Vulcan Energy [ASX:VUL] has announced a ‘strategic expansion’ of its lithium business into France.

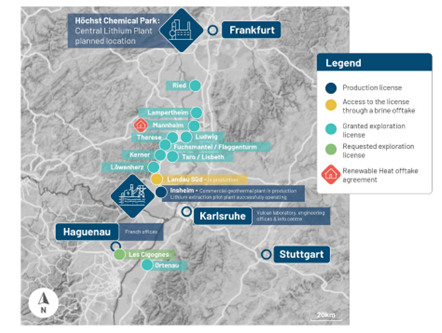

Currently, Vulcan is developing its Zero Carbon Lithium project in Germany’s Upper Rhine Valley region. The lithium developer is now seeking to expand into the Alsace region in France, arguing it is a ‘natural extension’ of its Upper Rhine Valley base.

VUL shares did not move on the news; however, they traded flat late on Wednesday.

Vulcan shares are down 30% year to date.

Source: tradingview.com

Vulcan Energy eyes France expansion

On Wednesday, Vulcan Energy announced plans to expand its business to France, saying the proposed expansion has been endorsed by Stellantis and Renault, France’s largest automakers.

The French side of the Upper Rhine Valley Brine Field (URVBF) accounts for one-third of the Upper Rhine Graben and harbours rich deposits of geothermal energy and lithium brines.

VUL has already taken around 10,000 litres of brine samples from this area, and tests revealed a high grade of 214 mg/L and low impurities — the same brine composition as Vulcan’s German operations.

This allows VUL to maintain the same processes used in Germany but in France.

Upon expanding its French operations, Vulcan has opened ‘Vulcan Energie France SAS (VEF)’ and is rapidly growing its French team.

Discussions for development with local companies are ongoing, and VEF now has its first lithium exploration licence ready to go, 155km worth of area, in Les Cigognes.

Vulcan’s Chief Commercial Officer Vincent Ledoux-Pedailles commented:

‘Vulcan is aiming to increase the future supply of our sustainable lithium product in response to significant customer demand, as we leverage our extensive experience in lithium extraction from heated brines to have a materially decarbonising effect on global electric vehicle supply chains. An extension of our core operating area, the Upper Rhine Valley Brine Field, expanding into France is a natural next step for Vulcan as we can apply the same expertise and technology to extract lithium sustainably. We look forward to supporting our French customers and working with local communities and companies to decarbonise their energy mix.’

Source: Vulcan Energy

Vulcan’s French connection

VUL flagged lithium production is ‘strategically critical’ for France’s automotive industry and quoted French President Emmanuel Macron:

‘We need to work across the entire supply chain. We have lithium resources in France and we will develop them thanks to a new mining code; it is key for our sovereignty.’

In its September activities report, Vulcan reported that Italy and Germany projects are progressing, the DFS for Phase 1 renewable energy and lithium production is underway, and an updated PFS for Phase 2 is nearly complete.

The company’s financial position held €158.2 million cash on hand at the end of the September quarter, with revenue of €1.52 million from the NatürLich Insheim power plant.

Cash outlay went into DFS engineering, Sorption Demo plant and CLP Demo plant works and equipment, NatürLich Insheim power plant production costs, exploration, and corporate costs.

Vulcan says it will seek public and strategic funding to boost its French expansion, but shareholders don’t yet seem convinced.

Are you prepared for the EV takeover?

The EV market is rapidly expanding, boosted further by government initiatives and funding programs supporting production across the globe.

But our energy expert, Selva Freigedo, thinks the global transition to EVs means the industry faces a supply crunch, which can send prices for battery materials soaring even higher in 2022 and beyond.

If you’d like to know more, check out Selva’s battery tech metals report — for free — here.

Regards,

Kiryll Prakapenka,

For Money Morning