In today’s Money Morning…the revolt…down with centralisation…it’s a wild story, and I think it’s only just getting started…and more…

Today is a fascinating day.

One that people may be talking about for months, or even years to come.

It seems the GameStop/WallStreetBets saga has taken a new turn. A story that I thought I was done with yesterday.

Because while it was obvious that the hedge funds would fight back, I don’t think anyone expected it to be so blatantly manipulative…

While most Australians were sleeping, and the US market was trading, GameStop Corp [NYSE:GME] was once again the focus for many.

The army of users from the WallStreetBets subreddit didn’t back down. Sending the stock to US$469.42 shortly after the market opened. Continuing their attack on the huge short squeeze I discussed yesterday.

But it didn’t last long.

Seemingly out of nowhere, Robinhood and a handful of other trading apps prevented users from buying — and only buying — GME stock. As well as a handful of other companies earmarked by WallStreetBets.

The free market had suddenly been clamped down. And when more than half of all Robinhood users own at least some GameStop shares, it was pretty clear what their intention really was…

[conversion type=”in_post”]

The revolt

As you’d expect, the WallStreetBetters were irate. Seeing these restrictions as a clear move by the hedge funds to protect their money by stopping them from trading.

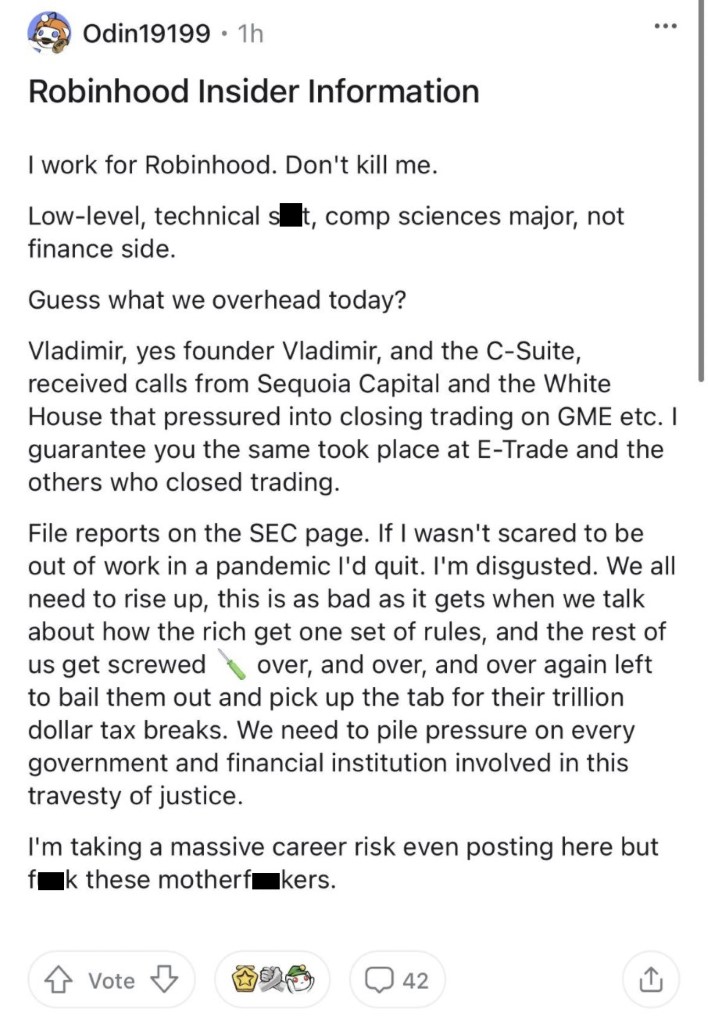

With one, and I can’t stress this enough, unverified whistle-blower sharing this on reddit (expletives redacted):

|

|

| Source: Reddit/Twitter |

Again, whether this is legitimate is unknown. It would not surprise me at all if it was just your typical internet troll. After all, WallStreetBets is infamous for them.

Having said that, it would also not surprise me if it was real either. Because when Robinhood shuts down market buying in the name of ‘volatility’ but allows users to sell — during a short squeeze, might I add! — it reeks of manipulation.

We’re already seeing some notable businesspeople come out and condemn this decision. With US politicians from both sides also calling for an investigation into Robinhood’s actions. Not to mention the filing of several class action suits already.

Like I said, I can’t believe the hedge funds and Robinhood would be this brazen.

Because of it though, we’re seeing this ‘meme’ turn into a movement. An event that some are already comparing to Occupy Wall Street.

Except this time, it’s hitting the elites where it hurts, their wallet.

And just like I said yesterday, someone is going to lose badly when this is all over. Whether it will be the hedge funds or the internet army though, is still very unclear.

I’m willing to bet though, that after today, Robinhood is finished.

You can’t turn your back on over half your userbase and expect them to stay loyal. They are going to seek out alternatives.

Down with centralisation

So, how does all this end?

Well, that is the ultimate question. One that no one has an answer to.

All I can tell you is that this market oddity is turning into an inflection point. Something that I fully expect to have dramatic repercussions for investing in the US, if not globally.

Whether it will benefit retail investors like you and I, is also an unknown. Because it would not surprise me if the hedge funds of the world find a way to tweak it in their favour.

Money talks, as they say.

However, I can tell you right now that it is already causing a shift.

The crypto market, for example, has gone nuts in the aftermath of all this. A sector that prides itself on being decentralised. Preventing any sort of ability for power to be rooted with any one person, or group.

Perhaps the closest thing there is to a truly free market in today’s world.

As Peter Smith, CEO of blockchain.com, tells Forbes:

‘This was a shot across the bow for institutional investors everywhere.

‘There’s incredible power in decentralized groups of individuals and the future of finance will be built less like Wall Street and more like the internet: by a decentralized group of individuals. My thoughts and prayers are with the many institutions that will learn this lesson the hard way.’

With political data expert Mark Rosenberg also weighing in on the matter:

‘This is a kind of “chaos finance” following the chaos politics of the past 4 years.

‘Bitcoin is a similar phenomenon. Expect further upheavals in markets, politics and society—and thus more and more pressure for tech regulation from the powers that be.’

It’s a wild story, and I think it’s only just getting started.

How it will shape broader markets — in crypto, stock, or otherwise — remains to be seen. But the point is, it has started.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.

Comments