There’s an old Chinese curse that says, ‘May you live in interesting times’.

The use of the word ‘interesting’ is a euphemism here.

The real point of the quote is that humans find it difficult to deal with times of extreme chaos and turbulence.

It sure feels like that in markets right now.

Trump’s tariffs, an era of AI-led disruption, trade wars, real wars, culture wars…there sure seems to be a lot of ‘interesting’ things for investors to contend with.

Working out what’s really happening and what it all means going forward is harder than ever.

Take AI, for example…

One minute, we’re told preparing for this future will require hundreds of billions of dollars in new investments.

The next minute, a Chinese AI model called DeepSeek entirely flips this outlook with a new tech that can achieve the same result for a fraction of the cost.

Or how about Trump’s new tariffs?

Over the weekend, it was announced tariffs of 25% are set to be put on imports from Canada, China and Mexico.

They go into effect on Tuesday with Trump saying the EU will be next in the firing line.

Markets are likely to panic at the thought of a new trade war and its effect on global inflation.

But what will it mean further down the line?

These are all key things you need to account for as an investor right now.

It’s not easy, and it is likely to result in turbulence, volatility, uncertainty and all the other things investors are said to hate.

Fear will dominate people’s emotions, and many will panic at the first sign of danger.

But is there any precedent for this?

Is there a way for you to navigate through this as an investor?

It turns out there is…

The unravelling is nigh

While it might feel like we’re entering unchartered territory, the fact is that times of immense change happen over the course of history on a regular basis.

The best-selling book – The Fourth Turning – does a good job of explaining this process.

As explained by Futurist Frank Diana:

‘The cycle is made up of four turnings, each 20-25 years in duration. First comes a High, a period of confident expansion as a new order takes root after the old has been swept away.

‘Next comes an Awakening, a time of spiritual exploration and rebellion against the now-established order.

‘Then comes an Unraveling, an increasingly troubled era in which individualism triumphs over crumbling institutions.

‘Last comes a Crisis—the Fourth Turning – when society passes through a great and perilous gate in history. Together, the four turnings comprise history’s seasonal rhythm of growth, maturation, entropy, and rebirth.’

It seems like we are in that fourth phase – the unravelling. And this unravelling process is likely to accelerate under Trump.

But that leads us to another ancient Chinese proverb…

In the midst of crisis lies opportunity

When written in Chinese, the word ‘crisis’ is the same as the word ‘opportunity’.

This is the way to think about the coming year. Because I firmly believe we’re entering a period of immense opportunity.

But the old rules won’t apply…

The key thing to internalise as fast as possible is that the game is changing, and it’s changing fast.

As an investor, you need to be able to adapt and evolve to a fluid situation.

That doesn’t mean scrambling around, chopping and changing your investments every two minutes.

But it does mean thinking through your process and seeing what might no longer work.

For example, one idea I’m leaning heavily towards is the end of old monopolies.

This will sound like a big call, but I think the days of the Mag 7 – the top seven big tech firms in the US dominating – is coming to an end.

I think the disruptive nature of AI will be a big part of that.

As Deepseek just demonstrated, the AI revolution is more likely to be like the dot com era than we were first told.

Transformative change, where smaller companies took market share away from tech monopolies like IBM.

Another theme I’m investing in is the end of big finance.

Trump’s agenda will open the playing field to all sorts of fintech companies, especially some crypto projects that were heavily attacked under the Biden administration.

The political protection racket for big finance and big tech could be coming to an end.

For me, that means the old era of ‘index hugging’ – just investing in the biggest stocks in the market in a passive way – will not be the way to play this market.

Instead, the big gains could come from finding the next big things in finance and tech.

Another casualty of the fourth turning?

US dollar dominance.

Trump’s ‘America First’ strategy is likely to hasten the dollar’s demise as the world’s ‘pristine asset.’

After all, a strong dollar isn’t good for America’s manufacturing competitiveness.

And we’ve already seen in recent years the US’s willingness to politicise the dollar, making it less useful as a neutral asset. The confiscation of Russia’s US assets in the wake of the Ukraine war is the most recent example.

So where to next?

Gold and Bitcoin are the forerunners in what a new financial order will look like, and the market is already starting to realise this.

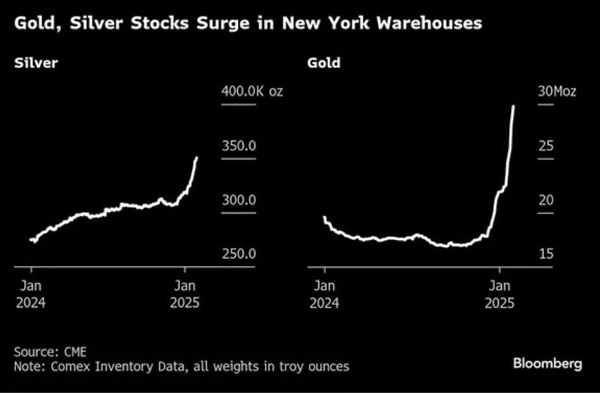

I could give you many examples to back this statement up, but one chart will suffice when it comes to gold:

| |

| Source: CME |

We’re seeing significant restocking of commercial gold reserves in the US right now with JP Morgan being a big buyer.

And Bitcoin?

Get this…

The Czech Central Bank just voted this week to examine adding Bitcoin as a reserve asset.

| |

| Source: Financial Times |

And people always told me the government would ban it!

Nope, instead, many who have criticised Bitcoin for years are starting to embrace it.

Make no mistake, the world is changing.

And perhaps the most relevant quote for investors in 2025 isn’t an old Chinese proverb but a Darwinian one instead.

‘Adapt or die.’

Speak soon…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments