The Castillo Cooper Ltd [ASX:CCZ] share price is up 4.35% today, to trade at 4.8 cents per share, as new results firm up the explorer’s copper target.

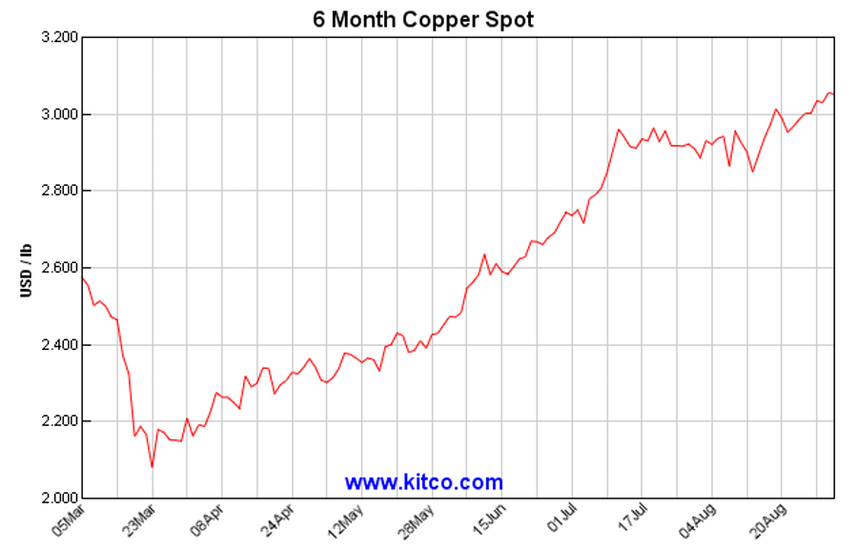

The copper price has been having a run akin to gold since the March market crash.

Source: Tradingview.com

As the Aussie–China relationship breaks down there has been some serious downwards pressure placed on the big Aussie miners.

This includes BHP Group Ltd [ASX:BHP], Rio Tinto Ltd [ASX:RIO], and Fortescue Metals Group Ltd [ASX:FMG].

I outline that specific risk here.

Though (some) small-caps have been surprisingly resilient.

Even thriving.

With the copper price kicking back into gear after a sluggish July, I thought it was time to check out a copper stock with some potential.

6kms of copper potential

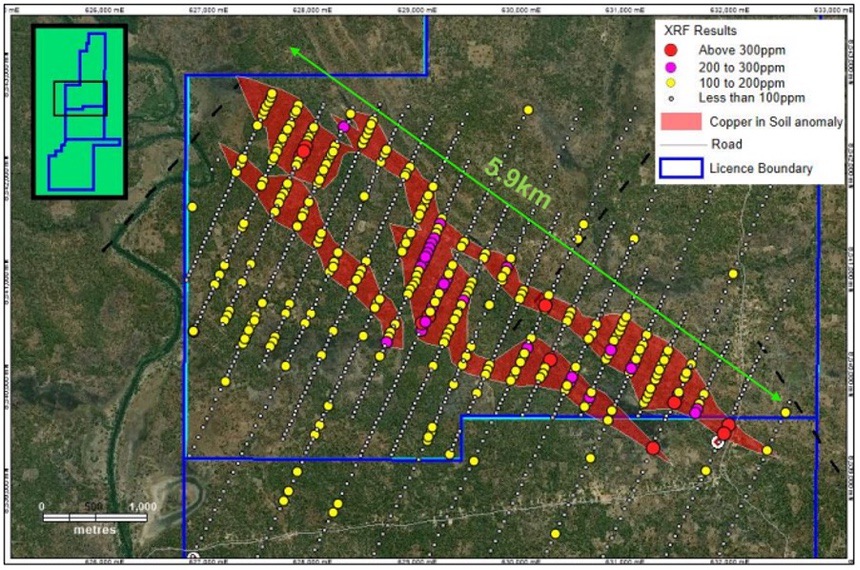

CCZ released the results of their surface sampling campaign at the Luanshya project in Zambia.

The project is located in Zambia’s traditional copper belt and is located close to two Chinese state-owned operating copper mines.

According to a Chinese entity’s 2018 annual report, its mines in the Luanshya region have proven probable JORC (2012) reserves at 52.3mt @ 1.26% Cu.

Which is comparable to some of the world’s larger copper mines.

Source: Castillo Copper

Though only a preliminary study of the area, the results underscore the potential exploration upside.

CCZ director Ged Hall remarked:

‘The work undertaken by our geology team in Zambia has delivered a compelling initial outcome, with a circa 6km copper strike to explore. This is the start of an exciting journey which is unfolding to the upside.’

CCZ said the next objective is to now systematically complete trenching and geophysical work to identify priority targets to test drill.

Though the company did not specify when drilling would commence.

Resurging resource mini boom

Though much of the focus has been on gold recently, the longevity of its bull run is a contentious issue.

The argument for base metals, such a copper, nickel, and lithium is far easier to make.

Source: Kitco

Copper has been on a tear since the end of March.

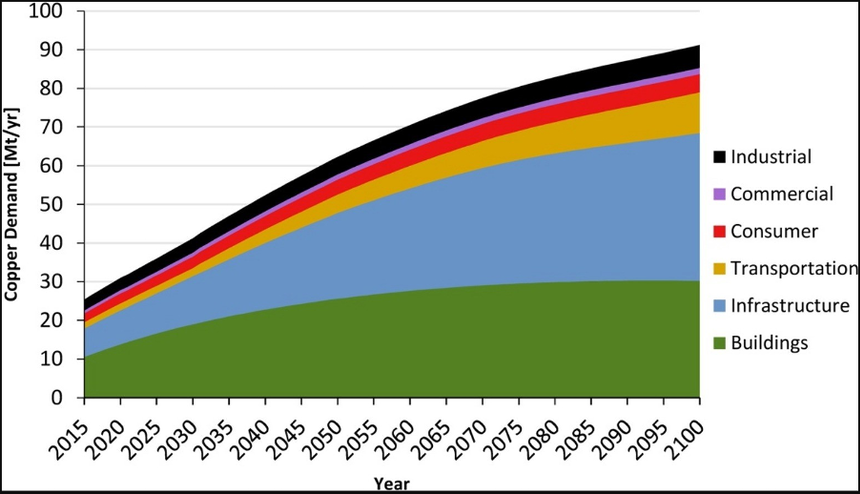

And demand is expected to significantly increase over the coming decade.

Source: Schipper et al (2018)

Nickel too is a boom time commodity.

Source: Kitco

Just take a look at its six-month performance.

What’s behind all this demand?

Despite all the doom and gloom you might see in the news, economies are pressing on.

And these metals are key to many materials and products consumers are demanding.

For example, electric vehicles have experienced an uptick during the COVID-19 pandemic.

Tesla has now turned a profit for the fourth consecutive quarter — a company milestone.

Much of the future tech — like EV batteries — needs copper, nickel, and lithium.

Which could be a key player in fuelling this next resources boom.

If you want to learn more about these in-demand base metals and how you can potentially profit from the next boom, then check out these two free reports:

Regards,

Lachlann Tierney,

For Money Morning

Comments