Magnis Energy Technologies [ASX:MNS] rose on Thursday after announcing ‘exceptional anode results’.

After rising as high as 75 cents a share in November, the MNS stock retraced and has hovered around 40 cents since.

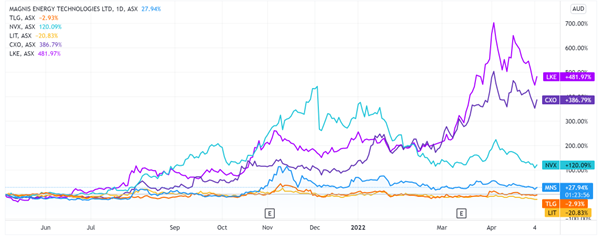

As it stands, MNS shares are up 25% in the last 12 months but down 25% year to date:

Source: Tradingview.com

Magnis reports ‘exceptional anode results’

Magnis today announced results for its Coated Spherical Graphite (CSPG) anode product, qualified using commercial grade lithium-ion battery cells.

MNS claims graphite procured from its Nachu Project in Tanzania is deemed both ‘high-purity’ and ‘high-quality’.

Classed as an electrochemical battery, the Nachu CSPG anode has now undergone required testing, with MNS confident its lithium-ion battery cells now qualify for the next step in commercial use.

Testing has undergone more than 1,000 cycles, and the CSPG anodes have kept 90% of their cell capacity, displaying long-life in anode materials.

Magnis said the production of commercial graded lithium-ion battery grade anode materials was demonstrated with the help of its tech partner, Charge CCCV.

Charge CCCV has given MNS exclusive access to its anode processing technology, which enables 30–40% higher yields in comparison with standard plants.

As well as its recently validated CSPG anodes, Magnis has also been working on high-purity natural flake graphite (NFG), which assist in high returns of CSPG.

MNS share price outlook

Magnis Chairman Frank Poullas commented on the test results:

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

‘We are blessed with such an amazing resource. Being able to produce a high quality, high performing green anode product at +99.95% purity or above without any acid, chemicals or thermal purification while using mechanical processes only, is truly remarkable.’

Today’s announcement comes a month after MNS’s subsidiary iM3NY closed US$100 million in financing, which the company explained would be used to lower capital costs and ‘fast-track expansion’ while it charges ahead with its New York gigawatt-scale lithium-ion battery plant.

Now, as Magnis’s announcement today highlighted, lithium isn’t the only material EV-focused battery manufacturers need to power the future.

Graphite, nickel, and copper are just as important.

Yet it was lithium stocks that dominated, with eight of the top 10 performers on the All Ords being lithium stocks in 2021.

But is lithium’s rally sustainable?

Is there a smarter way to play the lithium story?

As lithium continues to dominate attention, our Money Morning experts believe now is the time to look for a smarter way to play the EV boom.

They believe a potential answer lies with lithium’s ‘little brother’?

Click here to find out more about ‘The NEXT Lithium?’.

Regards,

Kiryll Prakapenka,

For Money Morning

Advertisement:

Will this no-name stock rule the ‘Aussie Mining Boom 2025’?

It’s showing all the traits, ambition and foresight that Andrew Forrest’s Fortescue Metals had in the early 2000s.

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story. Click here for the full take.