Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Rebounds As Coal and Tech Stocks Rise

Are we one step closer to AI generating code better than people?

There’s a new paper suggesting yes.

We are one step closer to having AI generate code better than humans!

There's a new open-source, state-of-the-art code generation tool. It's a new approach that improves the performance of Large Language Models generating code.

The paper's authors call the process "AlphaCodium"… pic.twitter.com/kmKIryokgM

— Santiago (@svpino) January 18, 2024

Uranium versus lithium stocks

2024 could be big for commodities.

So thinks our resident commodities guru James Cooper.

And he outlined several reasons why.

US election. China stimulus. Rate cuts. Falling US dollar. Rising India.

Any of these events can ignite commodities in 2024.

James joined me on this week’s episode of What’s Not Priced Into talk why he’s upbeat about commodities this year.

And, yes, I didn’t waste the opportunity to ask James about uranium’s rally. And lithium’s collapse. And iron ore’s dip.

Suffice to say, James and I covered a lot of ground. But the big topics were:

- Why James thinks 2024 could be a crucial year for commodities

- James’s prescient description of lithium in November 2022 as a ‘one-hit wonder’

- Have lithium stocks bottomed?

- Green energy transition stocks — not just lithium — are struggling…but for how long?

- The role of interest rates in propping up ‘brown’ commodities like coal

- Does the uranium rally have legs?

- Commodities to watch with true scarcity factors

Why Are Battery Metal Stocks Struggling and Uranium Surging? | What’s Not Priced In

More updates on Bitcoin ETFs

How are the spot Bitcoin ETFs going?

Are inflows and trading volumes slowing down? Or rising?

Bloomberg’s ETF expert Eric Balchunas has been tracking the numbers since the ETFs were approved last week.

Today’s update:

This is interesting, the Newborn Nine actually saw a 34% jump in volume today vs yesterday. Normally with a hyped up launch you see volume steadily decrease each day post-launch, rare to see it reverse back up. All but one saw jump too but GBTC change flat so wasn't a volatility… pic.twitter.com/f6xOsLRWjr

— Eric Balchunas (@EricBalchunas) January 18, 2024

Whitehaven Coal up 5% on December quarter report

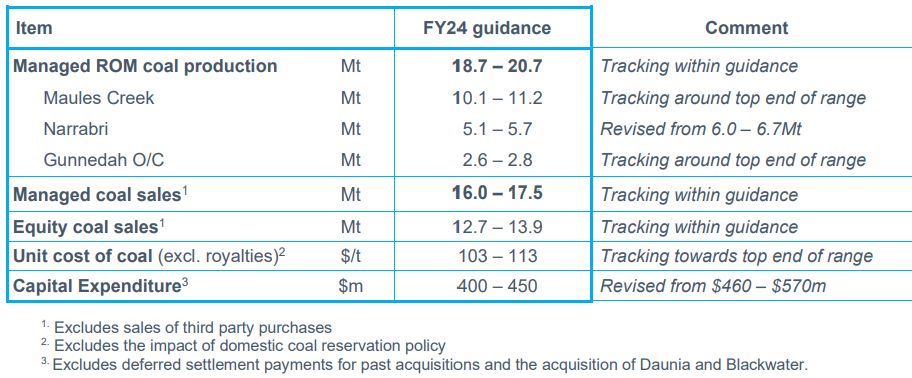

Whitehaven Coal is up 5% on Friday after releasing its December quarter report.

Despite coal production slipping 6% to 5 million tonnes, the producer kept sales and production FY24 guidance unchanged.

Whitehaven also pointed to strong demand from Asia. WHC said:

‘Underlying demand for high CV thermal coal remains strong in Whitehaven’s traditional and emerging markets in Asia, including to supply high-efficiency, low emissions (HELE) electricity generation, which is important for our customer countries as part of their long-term energy transition and decarbonisation plans.

Whitehaven was also upbeat about the supply dynamics of coal in general long-term:

‘The structural supply shortfall in the seaborne market for high CV thermal coal is continuing to grow as a result of underinvestment in new supply and depletion of existing mines. This growing supply gap is supporting strong long term high CV thermal coal prices.’

Imugene up on ‘cancer-killing virus’ trial update

Mesoblast isn’t the only bio-pharmaceutical company catching a bid from investors today.

Imugene is up 10% in afternoon trade.

Imugene said the trial evaluating the efficacy of its ‘cancer-killing virus’ — VAXINIA — progressed. First patients have now been dosed ‘in each arm of the higher dose cohort as part of the Phase I study’.

Imugene managing director Leslie Chong had this to say:

“Following the positive news on VAXINIA’s early signals and FDA Fast Track Designation to end 2023, we are pleased to start the new year by announcing the ongoing progress of the MAST trial as we continue to see no safety issues with the drug. We also look forward to expanding the trial to take a closer look at bile duct cancer where we’ve seen early encouraging results.”

Imugene is down 30% over the past 12 months.

Mesoblast Friday’s best performer on All Ords

Friday’s best performer — so far — is pharmaceutical firm Mesoblast, up 13%.

Mesoblast announced that the United States Food and Drug Administration (FDA) granted a rare pediatric disease (RPD) designation for its allogeneic cell therapy product Revascor.

Mesoblast said the FDA grants the designation for some ‘serious or life-threatening diseases which primarily affect children’.

Mesoblast was granted the designation after a randomised controlled trial:

‘Results from a blinded, randomized, placebo-controlled prospective trial of REVASCOR conducted in the United States in children with HLHS were published in the December 2023 issue of the peer reviewed The Journal of Thoracic and Cardiovascular Surgery Open (JTCVS Open).

‘In the HLHS trial conducted in 19 children, a single intramyocardial administration of REVASCOR at the time of staged surgery resulted in the desired outcome of significantly larger increases in left ventricular (LV) end-systolic and end-diastolic volumes over 12 months compared with controls as measured by 3D echocardiography, (p=0.009 & p=0.020 respectively).’

Over the last 12 months, Mesoblast stock is down 65%.

Key Posts

-

4:15 pm — January 19, 2024

-

3:48 pm — January 19, 2024

-

2:15 pm — January 19, 2024

-

2:08 pm — January 19, 2024

-

1:59 pm — January 19, 2024

-

1:45 pm — January 19, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988