Uranium stocks Lotus Resources [ASX:LOT] has completed a $25 million placement to progress its Kayelekera Uranium Project in Malawi.

The placement was at 24 cents per share, with LOT’s last closing price around 30 cents a share.

Friday’s drop means the uranium stock is currently trading at about the discounted placement issue price.

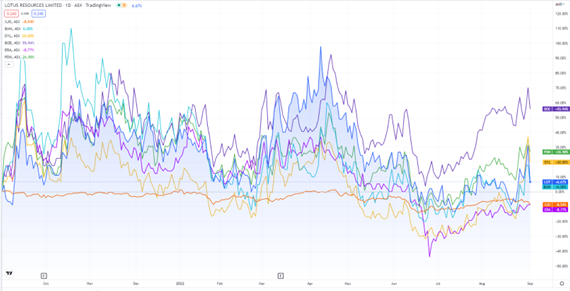

Year to date, LOT shares are down 20%.

Source: www.tradingview.com

Lotus completes its institutional placement

On Friday, Lotus Resources announced that it has now seen through the completion of its $25 million placement, floated with the intention to accelerate progress at its 85%-owned Kayelekera Uranium Project in Malawi.

The Placement — which has not been underwritten — will comprise the issue of around 104.2 million new fully paid ordinary shares at 24 cents per share.

Lotus said it was pleased by the ‘specialist uranium investors’ taking up the offer:

‘The Company is particularly pleased to welcome a number of specialist uranium investors to the register, which is a strong endorsement for the recommencement of uranium production at the Project as outlined in the Company’s recently released Definitive Feasibility Study.’

The fresh capital will fund the development of its Kayelekera Project.

This includes the finalising of a mine development agreement (MDA), pushing offtake negotiations, processing FEED (Front End Engineering and Design), and a FID (Final Investment Decision).

What’s the outlook for LOT shares amid the energy crisis?

Lotus’ Managing Director Keith Bowes offered his thoughts on the placement:

‘We are very pleased to have received such strong support for the Placement which will enable us to progress offtake negotiations with the various utilities and project funding during a period of significant support for nuclear energy globally.

‘In particular, the demand received from global sector specialists during the bookbuild provides significant validation for the Company’s restart strategy and underscores the value of the project as one of the nearest term producers globally.

‘I’d also like to thank our existing shareholders for their strong, ongoing support, and welcome all our new shareholders aboard. We look forward to providing further updates on our activities in the coming weeks and months.’

While oil prices have been dropping recently, other key energy inputs like gas remain elevated.

Russia’s invasion of Ukraine crimping fossil fuel supplies at the same time as the world seeks to phase fossil fuels out in its decarbonisation pursuit has once again brought nuclear into the spotlight.

Nuclear once again is starting to look like a potent alternative to Russia’s tainted oil and gas.

And uranium stocks are responding.

But there is one small Aussie uranium stock few are talking about it.

This unheralded uranium miner could help solve Europe’s energy crisis.

Ryan Clarkson-Ledward, our small caps expert, has profiled this potential saviour in a recent research report.

You can read it, for free, here.

Regards,

Kiryll Prakapenka