A fortnight ago, I informed you that we were leaving. I’d just received notice to vacate my current home. My landlord decided to put the place up for sale. While we had been searching for a place to buy for a few months, this gave us a clear deadline to find something.

Well, I’m glad to tell you that the search is over. Cindy and I found a house we liked on the Saturday after I wrote that article. We’ve made the bid, had it accepted and will prepare for the move in the coming month.

Moreover, we won’t need to get a mortgage to buy it. Part of this is help from our parents who agreed to lend us a small sum ahead of settlement so we don’t have to rush to sell our investments. The other is that house prices became more affordable for us over the years, especially the last two – I’ll tell you why in a short while!

We went for the first house inspection and checked the exterior, floorplan, conditions of the fixtures, and the neighbourhood. It was an all-round good feeling.

The price was reasonable for us. There were other houses that had similar features that sold for higher, but that’s because they were on a larger piece of land or the building was a bit younger. However, those places didn’t quite tick all our boxes. This one did and we were making plans on making an offer.

Normally you’d expect us to approach the agent and request more information before we put in a bid. But perhaps this was one that God destined for us, and so things didn’t play out that way.

Don’t call us, we’ll call you

The following Monday, the agent reached out to us and asked us what we thought of the place. I said we’re interested in looking more into it. He then told us there were already two bidders, but they were below what the vendor would accept.

Next, he offered to have us come again later that week for a private inspection. He pretty much was setting us up for the rest of the process.

We set to work downloading the builder and pest control report and sent copies to my builder and solicitor to review. We even went and talked to two neighbours after that house inspection to learn more about the place and what it was like to live there.

In our mind, we felt that this would be where we make our first purchase. And a day after the private inspection, we called the agent and submitted our first bid.

Had it not been a property that we really wanted, we may have made a lower bid and toyed around. However, the agent gave us enough clues about what the vendor was looking at. So I decided to lodge a bid close enough to the guide price to stomp out other bidders.

The agent told us we were in the game, but the vendor wanted something higher. We politely declined to raise the bid as we were in pole position already. Our aim was to run down the clock and have the vendor fold before the auction.

You probably know the feeling. You just need to make sure there’s no one else who would come in to spoil your plan. And given that it’s a buyer’s market in our area with, many properties of a similar type and price range, we thought we’d had it in the bag.

But every success comes with a tribulation.

The phone call that I feared would come

This Monday, the agent called me to inform me that there was a bidder who slipped in with a higher offer, and one that I had refused from the vendor to secure the place just days before. He asked me for my response. We knew that we wanted to place so it was a no brainer. After an hour, I phoned him back and put up a few thousand dollars extra.

Fortunately, the other bidder forfeited by the end of the day so the vendor called us on Tuesday morning to inform us that we were through.

In a way, we all won. Though I told the agent to pass my congratulations to the vendor as he was the biggest winner. He was clearly waiting for another bidder to flush me out and that happened.

Now for the next step: settlement. That means stumping up the funds…

Building the right foundation

Unlike many Australians making their first purchase, I won’t be getting a mortgage from a bank.

That was one key reason for us buying our home so late in our lives.

I had insisted on not saddling ourselves with a big debt load to enrich the banks and restrict my personal liberty. Instead, Cindy and I rented and used our capital to invest predominantly in gold and precious metals assets.

You can say that we did pay our dues to the bank through renting. We indirectly paid down the mortgage of our landlords, if they had a loan. However, we chose this path because I had developed my insights and strategies in the gold space having spent over a decade refining my knowledge and strategy.

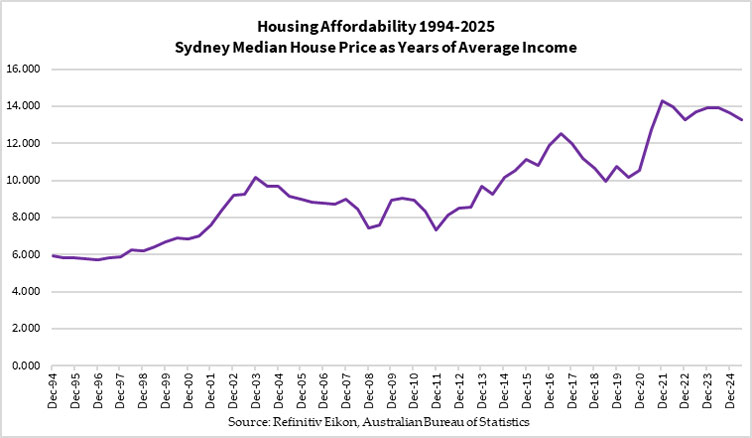

It was a gamble, no doubt about it. Property prices in Australia, especially in Sydney and some of the major capital cities, have been rising at a pace that locked many buyers out of the market. You can see it in this figure below, showing how Sydney property prices continue to become more unaffordable relative to the average annual income:

Those wanting to keep up would need to take greater risks, with some succumbing to the pitfalls of investing in what they didn’t understand and end up falling further behind.

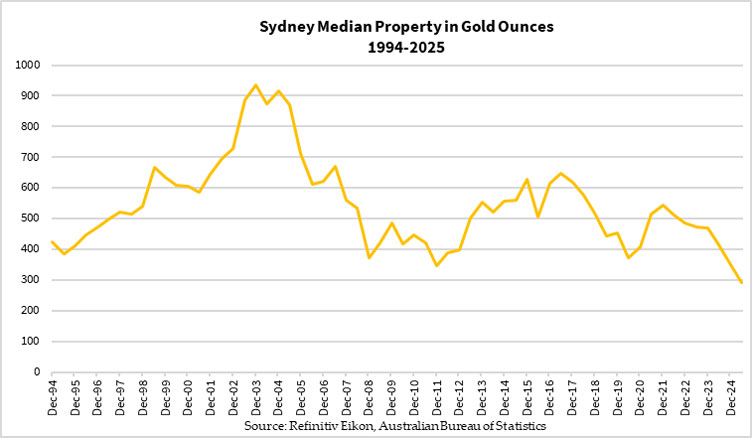

If you’ve invested in gold and gold stocks alongside me in the past few years, you know how this gamble ended in my favour. It wasn’t always easy either. For some time, gold didn’t really move as much as property. But property prices slumped relative to gold in the last five years as you can see below:

You hear so often how property prices have soared. But not in gold terms! They’re actually the most affordable they’ve ever been in the last three decades if you held your wealth in the shiny metal.

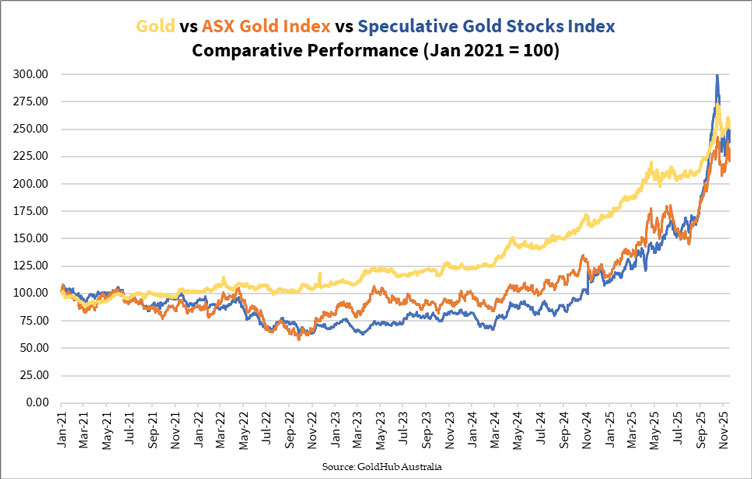

During this time, we sought to leverage gold’s gains by buying gold mining stocks. How did that go?

You can see it from the performance of gold vs the established gold producers (orange line) and the speculative explorers and developers (blue line):

The chart above may suggest that investing in precious metals assets is a low-risk and high-conviction way to accumulate wealth.

But don’t let that fool you. These are indices, not individual stocks (except for gold). Individual companies, even the biggest companies like Newmont Corporation [ASX:NEM], Northern Star Resources [ASX:NST], Evolution Mining [ASX:EVN], etc. traded down by at least 50% from its highs during the bear market in 2022-23. Smaller companies took a more brutal battering in some cases, and stayed low for longer.

Besides that, there’s stock selection, timing your entry and exit, and knowing when to double down or cut your losses. All these require deeper research, discipline, and patience. It comes with practice and guidance.

To learn more about how to build a precious metals portfolio, consider signing up for The Australian Gold Report. Learn about how gold maintains purchasing power, what precious metals assets you can buy and where, and how to buy and value gold mining companies.

As I wrap up this update, I’d like to invite you to consider a proposal. If you know any under 30 year-olds who are wondering how they can bring forward home ownership and reduce their burden, send them this article. While gold has run up a lot and my strategy isn’t guaranteed to work for them, it could give them valuable insights into realising their dream sooner and with less stress.

It might change their lives for the better, as it has mine.

Have a good weekend ahead.

God Bless,

Brian Chu,

Gold Stock Pro and The Australian Gold Report

Comments