After last week’s small panic, US markets are back.

The NASDAQ is trading at pre-COVID levels and the S&P 500 is trading a little over 7% lower than it was in March.

Yet the US economy isn’t looking at all like it did at the beginning of the year. The US has lost 20 million jobs since February. While May unemployment numbers were better than expected, looking ahead the Fed believes the US economy will end the year with a 6.5% drop in GDP and unemployment at 9.3%, over double the 4.4% they had pre-COVID-19.

The economy is in dire straits but markets keep rising. How is this possible?

In a recent interview with 60 Minutes, the US Fed chairman Jerome Powell answered said:

‘Fair to say you simply flooded the system with money?’ the interviewer asked.

‘Yes. We did. That’s another way to think about it. We did. We print it digitally. So as a central bank, we have the ability to create money digitally. And we do that by buying Treasury Bills or bonds for other government guaranteed securities. And that actually increases the money supply. We also print actual currency and we distribute that through the Federal Reserve banks.’

It’s not the perspective of higher company earnings that’s pushing the markets, but central bank stimulus.

And, with interest rates at record lows, investors are jumping into the markets and taking on more risk to get a decent return.

The Fed Flooding the System with Money

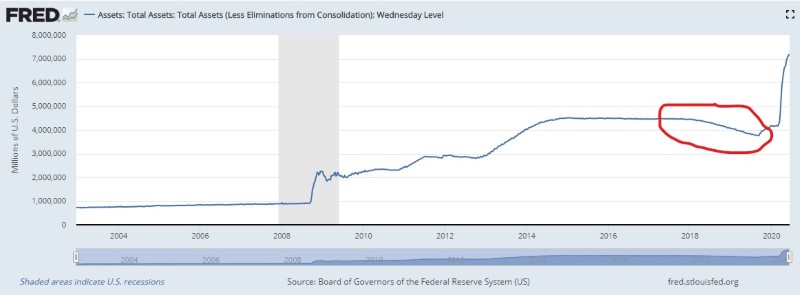

Flooding the system with money is something the Fed did after the 2008 crisis

The US Federal Reserve pumped US$4.5 trillion into the economy back then through quantitative easing (QE).

It was supposed to be temporary emergency measure to boost the economy.

And it worked…well, kind of.

Asset prices recovered, unemployment went higher…but the cost was low growth.

In 2015, the Fed thought it was time to start pulling back on the ‘temporary’ measure. They began raising rates slowly.

They then began the process of unwinding their balance sheet…slowly. This drains liquidity from the system. The then Fed Chair Janet Yellen said it would be a process akin of watching paint dry.

The chart below shows the Fed’s total assets. The small decline circled in red is the Fed attempting to decrease their balance sheet. As you can see, it didn’t last long.

Source: FRED

In late 2018, markets suffered a correction…

The Fed then announced it would stop the unwinding, and markets breathed easy…

…until the unthinkable happened. A killer virus surfaced into the world forcing countries to completely close their economies. The Fed pumped over US$7 trillion into the economy in a short period of time to keep liquidity.

The Fed steps it up a notch

On Monday, the US Fed stepped up their support of liquidity into the markets by announcing they will be buying corporate bonds directly.

Why is this so significant?

As Credit Suisse strategist Damien Boey explained in the Australian Financial Review:

‘”The Fed is now bypassing the banks and lending directly to the private sector,” Mr Boey said.

‘“[Quantitative easing] is no longer just an asset swap with the banks – it is the creation of new money in the public domain.”[…]

‘The central bank intervention pushes the cost of debt and equity down in the world’s largest capital market, which in turn lifts the value of shares relative to other lower-risk assets such as bonds.

‘And while the Reserve Bank of Australia’s policy program is narrower than the Fed’s, Australia’s central bank struck a similar tone of unqualified support at its last monetary policy meeting at the start of the month.

‘Minutes from the meeting released on Tuesday reaffirmed the RBA’s commitment to keep funding costs “as long as required”, adding to the liquidity-fuelled rally.’

Central banks are what keeps supporting the market rally…the question is: How long they can do this for?

This is a huge economic experiment, one we have no idea how it will end up. In this scenario, gold has been gaining ground.

If you are interested in knowing more about how to invest in gold, check out Shae Russell’s step-by-step guide on the ‘Best Way to Buy, Sell and Store Gold’.

To read this FREE report, click here.

Best,

Selva Freigedo

Comments