Meridian Energy [ASX:MEZ], 100% renewable energy powerhouse based in New Zealand, was falling more than 2% in share value on Wednesday afternoon.

The falling shares came not long after the company provided its monthly operational report for the month of February 2023, in which it flagged decreasing national hydro storage and South Island storage, while New Zealand national electricity demand dipped on the same time last year.

Shares for MEZ were selling for around $4.85 at the time of writing.

The power company’s stock is currently performing in line with the ASX 200 market average, despite dropping more than 16% in its own sector, and down more than 3% so far in 2023:

www.TradingView.com

Meridian’s operations and market highlights

It was time for Meridian Energy’s monthly market review and operational highlights to be laid out on the table for its shareholders, so today the New Zealand renewable energy powerhouse provided its report for February.

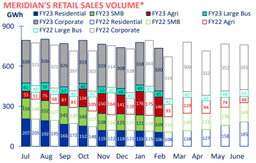

Meridian’s retail sales volumes in February were 9.7% higher than the same time last year, and compared to February 2022, segment sales had increased in small medium business by 5.1%.

Agricultural sales went up 56.1%, large business climbed 7.7%, and corporate also went up 2%.

However, the company’s residential sales had decreased by 2.5% in February the year before.

The group reported significant rainfall on North Island from Cyclone Gabrielle, and South Island rainfall was somewhat more variable, with above average temperatures recorded in most parts of the country.

The energy group said that in the month of February to 13 March, national hydro storage had decreased from 111% to 105%.

Likewise, storage at South Island had also moved down 94% of its average. However, in parallel to its cousin’s situation, North Island storage had increased 194%.

Total inflows for Meridian’s February energy were 86% of its historical average, made up of Waiau catchment inflows of 71%.

In terms of water storage, Waitaki catchment was 103% of average and Waiau was 62%.

Source: MEZ

Appraising the markets

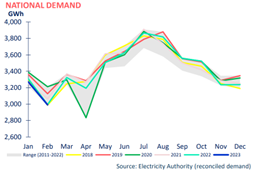

The group reported that national electricity demand in February was slightly lower than the same time last year.

National electricity demand had dropped by 0.1% as above average temperatures were recorded across New Zealand.

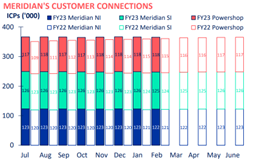

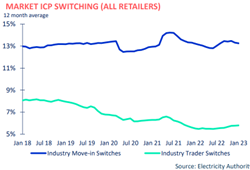

Demand in the last 12 months was 0.3% lower than the prior 12 months, and the 12-month average switching rate of customers swapping retailers was 5.8% by the end of January 2023.

Move-in switches, which consisted of customer’s switching retailers, was 13.3% by January’s end.

To date this financial year, retail sales volumes are 4.5% higher than the same period last year.

Source: MEZ

Yesterday, Meridian advised a dividend reintestment plan strike price for 2023 interim ordinary dividend under the company’s plan at NZ$5.21 per share.

The price was determined under the volume-weighted average sale price calculated on all sales of shares over a five-business-day period which started on 7 March.

Shareholders who wished to take part will receive shares instead of cash, as per the plan.

Meridian Energy reported net profit after tax of $201 million for the six months ended 31 December 2022, $56 million (or 39%) higher than the same period last year, and started 2023 strong despite variable changes in weather and demand.

The approaching drilling boom

It’s the era of drillers, with another boom already primed to begin.

In fact, several booms are marked to happen for every single metal that can be found on the periodic table.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Yes, it’s very possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert, James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart

For The Daily Reckoning