Megaport [ASX:MP1] shares rose 9% after releasing its FY22 results with revenue increasing 40% to $109.7 million, and net loss shrinking 12% to $48.5 million.

While the stock has risen 35% in the last month, Megaport is still down 50% year to date.

www.tradingview.com

www.tradingview.com

Megaport releases its 2022 financials

Last month Megaport released its Q4 results for FY22 — becoming group EBITDA positive during the quarter.

This morning the company released its full FY22 accounts.

The key financials are as follows:

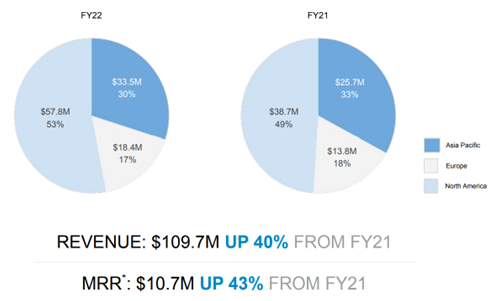

- Revenue from ordinary activities was up 40% on FY21 — reaching $109.7 million.

- Losses after tax fell 12% to $48.5 million in FY22 — down from $55 million.

- Monthly recurring revenue saw a 43% increase to $10.7 million from $7.5 million.

- Annualised revenue hit $128.3 million, up 43% from $89.8 million.

- Total customers rose 16% to 2,643.

- Total number of ports rose 24% to 9,545.

- Total number of services rose 26% to 27,383.

- Normalised EBITDA losses improved 23% to $10.2 million.

- Megaport’s closing cash balance shrank 39% to $82.5 million — down from $136.3 million.

Source: MP1

Source: MP1

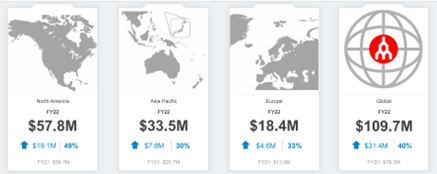

Revenue by region

- North America revenue was the strongest growth, climbing 49%, a total of $57.8 million on 2021’s $38.7 million (an increase of $19.1 million).

- Europe revenue also climbed, a 33% increase of $18.4 million compared with last year’s $13.8 million (an increase of $4.6 million).

- Asia rose 30%, bringing in $33.5 million in revenue — up from $25.7 million in 2021 (a $7.8 million increase).

Source: MP1

Source: MP1

Operational highlights

But what drove these results?

- Total customers improved in 2022, up 2,643 on 2021’s 2,285 customer base.

- Average ports per customer also rose, 3.61 on last year’s 2.37.

- Average services per port increased slightly, 2.87 up from 2021’s 2.82.

- Revenue per port also increased at an average of $1,120 in comparison with $974 in 2021.

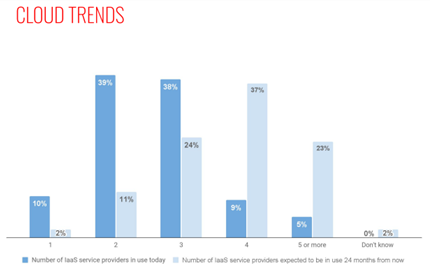

Cloud trends

Megaport cited research that 60% of study participants expect their companies to adopt at least four IaaS CSPs in the next 24 months.

Network investments are set to rise 15% over general IT budgets in the coming year.

Right now, 66% of branch locations rely on cloud connectivity.

Source: MP1

Source: MP1

Bevan Slattery, MP1’s Chairman said:

‘This massive growth in cloud adoption is fueling an ever-increasing dependence on critical communications infrastructure as data traverses between end users and public and private cloud locations. Megaport was built to solve this problem and founded at the junction where network infrastructure and operations meets next generation software and automation.

‘More than a means of scaling cloud connectivity, Megaport has become a fundamental part of solving for cloud interoperability.’

Megaport cuts staff as inflation bites

In its FY22 report, Megaport acknowledged it made 35 positions redundant to ‘reduce costs and prepare for rising prices and inflation’ across its key markets.

The redundancies were not announced during FY22 (having been made last month) meaning the redundancies have not been reflected in the current full year reports.

Megaport said the resulting redundancy costs were ‘unable to be measured.’

Lithium’s little brother

The world is striving to decarbonise, and electric vehicles (EVs) are a big part of that.

The mass adoption of EVs is set to boost demand for metals like lithium, copper, nickel, cobalt, and graphite.

And while the focus has been on lithium, our experts think there must be a much smarter way to play the EV boom.

It involves what you can call lithium’s ‘little brother’.

Regards,

Kiryll Prakapenka,

For Money Morning