In today’s Money Morning…battery metal boom lures big names and big capital…EV records put nickel demand in the spotlight…and more…

Forget about the standoff between state premiers, the real drama is happening in the mining sector!

If you haven’t already caught wind of the ongoing fracas, Andrew Forrest and Mike Henry are in quite the bitter battle at the moment. With Forrest’s investment vehicle (Wyloo Metals) trying to secure a takeover of Canadian nickel miner Noront Resources.

The problem is, Mike Henry’s new-look BHP is also vying to win over Noront. Launching its own bid, and trumping Forrest, back in late July.

However, this week Forrest has hit back again. Making a revised bid for Noront that beats BHP’s recent offer. Kicking off a bidding war that is looking unlikely to end anytime soon.

As the AFR reports:

‘BHP has slapped down claims from Andrew Forrest’s Wyloo Metals that its bid for Canadian nickel play Noront Resources is doomed to fail and says it will not walk away from a takeover war.’

So, get ready for what could be an ugly clash of wealth and egos. A sideline spectacle that is putting nickel back into the spotlight for Australia’s biggest miners.

Battery metal boom lures big names and big capital

Perhaps the most fascinating aspect of this whole situation is just how tiny a prize Noront is.

Forrest’s latest bid amounts to roughly $445 million. A veritable drop in the ocean for Australia’s richest man. Which is precisely why a bidding war seems so likely.

Because cash or capital clearly isn’t the issue. It seems that pride is a far bigger factor.

Again though, the bigger story for outside investors, like us, is why this fight is happening at all. Because it is not every day you see two of Australia’s biggest iron ore miners clash over a relatively small nickel project.

But when you take into consideration the direction both BHP and Fortescue have been heading lately, it does make a lot more sense. After all, BHP is in the midst of shedding its huge petroleum business. While Fortescue is in the midst of conducting a massive pivot towards green energy solutions, like hydrogen.

Factors that provide some context for this apparent rush to secure nickel.

Battery metal fever has seemingly struck both BHP and Fortescue…

A scenario that presents a lot of interesting possibilities for Aussie investors. Because while this may just be some short-term speculative punt, I’d be inclined to suggest otherwise.

It seems more and more likely to me that nickel is quickly becoming the next ‘critical mineral’ in Australia. A potential boom that BHP and Fortescue are clearly hoping to play a part in. Especially after both of these major miners arguably missed the lithium bonanza of 2020.

Either way, it is something that you should take note of. Particularly as demand and the price of nickel climbs ever higher…

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

EV records put nickel demand in the spotlight

It shouldn’t really come as a surprise that nickel has had a strong year. Like many of its fellow base metals.

But the fact that it is seemingly still climbing is worthy of note.

Tuesday saw nickel prices reach a record high on the Shanghai Futures Exchange. Peaking at US$23,197 a tonne, marking a 21% year-to-date rise.

Meanwhile, on the London Metal Exchange, nickel prices also climbed higher to US$19,810 a tonne. Up an equally impressive 17% for the year, and closing in on that key US$20,000 mark.

Perhaps even more importantly though, stockpiles in both Shanghai and London are shrinking. Proving that the price movement isn’t fabricated on some sort of future expectation. Demand for nickel right now is strong and likely to only grow stronger.

After all, nickels use to make steel isn’t going away anytime soon. And as electric vehicle (EV) manufacturing continues to rise, more nickel will be needed than ever before.

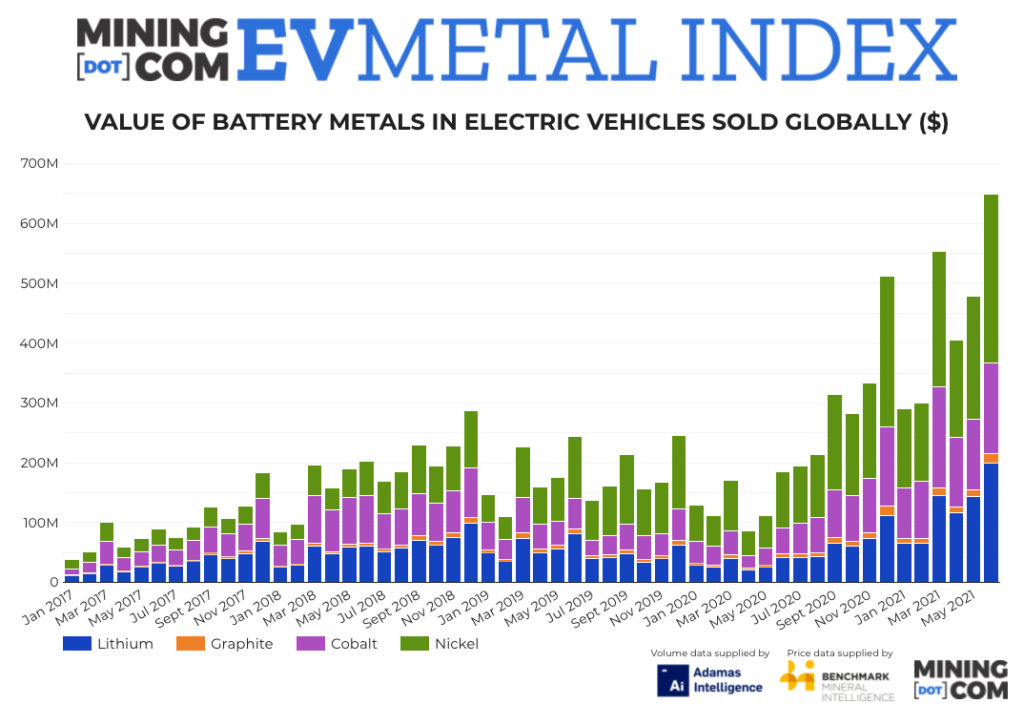

That’s not an opinion, that’s a fact. As can be seen in the following chart:

|

|

| Source: Mining.com |

What you’re looking at is a breakdown of the value of key battery metals in EVs. Split up between lithium, cobalt, nickel, and a smaller amount of graphite.

The last bar (June) shows that the amount of battery metals used in new EVs totalled US$649.2 million for the month. A 237% increase compared to the same month last year. Bringing the year-to-date total to a record US$2.68 billion.

Which, as mining.com points out, ‘means more EV battery metal business was done in H1 2021 than all of 2020, itself a record year’.

Plus, as you can no doubt see for yourself, nickel is the biggest contributor to this value metric. Due in large part to the increasing cost of the prized base metal.

A fact that I’d wager isn’t likely to change anytime soon.

BHP and Forrest’s clash for Noront seems to be proof of that. Something that should have you considering how to take advantage of this commodity resurgence.

Because if the big miners are fighting tooth and nail over it, it’s probably worth paying attention to.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.