1) After reading, hearing, and talking about COVID-19 these last two years, I’ve finally got the damn thing.

Your editor is composing these notes slightly into my seven-day isolation. Does the world look any different now?

Not really. Beside a bit of a headache, there’s not much else wrong with me as far as I can tell. If only everyone else was so lucky.

In fact, I’m still exhilarated after watching Rafael Nadal’s epic comeback last night. What a legend!

Can the ASX 200 do the same thing?

You don’t need me to tell you the ASX has been carted around like the English bowling attack lately.

But one or two rough weeks is not that long in the markets if you look out over the expanse of 2022. Personally, I see opportunity.

Why do I say that?

The market has been consolidating a lot longer than you might presuppose if you tee off the recent headlines. It’s been a slog in a lot of sectors for six months! I reckon a lot of stocks are darn cheap already.

The market has been wrestling the whole time with the conundrums we all know about today: supply chain issues, rising costs, and whither interest rates.

These factors are hitting individual stocks now as we inch closer to the official earning results due this month.

Take Ansell Ltd [ASX:ANN], for example. This morning they came out and slashed their guidance by 25%. That’s big and nasty. The stock is down 20% in early trade.

There’s been quite a few downgrades and big drops like this lately. Retailer Adairs Ltd [ASX:ADH] was another one.

Forget about finding winners for a moment, and make sure you’re not already sitting on a potential landmine like this in your current portfolio!

But there are massive bright spots on the ASX right now too. Iron ore is absolutely roaring currently, back up near US$150 a tonne.

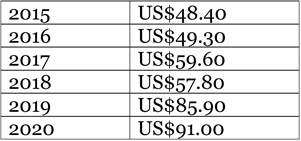

I’m going to share a table I put together for my readers last year. It shows the average yearly iron ore price between 2015 and 2020:

|

|

| Source: Catalyst Trader |

That shows you just how juicy the iron ore price is right now. BHP, RIO, and FMG have rallied already off this bounce.

But the longer it continues — presuming it does — the more pressure the market will come under to upgrade their current share prices again.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

The market was NOT previously pricing in this lofty iron ore level.

How astonishing the swing has been here. It was only in September last year that the market was panicking over Chinese real estate!

And don’t forget most of the iron ore juniors are still on the floor after their knockout punch last year. We could see them lift again if iron ore can hold the line at this price.

But that’s not all!

Coking coal is absolutely barnstorming its way around as well. One producer reported this morning that the price remains between US$350–380 a tonne.

Then we have oil pushing US$90 too. This could be important…

2) Why?

One mantra I’ve been hearing lately like an endless drumroll is that the high oil price is because there’s been too little investment to meet future demand, which is coming to the fore now.

That might be true, or it might not be. I used to think (and write) the same thing until I had my backside walloped in 2018.

Oil — and oil stocks — got carted for six back then after the price collapsed by 40%. So much for too little investment!

One of the reasons oil got smacked in 2018 was because investment banks were selling it down to protect themselves from their order books loaded with futures contracts sold to the fracking industry.

In other words, oil’s massive swings back then had little to do with supply and demand and everything to do with financial positioning on Wall Street.

Bloomberg analyst Javier Blas suggests something like that might be in play today but in reverse.

What’s his line?

Wall Street investment banks sold a lot of call options on US$100 oil when it was much lower. Now they are buying futures contracts to hedge themselves in case it darn well gets there!

And all those holding those options have every incentive to juice the market higher and higher…because they make millions more!

That’s pushing up the price of oil, and in turn driving up costs for the global economy at the same time, including your petrol bill.

How long this dynamic remains in play is anyone’s guess. But any oil producer is getting windfall profits right now. The question is, how sustainable is it all?

That doesn’t mean avoid oil stocks. I’m wildly bullish on one right now. Goodness knows it’s cheap enough already to sustain a swing down in the headline oil price. I’d say that’s true for most oil stocks on the ASX. The market has been just so indifferent to them for so long!

I’m sure you can see what I’m getting at. Iron ore, coal, and oil stocks are likely to surprise the market to the upside.

That, as an investor, is where you want to be!

All the best,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.