also said the iM3NY facility clear-out work will be completed by 16 August.

This work will then trigger the moving of machinery into their permanent locations.

Construction material for the facility customisation work has already started to arrive at the New York factory.

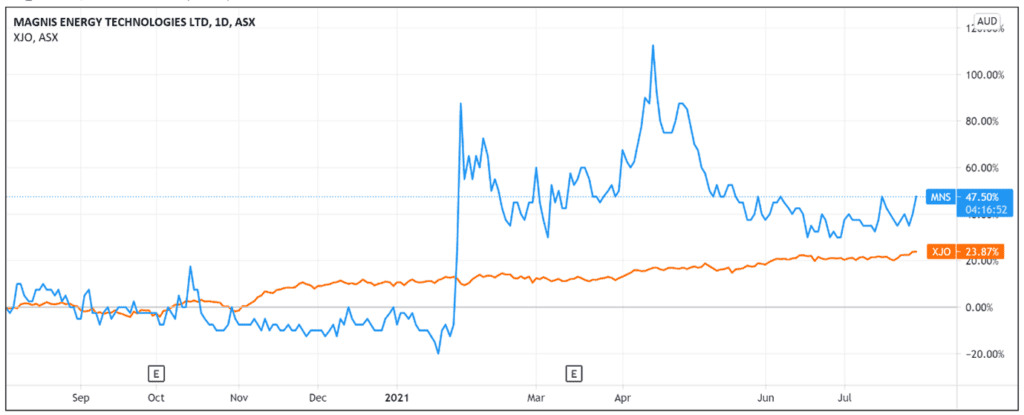

Magnis share price: lithium sector outlook

After a surge of investor interest in lithium stocks early this year, which saw the likes of Vulcan go from $3 per share to $10 per share in a month, the sector cooled somewhat.

But there seems to be renewed buying interest.

Take, for instance, Lake Resources.

After rising from as low as 8 cents to 39 cents in January, the LKE stock then traded sideways for months, even dipping in early May.

But the stock is surging again.

LKE shares are up 65% in a month, reaching its all-time high of 58 cents.

We can also see a similar story if we look at the Solactive Global Lithium Index.

This index tracks the performance of the largest and most liquid listed companies active in the exploration or mining of the white metal, as well as the production of lithium batteries.

As the chart above shows, after dipping in March and treading water through to early May, the global lithium sector is rising once more.

In fact, the index is at its all-time high right now.

Closer to home, asset manager ETF Securities reported last month that its Battery Tech and Lithium ETF returned 73% over the previous year to 7 July, making it Australia’s best performing ETF for the year.

What does this mean?

It seems the lithium industry is gaining momentum as investors are buoyed by the fact the January spike doesn’t look like the top.

James Stewart, co-portfolio manager of Ausbil’s global resources fund, told the Australian Financial Review that ‘what was a concept story a few years ago, is all of a sudden real now.’

‘Over the next 12 months, in particular,’ continued Mr Stewart, ‘we can’t see significant lithium volume coming online to meet the phenomenal demand for electric vehicles we’re seeing across Europe, China, and the US.’

What does this mean for the outlook for MNS?

For Magnis, like other producers dealing with a commodity like lithium, it’s best to make hay while the sun shines.

Meaning that Magnis will likely seek to capitalise on the tight market and rising prices by ramping up production.

That’s why iM3NY Chairman Shailesh Upreti said today they are encouraged by the recent developments that will ‘assist our growth plans to exponentially increase our annual capacity.’

Amidst the rising demand for lithium, many investors are likely monitoring the ASX lithium sector.

So, if you’re someone who’s interested in finding out more about the sector, I suggest checking out Money Morning’s free 2021 lithium report.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report