Insurance company Medibank Private [ASX:MPL] was in the hot seat last year when it refused to pay the ransom cyber-hackers demanded before sensitive customer data was released on the dark web.

While the company today said it expects more fallout costs to come, it found improving conditions linked to international students returning to Australia.

Medibank posted a 6.7% increase in underlying net profit to $226.7 million.

After a 5.4% rise on Thursday afternoon, MPL’s value had been boosted by 12% in the month, though it’s kept mostly flat for the full year:

Source: tradingview.com

Medibank takes 6.7% in profit as market momentum returns

The private health insurance provider released its half-year report on Thursday, buoyant on business momentum returning after the horrific incident regarding the cyberattack last year.

With an influx of international students flooding back into the country, Medibank is taking advantage of rising overseas student health coverage once more.

MPL said net resident policyholders slowed to 1,100 last month, though change may be afoot. In the month leading to February 18, the group noted net growth of 200.

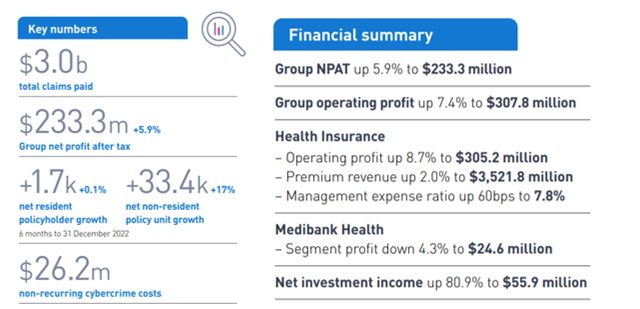

In terms of its latest financial highlights, the health insurance provider reported an increase of 6.7% in underlying net profit, a total of $226.7 million.

Revenue from the groups’ health insurance premium programme increased by 2.2% from $3.46 billion to $3.53 billion.

Unfortunately, Medibank’s Health segment revenue dropped 22.5%, from $119.8 million to $92.8 million.

Group net profit increased by 5.9% from $220.2 million to $233.1 million. The group’s board decided on a fully franked interim ordinary dividend of $6.30 per ordinary share.

Operating expenses increased by 7% — with cost inflation of approximately 4% and modest volume impacts. This was partially offset by around $4 million of productivity savings.

Source: MDL

Medibank is now targeting $30 million of productivity savings over FY23 and into FY25, including $10 million in FY23.

With the one-off charge of $26.7 million related to the cybercrime under its belt, Medibank says it will spend between $40–45 million through the full year. This range has increased since the group’s previous guidance of $30–35 million.

Today’s financial report was better than analysts were expecting and could account for the market’s strong jump in share price, which started with a bang on market opening.

CEO, David Koczkar, concluded:

‘There is more work to do, and the lessons we have learnt from the cybercrime will continue to shape our response and we will emerge stronger.

‘We are a resilient business with great people, a unique offering in health, and a track record of responding to whatever challenge is in front of us. Whether it be COVID, inflation, cost-of-living pressures or the cybercrime event, our strategy has and will continue to put our customers and their needs at the heart of our business.’

Australia is set for some big change

Australia’s 30 years of abundant, robust trade has broken.

On top of that, global supply chains have changed into completely different systems than what existed years ago.

You may have noticed there’s less on our supermarket shelves and wondered why inflation is so out of control, why the banks are closing branches, and packaging is shrinking (while costing more!).

Clues and signs are everywhere, but everyday Australians don’t know what it all means. Even the media doesn’t know.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots.

He says no one is talking about how the Australian economy as we know it could soon end.

It could happen as soon as within the next 12 months…and it will change the way we all live.

Australia is going to be looking very different very soon.

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime, click here for more.

Regards,

Mahlia Stewart,

For The Daily Reckoning