Diversified miner Mineral Resources [ASX:MIN] responded to media reports it is considering a potential listing of its lithium assets.

MIN’s response was not exactly definitive, with the producer saying it regularly evaluates ‘various strategic options to maximise value creation for shareholders’.

Spinning out its lithium assets is one such option.

But whether it is being seriously considered, MIN was unwilling to say.

Any ‘previously undisclosed potential strategic initiatives being considered by MinRes are not sufficiently advanced or certain to warrant disclosure’.

But clearly sufficient for investor speculation.

MIN shares were up more than 11% in late Friday trade on the announcement.

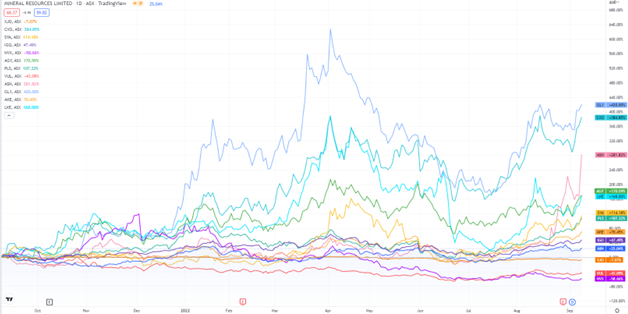

After a year marked by wild swings, MIN shares are up 40% over the past 12 months.

Source: www.tradingview.com

MIN confirms lithium plans

On Wednesday, the Australian Financial Review’s ‘Street Talk’ section reported that MIN was considering a ‘mega lithium spin-off’, with heavyweight JPMorgan in talks to handle logistics.

‘Street Talk’ said it could reveal that JPMorgan was working on floating MIN’s lithium assets in the US ‘in a bid to create billions of dollars of value for investors’.

Street Talk reported that MIN’s board has not committed to the spin-off yet.

But the spin-off looks attractive given the belief there is a big difference between the value of its MIN shares and dedicated lithium big-hitters like US-listed giant Albemarle.

In response to the article, MIN released a short statement on Friday.

In full, it reads:

‘Mineral Resources Limited (ASX MIN, MinRes) is considering a potential listing of its lithium business, MinRes wishes to advise that, in the normal course of business, it regularly evaluates various strategic options to maximise value creation for shareholders, including in relation to its lithium business. At this stage, any previously undisclosed potential strategic initiatives being considered by MinRes are not sufficiently advanced or certain to warrant disclosure.’

Lithium, net zero, and EVs

Governments worldwide are rushing to decarbonise in pursuit of Net Zero targets.

That has brought plenty of attention to battery metals — and battery metals stocks.

In 2021, lithium stocks dominated the ASX — eight out of the top 10 performing stocks were lithium stocks.

But the easy money has largely been made.

And many highflyers of last year — like Lake Resources — are trading down from their highs.

Yet the lithium theme is still strong, boosted by secular tailwinds.

So are there any overlooked ASX lithium stocks out there?

Yes, according to a recent research report from Money Morning.

In fact, the free report has outlined three Aussie lithium stocks that have been severely overlooked.

Regards,

Kiryll Prakapenka,

For, Money Morning