If you’re a property buyer shopping in today’s market, you’ll be used to witnessing properties selling way above reserve.

Seems like every other day there’s another great BBQ story of an auction result smashing all records.

The latest to hit the headlines is a renovated four-bedroom house in Haberfield, NSW.

|

|

| Source: Domain |

20 bidders registered for the online auction. Frenetic bidding pushed the price more than $2 million above reserve.

The property sold for a suburban record of $7.02 million.

Happy vendors — happy bank.

Meanwhile, the RBA has warned it may be necessary to clamp down on household debt-to-income levels that increase the risk of financial instability.

‘The central bank is finding it hard to judge in real time whether prices are out of line with market fundamentals…’

Fundamentals?

There are no fundamentals behind a buyer’s decision to bid prices into the stratosphere in today’s market.

They’re merely speculating that in a few months/years, some Joe will come along and pay more.

If you know your real estate cycle history (that we teach over at Cycles, Trends & Forecasts) — that will certainly be the case in many regions of the country.

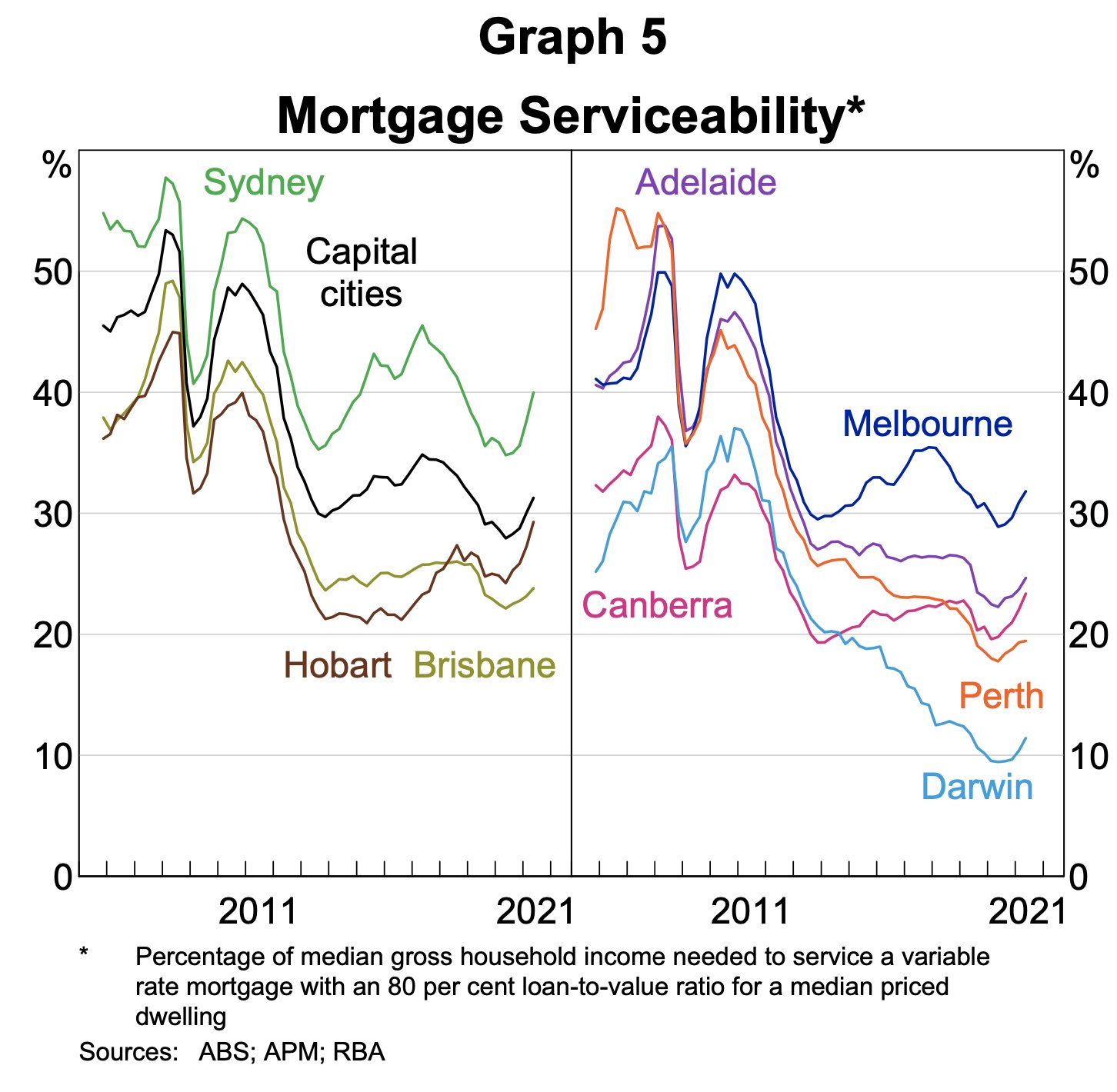

The thing is, data to the end of 2020 shows principal and interest repayments as a ratio of disposable income are at a 17-year low.

Mortgage rates fell further in early 2021.

In other words, housing affordability has improved considerably.

You can see this on the RBA chart below.

It shows the percentage of median gross household income needed to service a variable rate mortgage with an 80% LvR:

|

|

| Source: RBA |

Right now, Aussie households are sitting pretty despite the rise in household debt.

Problems won’t arise until lending rates begin to rise sharply.

The RBA has stated that annual wage growth needs to be ‘growing by at least 3%’ before rates are increased — and marked that date as 2024.

Financial markets are pricing it in earlier.

But either way, we have a while to go yet before we see the inevitable hike.

The other factor playing into price rises is an acute shortage of stock.

The table below paints the picture:

|

|

| Source: CoreLogic |

The figures above are based on the percentage change of old property listings.

By this, I mean listings that are more than 180 days old.

This is the discarded stock that lingers on the market.

There’s been a dramatic decrease in the volume of old listings.

That means buyers are scraping the bottom of the barrel for options — soaking up the old stock.

In the yearly trends, Canberra and Hobart have had over a 60% decrease in old listings.

Other capitals — a 50%-plus annual decrease.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

In the monthly percentage change, however, there’s been a marginal shift in Melbourne — with an increase in old stock hanging around.

This could be merely due to the lockdown — with restrictions preventing property inspections.

Or it could be part of a bigger trend.

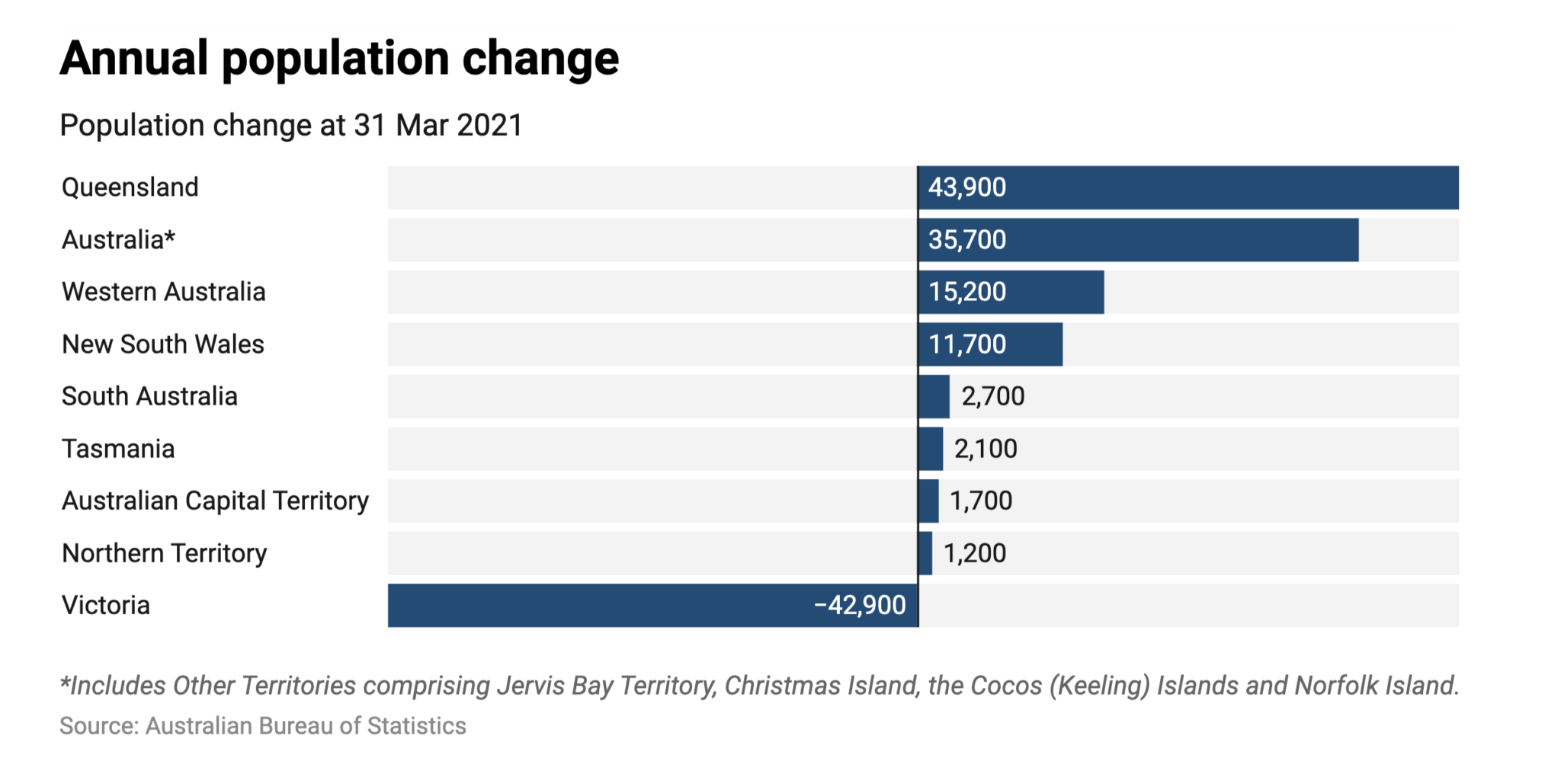

Melburnians are fleeing the state.

Many not willing to live with an increasing number of mandates and restrictions and no right to protest.

|

|

| Source: ABS |

That indicates there could be a slowing in Melbourne, with rumours of a flush of properties coming onto the market once lockdown lifts.

Vacancy rates are already high in many regions of the city.

Buyer beware.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.