One of my recent themes in The Daily Reckoning Australia is the stronger-for-longer market of iron ore.

A point I made to my paid subscribers a few weeks ago was the high likelihood that bank analysts would have to mark up their earnings forecasts for the big miners like BHP, Rio Tinto and Fortescue.

And what did we see in the Australian Financial Review last week?

This!

‘Analysts have been forced to rapidly upgrade their forecasts following a surprise resurgence by spot iron ore this month, as China’s jawboning of commodity prices fails to keep a lid on the price of Australia’s No.1 export.

‘Elevated prices will only lend further credence to the expectation that dividend records are set to tumble in the next earnings season as the price of iron ore sits well above consensus with just three weeks of the 2021 financial year remaining, and keeping the S&P/ASX 200 in record territory…

‘“The upgrades to our iron ore price forecasts have transformed the earnings outlook for the producers,” said Macquarie analyst Hayden Bairstow. At spot prices, “material upside to our new upgraded earnings forecasts remains”.’

The dividend yields on the big three are huge. Fortescue Metals Group Ltd [ASX:FMG] may be around 15% now. The market could start to buy them up for income.

Now, a word of caution. The market doesn’t leave a cash cow like that alone for nothing. It is sceptical that iron ore can stay so high for much longer.

I’m arguing that FMG and the like will climb the wall of worry. My colleague Greg Canavan says it’s a warning sign. We’ll find out soon enough.

However, do we also have a little bit of ‘new paradigm’ thinking coming out now?,/p>

I saw this this morning too…

‘A new research note by investment bank BMO Capital Markets argues shifts in China’s steel industry, responsible for more than half of global crude output, will bring to an end a prolonged period of low margins and low capacity utilisation.

‘BMO points out that with global crude steel demand exceeding 2 billion tonnes for the first time ever and Beijing’s emissions curbs reportedly being extended into the second half of the year, Chinese exports will be significantly lower than in recent months:

‘With a robust global demand environment and very little spare hot-end capacity available to restart, we see an environment where global prices and industry margins remain well above through-cycle norms for the next 12-18 months at least.’

This last dynamic is not unique to iron ore now. I had a conversation with a mate of mine last week around this.

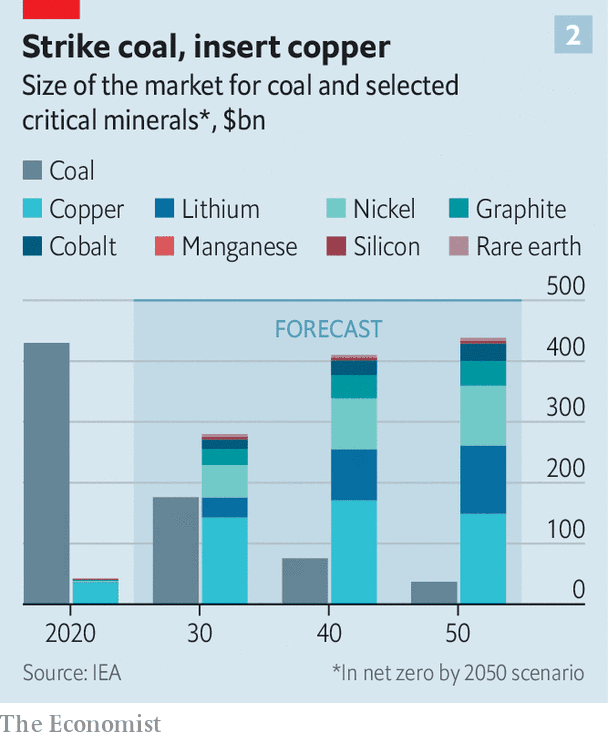

We are switching from a ‘fossil-fuel’ economy to a ‘metal’-based one. That must be true if the vision of electric cars and renewable energy is going to come true.

The Economist has a good piece on the scale of the challenge ahead in terms of raw material supply.

See here…

‘However, the fact that wind farms, solar farms and battery-powered vehicles are now cost-competitive does not mean they can be built at whatever pace politicians choose.

‘They require raw materials—sometimes, as with the Haliade-X turbines, in prodigious amounts—siting permits, infrastructure for transmission, recharging and the like. They also need lots of capital. And the necessary materials, sites and capital are all, to various extents in different places, in short supply.

‘The price of lithium has more than doubled in the past year. Copper prices are up by about 70%. Fights are breaking out over permits for new mines, wind and solar farms.

‘Capital remains poorly allocated; while big companies rush for offshore-wind projects around Britain, poorer countries with rising emissions remain starved for investment. If efforts to ease those constraints fail, the world’s decarbonisation plans will stall instead of soar.’

The article included the following graph just to ram the point home too…

|

|

| Source: The Economist |

Whenever I want to catch up with what’s happening in the ‘green’ shift in asset markets, I follow my colleagues over at New Energy Investor.

These guys are following the big markets of China, the US and Europe to make sense of this transition. You have to because it’s a world market with global implications.

It can also be very profitable for early investors who back the right companies. The market will always pay up for growth. I doubt there has been a market with a bigger growth runway than the global economy shifting from fossil fuels to metals.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.