In today’s Money Morning…why you should look further ahead than today’s rally…oil-gold ratio is not overbought…watch (or act!) as new money comes…and more…

It seems to be a good day to be holding anything.

In Australia, in the US, in the world.

Positive vaccine news is the trigger here.

According to the Australian Financial Review:

‘Stockmarkets exploded with euphoria after drug companies Pfizer and BioNTech said their COVID-19 vaccine was proving 90 per cent effective, fuelling hopes that an end to the pandemic nightmare is within reach.’

And, according to Bloomberg:

‘The news fueled [sic] a global rally that added more than $1.8 trillion to the value of the MSCI All Country World Index.’

The mega-bull returns.

Oil gained ground with WTI up around 7.5%, while gold sold off — shedding more than 4% in a short space of time.

So, oil is back on the agenda?

And gold is off the agenda?

It all depends on your time frame.

Three Innovative Fintech Stocks to Watch Now. Discover more.

Oil-gold ratio is not overbought

I’d be hesitant to say oil is in and gold is out over the next six to 12 months.

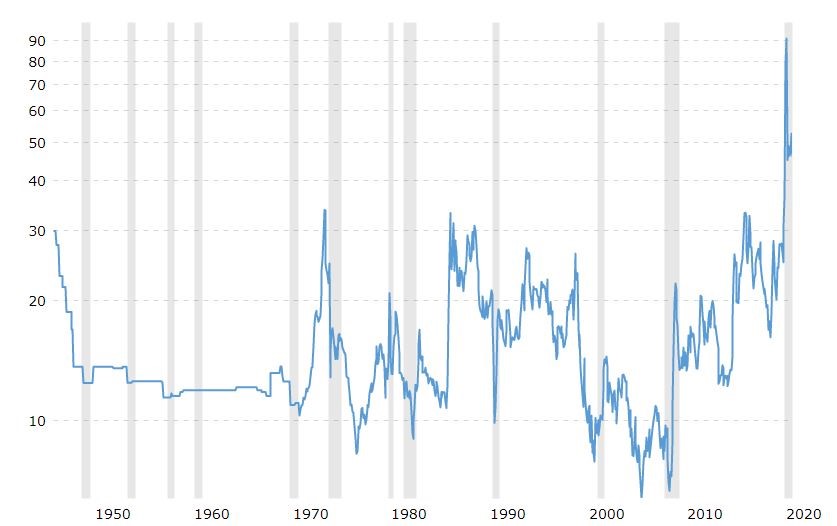

You can see the gold-oil ratio below:

|

|

| Source: Macrotrends.com |

Now if you chucked an RSI indicator on this, you would likely get an overbought reading.

An RSI indicator is (according to Investopedia):

‘A momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.’

All very useful in a chart, where you are looking for buying or selling opportunities.

But in terms of a long-term shift — a fundamental shift?

Definitely less so.

Fiat money will get cheaper — promise.

Renewables will see more money flow towards them — promise.

Oil enthusiasm should be short-lived in the grand scheme of things.

Gold enthusiasm should only accelerate as the Bank of England experiments with negative rates.

Not immediately, of course.

For clues and a crystal ball, let’s look to the north of Australia.

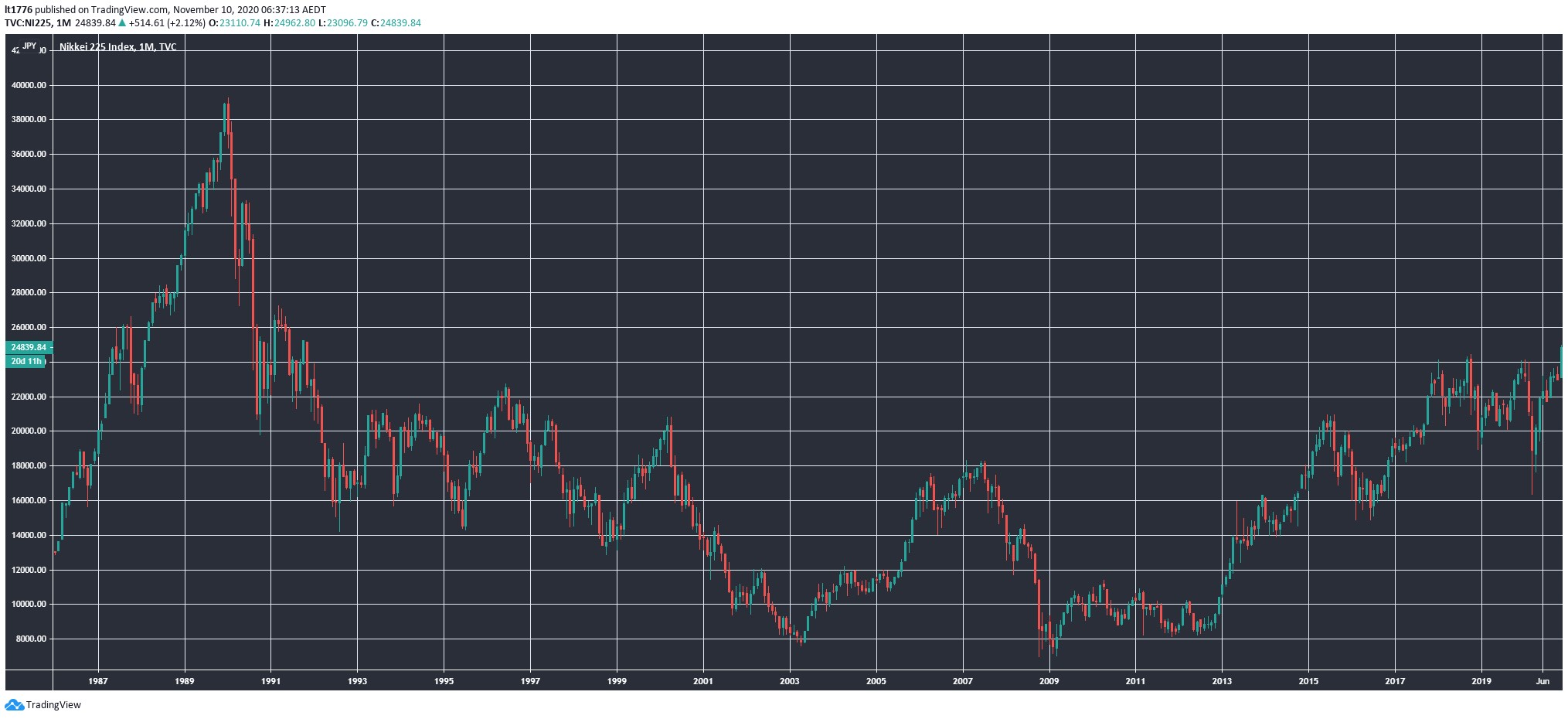

Decades of intervention in the Japanese economy results in a chart that reads like this:

|

|

| Source: Tradingview.com |

From a mid-80s high the Nikkei 225 Index [NI225] is trading sideways or down for the better part of 35 years.

Dead as a door nail. I’ll get to what this means at the end.

This is not a bearish piece though — it’s more so about being bullish about the right things.

Here’s why…

Why you should look further ahead than today’s rally

The trends that will shape the next year, the next five years, are not born today.

They’ve been brewing for years as Gen Z gets going.

My colleague Ryan Dinse highlighted a couple of these trends yesterday.

These include companies that are on the frontier, like Beyond Meat Inc [NASDAQ:BYND] and Square Inc [NYSE:SQ].

Companies that make fake meat and crypto accessible to Gen Z, or any generation for that matter.

It feels like there’s too much to discuss and too little time.

But the point is at Money Morning we are bullish on AI into healthcare, bullish on medtech, bullish on renewables, and bullish on crypto.

This is not a random assortment of things to be bullish on.

It’s a carefully chosen array of sectors and an asset class that are geared towards the massive trends that will shape the future.

Which brings me to one final point.

Watch (or act!) as new money comes

I spoke to you recently about the largest IPO ever.

Well, that was called off by the Chinese authorities very quickly.

In question, was the listing of the largest fintech the world has ever seen.

‘Supervisory interviews’ led to the Ant Group Co’s IPO grinding to a halt over regulatory issues.

Apparently, it’s too easy to collect a mass of data and grant a loan based on an algorithm and this trove of information.

Authoritarian dictates about marketplace behaviour usually only last so long in the West though.

So, the larger story is a story of competition.

In our neck of the woods, the ASX, companies like Wisr Ltd [ASX:WZR] are nipping at the heels of the big banks.

Monetary policy will not favour these dinosaurs.

As with the Nikkei, constant monetary intervention eventually saps a market of its strength.

Should we see something similar rear its ugly head in the Aussie market, or even in the US despite a Biden win — then again, it is the innovative small-caps that will come to the fore.

And the crypto asset class.

‘New money’ is coming and you can either watch or act.

Market euphoria today, digital currencies, and a distrust of fiat tomorrow (metaphorically).

If you have the patience to see past oil’s short-lived spike, you may be richly rewarded.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.