It’s been months in the making. But I’m thrilled to welcome the mercurial James Altucher to Fat Tail Daily. He comes with his usual coiled-spring energy…and one of the better investing ideas I’ve seen in many years.

Without further ado, over to James.

Cheers,

|

James Woodburn,

Publisher, Fat Tail Daily

*****

Greetings and salutations!

|

I’m thrilled to be able to rejoin my old pal Callum Newman and show you folks at Fat Tail Daily what I’ve been up to recently.

I’ve put a lot of time into putting this all together for you. It’s perhaps one of the biggest investing stories of my career.

Put simply: there is a simple move you can make now to get exposure to what I think could be the greatest investing catalyst of the 2020s.

We’ll get to that in a second.

First, I want to take you back to Fall (I believe you guys call it autumn) 2001.

The prominent venture capitalist Adeo Ressi was telling me about a former college roommate.

This guy was setting up a company to make rockets.

These rockets were going to take people to Mars.

Adeo didn’t know it, but I had just gone broke and was scared to death that I was going to lose my home. Which I did.

The first thing I learned about going broke, though, is to never tell people you are going broke. Because then they stop returning your calls. You cease to exist.

‘People are going to go to Mars’, Adeo was telling me. His college roommate, of course, was Elon Musk.

‘I’m going to move out to San Francisco,’ Adeo said, ‘this is where it’s all happening. You should come also.’

‘I would’, I said, ‘but I don’t smoke a lot of crack and it seems like you’ve been doing more than usual’.

He laughed. ‘This is serious. My friend knows what he’s doing.’

Well, we’ll see, I thought. But I couldn’t even afford diapers for my kids, or my $18,000/month mortgage.

I was going broke and crying myself to sleep every night, pretty sure that I had screwed up not only my life but my two-year-old children’s lives as well. I paid for lunch.

The Elon Effect

Here’s why this is important though — ‘The Muskonomy’, as I like to call it, has existed for a long time. First, it was in Elon Musk’s head. Then it was in startups that were barely surviving, then it was in IPOs of companies that had no revenues, and now it’s a reality.

This is what we should care about.

Not a 0.25% increase in the interest rates on our savings account but how soon it will be before I can send telepathic messages to you through the Neuralink chips implanted in our brains.

‘Brain Emails.’ BMail. You’re welcome.

What’s interesting to me is that everything Musk sets out to do seems impossible at first.

But then it turns out he’s thought it through and it’s now possible and then it happens. It’s interesting to look at what Musk DOESN’T do.

For instance, he’s not working on quantum computing. You know why?

Because at the moment there are no practical uses for quantum computers.

Not yet, anyway…

It is real and we DO need solutions for things like quantum security, etc.

But in terms of what is scientifically possible right now, it’s just not there.

But let’s look at the things Musk chose to work on 20+ years ago.

• Rockets to Mars

• Chips in our brains

• High-speed tunnels that can take you around the world in less than an hour

• Self-driving electric vehicles

• Solar power to power all our needs

• AI so powerful that the AI itself creates the next generation of…even more powerful AI

All of these things sound ridiculous. Scratch that. Sounded ridiculous.

But they’re real.

Which brings me to SpaceX, Starlink and the very interesting investing idea we’re debuting today…

SpaceX put up more satellites last year than all the satellites launched into space in the prior 60 years.

But Elon’s plans for SpaceX are only getting started.

What you need to be watching like a hawk is the coming ‘spin-off’ of SpaceX’s internet service, Starlink.

If my intel is correct, it’s imminent.

It will be the biggest IPO in the history of the world.

With the potential to be one of the biggest investment catalysts of this decade.

And there’s a way for you to get a back-door entry into this amazing story.

Right now.

From right here in Australia.

For the first time, I lay out everything for you here. Enjoy.

And thanks for having me!

Regards,

|

James Altucher,

for Fat Tail Daily

***

Murray’s Chart of the Day

| |

| Source: Tradingview.com |

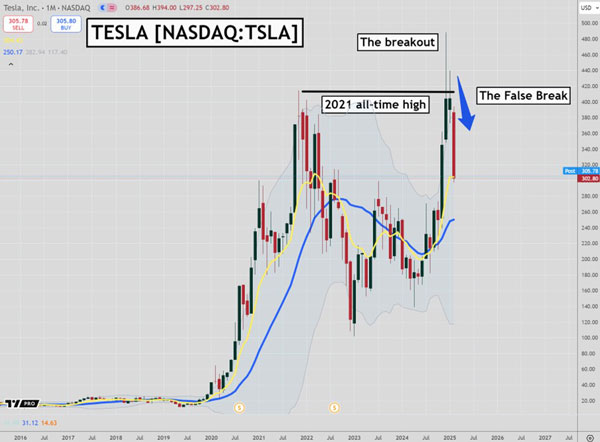

Beware the False Breakout

Novice investors are often on the lookout for breakouts. They believe that there is money to be made buying a stock that rallies above a former resistance level.

In my experience false breakouts occur far more often than breakouts. They are the reason why so many novice traders end up losing money.

Tesla [NASDAQ:TSLA] has traced out a classic breakout and then false break over the last few months.

The price of TSLA flew higher on the back of confidence that Musk’s close relationship with Trump would lead to great things for Tesla. But the fact is EV sales are in trouble all over the world.

Notice the sharp spike in the price of Tesla when it broke out above the all-time high set in 2021.

The price jumped from US$409 to $488 in the blink of an eye.

That was the novice traders buying the breakout (as well as shorts exiting their positions).

Once that buying was done there was nowhere left to go but down.

Once the price had fallen below the 2021 high, a false break was confirmed. Then the sharp fall we have witnessed over the last month took hold.

People who had bought the breakout dumped their positions in a panic as the price fell sharply.

That is what causes the mean-reversion event.

The price of the stock gravitates back to the middle of the range it has been trading in for the past five years.

Investors who don’t understand this process of false breakouts and mean-reversion end up being a victim of it.

Traders who understand it can benefit from the mistakes of novice trader.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments