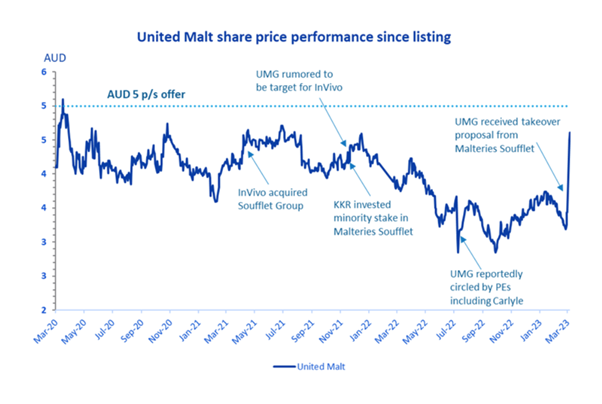

United Malt Group [ASX:UMG] shares have jumped up by 8.98% today, trading at $4.79 per share this afternoon after announcing UMG has entered a binding deal with Malteries Soufflet, a branch of French agribusiness InVivo. Under the deal, Malteries Soufflet will acquire the company for $5 per share.

The buyout represents a 45.3% premium to the share price at the time of the announcement. The agreement marks the end of a drawn-out period of dealmaking for the bulk beer and whiskey malt producer, where the company has been seen as a darling of the industry with many interested suitors.

Share prices in the past 12 months have been up by 38.82%, which is 30% above the sector’s performance as many consumer defensive companies struggled with rising costs and reduced demand across the board.

Source: TradingView

United Malt signs drawn-out deal

UMG has signed a scheme implementation deed with Malteries Soufflet, a leading global malt producer. The agreement will see Malteries Soufflet acquiring 100% of the shares in United Malt at $5 per share — a deal worth AU$1.5 billion.

Shareholders can finally breathe after a nail-biting end to the drawn-out due diligence process that started at the end of March.

The 10-week look at UMG’s books came and went without a deal as the French agribusiness giant faced data issues conducting due diligence.

Then, midway through the process, UMG reported a 17% drop in half-year earnings, which prompted further investigation by the Malteries Soufflet and clouded the process.

The delay freed UMG from exclusivity and allowed them to look elsewhere for offers.

UMG was comfortable letting Malteries Soufflet know that it had other interested parties, leading to the bid being raised from $4.15, $4.50, and $4.90 before the agreed price of $5.

United Malt is the world’s fourth-largest commercial maltster, producing bulk goods for brewers, distillers, and food companies. The company has processing plants in Australia, Canada, the US, and Britain that annually produce approximately 1.25 million tonnes of malt.

The deal still requires sign-off from shareholders and Australia’s Foreign Investment Review Board (FRIB), as it puts Australia’s largest malt producer in the hands of French companies.

United Malt managing director and CEO Mark Palmquist said the scheme — if implemented, would provide an attractive value outcome for United Malt shareholders.

‘Malteries Soufflet is one of the world’s leading malt producers, operating 28 malt houses across Europe, Latin America, Asia and Africa and is a strong complement to our business’, said Mr Palmquist.

United Malt’s outlook

The deal is a good one for United Malt shareholders and the company moving forward, as the execution of a long-held plan bears fruit.

UMG demerged from Graincorp [ASX:GNC] back in 2020 with the help of Macquarie Capital. In the demerger booklet, Macquarie advised that the spin-off was a good idea for UMG as a way to catch a takeover premium of its share price.

In the proceeding years, UMG share prices struggled to gain significant momentum until rumours of serious takeovers began to arise.

Source: Ion Analytics

The takeover of UMG by InVivo will combine the world’s second- and fourth-largest malt producers, which will present a significant force in the craft beer and distillery market.

InVivo also penned an agreement in January with craft beer giant Belgian malthouse Castle Malting, showing the company has aggressively moved towards capturing the growing craft beer craze sweeping consumers.

InVivo Chief Executive Thierry Blandinieres was positive about the acquisition’s future prospects, commenting today, ‘We would already have a share of 20% of the malt market with great growth potential ahead of us’.

For UMG, the deal will see fantastic growth opportunities as the company can further expand into the European market.

Currently, 60% of UMG’s revenue is generated from North America — while 21% is from Europe.

If the deal goes forward, it could be a good time for UMG to raise a glass to prospects.

Future prospects for you

United Malt may be cheering its long-term earning potential but what about you?

With a bearish market that has roiled investors for the past year and an ASX that has seen little gain — where can you look to secure your future?

Our experts have been searching for the ultimate play in a bear market and are excited to show you the smartest play you can make today.

Editorial Director and investment guru Greg Canavan has released his brand-new report that will show you how to capture value AND make great dividends along the way.

So, if you want to stay ahead of the market with the latest strategies, click here for our latest play for smart investors.

Regards,

Charles Ormond,

For Money Morning