Tech stock Megaport [ASX:MP1] surged more than 20% on Wednesday after its June quarter saw record monthly recurring revenue and an inaugural EBITDA profit.

Megaport reported an EBITDA profit for Q4 FY22, a company first, with Canada and Japan ‘becoming individually profitable ahead of schedule’.

Total revenue for the quarter rose 10% quarter-on-quarter to $30.6 million.

The popular ASX growth darling has been hit hard recently as sentiment soured, falling from an all-time high of $22 reached in November 2021, all the way down to $4.70 last month.

But it seems some investors are eyeing the stock again. MP1 shares are up 50% in the past month.

Source: Tradingview.com

Megaport eyes profitability

Megaport, who describes itself as a network as a service provider, today released a string of updates, biggest of all being its Q4 FY22 results.

Here is a snapshot of MP1’s performance:

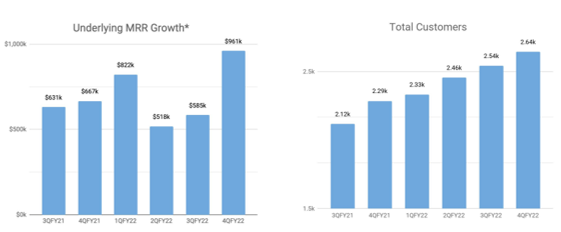

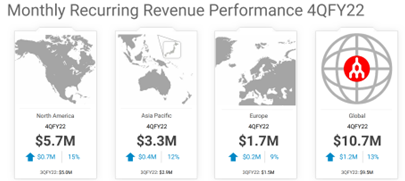

- ‘MRR for the month of June 2022 was $10.7M, an increase of $1.2M, or 13% QoQ.

- Revenue for the quarter was $30.6M, an increase of $2.7M or 10% QoQ.

- Customers at the end of the quarter were 2,643, an increase of 102, or 4% QoQ.

- Total Ports at the end of the quarter were 9,545, an increase of 533, or 6% QoQ.

- Total VXCs at the end of the quarter were 15,545, an increase of 839, or 6% QoQ.

- Total MCRs at the end of the quarter were 731, an increase of 61, or 9% QoQ.

- Total MVEs at the end of the quarter were 73, an increase of 14, or 24% QoQ.

- Total Services at the end of the quarter were 27,383, an increase of 1,447, or 6% QoQ.

- Average Revenue per Port in June 2022 was $1,120, an increase of $71, or 6.8% QoQ.

- At the end of June 2022, the Company’s cash position was $82.5M.’

Source: MP1

Megaport’s Chief Executive Officer Vincent English commented on the performance:

‘During the fourth quarter of fiscal year 2022 Megaport drove steady underlying revenue growth. Uptake of core products, as well as monthly recurring revenue growth, were strong in the quarter. This is driven by customers continuing to increase the number of service providers they securely connect through our platform as they undertake global digital transformation initiatives.

‘Increased service uptake and strong new customer growth resulted in our delivering EBITDA profit in the quarter. The underlying Megaport network and business model has strong operating leverage to further increase profit and generate cash as revenue grows. Japan and Canada have reached profitability ahead of plan and early indications are that Mexico may outperform plan expectations.’

Source: MP1

Megaport said the driving factor for its revenue growth is interconnection within its ecosystem:

‘The combined opportunity for interconnection within the Megaport IT services ecosystem is the primary driving factor for revenue growth, as opposed to enabled data centre metrics alone.’

MP1 share price outlook

English thought the fourth quarter boded well for the network connectivity stock, stating MP1 has a ‘clear runway to profitability’:

‘Closing fiscal year 2022 with a solid fourth quarter performance across all operating metrics provides excellent momentum going into fiscal year 2023. We have aligned our business to reduce cash burn and have a clear runway to profitability with a proven business plan.

‘We have a strong cash position with more than $80M available. With a record of successfully executing on our plans, we have a high degree of confidence in FY23 and will continue to stay out front as the leading global NaaS provider.’

While Megaport was pleased to report an EBITDA profit for the quarter — and English sees a clear runway to profitability — the tech stock still ended the year with negative free cash flow.

In the 12 months to 30 June, Megaport reported net cash outflows from operating activities of $16.4 million.

A further $50.2 million in cash outflows were recorded from investing activities, with Megaport spending more than $25 million on property and equipment during the 12-month period.

Can Megaport network as a service offer scale in the next financial year? Time will tell.

Now, while connectivity is of growing importance in the modern age, so too is decarbonisation.

One way to achieve our decarbonisation goals is via electric vehicles.

And while lithium has dominated the headlines surrounding EVs, we should not forget the other equally necessary battery tech materials — copper, nickel, cobalt, and graphite.

With lithium stocks correcting in 2022, there may be a smarter way to play the EV theme this year.

In our latest report, we profile this smarter way — which involves what you might call lithium’s little brother.

Regards,

Kiryll Prakapenka,

For Money Morning