Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Lifts as Big Miners Gain, Cettire Surges 30%

MIT econ professor showcases Vision Pro use case

Free marketing for Apple’s Vision Pro is everywhere on Twitter.

People are spamming the site with “incredible use cases for Vision Pro”.

Some are genuine. Some are laughable.

Ivan Werning, MIT economist, has turned Apple’s ‘spatial computer’ into his new work station.

Can you envisage working like this?

Maybe your next employer won’t supply you with monitors and a laptop but just hand you a Vision Pro.

My new workstation… pic.twitter.com/xUkwIcQkyg

— Ivan Werning (@IvanWerning) February 6, 2024

“F the RBA”

Here’s an excerpt from Callum Newman’s latest piece for The Insider.

***

Did you hear about the RBA yesterday? I’m sure you did.

Here’s what I’ve got to say about that…

BORING!

I don’t have time to obsess about that piffle when stocks are roaring up.

I ask you:

Are you watching the small-cap sector currently? Stocks are flying all over the place!

Let me show you in action…

I gave a speech in November. I canvassed six stocks I was eyeing.

One of the stocks on my radar was US financial fund manager GQG Partners [ASX:GQG].

It’s now up 56% since my speech.

Now that’s what I call fun!

OK. OK. One sparrow doesn’t make a spring.

I’m just showing you examples of how the market is shaking off the doldrums of the last two years and embracing growth again.

If you’re holding back from fear, or uncertainty, around the economic outlook, right now it looks to me you’re missing out on a lot of potential alpha.

we are in a rare window where small-cap stocks have been suppressed for a long time…and are now bouncing back strongly as the investing environment improves.

Here’s one thing I can tell you with confidence: it won’t last forever.

Here’s an example…

Both Myer and Nick Scali came out yesterday with trading updates. Both went up over 10% on the day.

Here’s the thing though…

Myer reported FLAT sales and Nick Scali’s are DOWN.

Why did the stocks fly up?

Because the results were better than the very negative outlook the market had previously priced in!

How many other companies are out there, and suppressed like this? How many companies go up because things are ‘less bad’ than the market currently thinks?

I’d wager quite a lot of them are like this. I just put five down in a recent report in this presentation, if you’re interested.

I can point the way. I can show you results and research. But only you can act on any of it.

All I ask you is this.

If not now, when?

Market looks past Amcor’s soft 1H24

The world’s biggest packaging company thinks the worst is behind it. Given today’s price action, the market thinks so, too.

Amcor is up ~1.5% in late trade, despite some weak ‘adjusted non-GAAP’ 1H24 numbers:

- Net sales down 9% to US$6.7 billion

- EBITDA down 8% to US$994 million

- Net income down 10% US$453 million

Amcor CEO Ron Delia said 2Q24 volumes were ‘slightly lower than we anticipated at the beginning of the quarter, as destocking accelerated, particularly in the month of December, and demand remained soft.’

Despite that, adjusted free cash flow rose from a negative US$61 million to a positive US$52 million. ‘Inventory reduction initiatives’ were the primary explanation.

On another good note, Amcor reaffirmed FY24 guidance. Amcor thinks FY24 adjusted EPS will be between US 67 to 71 cents and adjusted free cash flow to be between US$850 million and US$950 million.

Amcor’s flexibles segment fared worst, with management breaking down the reasons:

‘In North America, net sales declined at high single digit rates driven by lower volumes. Volumes were higher in the condiments, snacks and confectionary categories and this was more than offset by lower volumes in categories including healthcare, meat and liquid beverage. In Europe, net sales declined at low double digit rates driven by lower volumes, partly offset by price/mix benefits. Volumes were lower in healthcare, snacks, coffee and unconverted film and foil end markets and this was partly offset by higher confectionary volumes. Across the Asian region, net sales and volumes were modestly higher than the prior year. Volumes were lower in South East Asian healthcare and this was partly offset by volume growth in Thailand, India and China. In Latin America, net sales declined at high single digit rates driven by lower volumes mainly in Chile and Mexico, partly offset by growth in Brazil.’

But what about non-adjusted, raw GAAP numbers?

They are less flattering.

Despite net sales falling ~9%, operating income fell 43%. Net income fell 58% year on year to US$290 million.

Fixed costs didn’t budge with lower volumes, compressing margins.

Cash and cash equivalents fell 49% to US$430 million.

BNPL Zip is up 245% since October

Talk about a turnaround.

Out of favour BNPL stock Zip [ASX:ZIP] is slowly becoming in favour with parts of the market.

Since early October 2023, the stock is up ~245%.

Of course, Zip is still down 92% since February 2021. So for some investors the recent surge is small consolation.

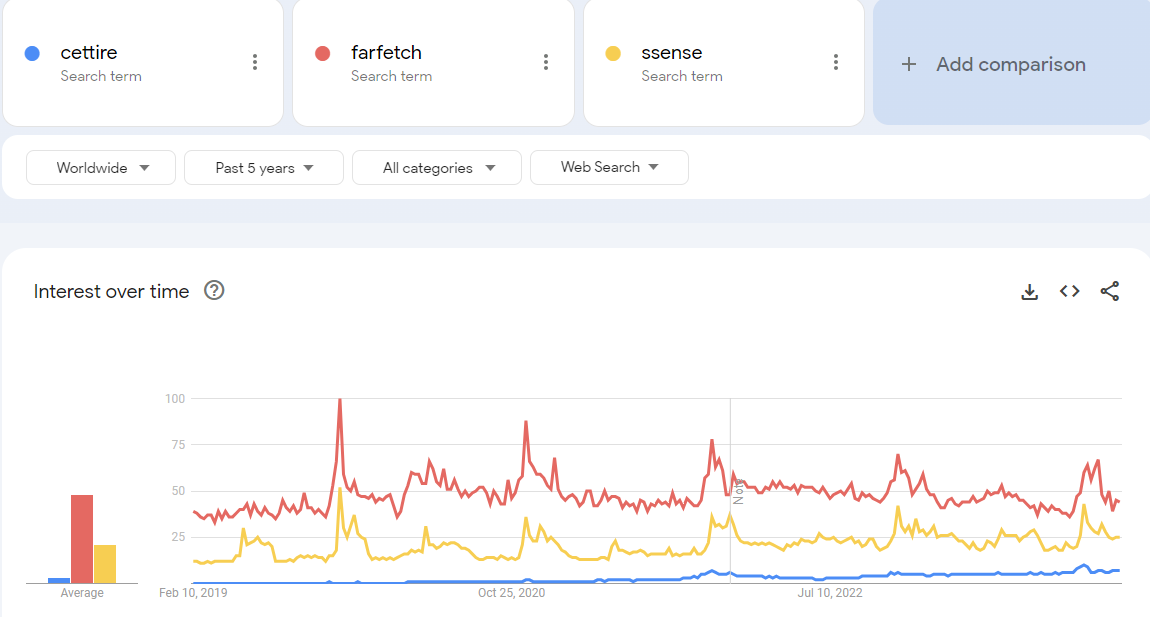

Cettire competitors struggling

Cettire operates in the grey luxury market. But it isn’t alone.

Customers often speak of the drop shipping triumvirate: Cettire, Farfetch, and Ssense.

farfetch, ssense, or cettire your best bet and they come really fast

— ⭑ ⭑ ⭑ ⭑ ⭑ (@marrdechrisean) January 27, 2024

Cettire is clearly doing well, evinced by the 1H24 sales growth. But what about the others?

Farfetch hasn’t had a great time.

Valued north of US$20 billion in 2021, the company is now almost worthless, dealing with litigation and stalled attempts to take it private or get acquired.

In mid-December, Farfetch entered a bridge loan facility of US$500 million to keep the lights on while seeking approval to sell the business to Athena Topco, a subsidiary of Coupang.

In the update, Farfetch said:

‘Farfetch Limited and its financial advisors have conducted a thorough and extensive process to secure additional liquidity for Farfetch Limited and its subsidiaries. Without such liquidity, Farfetch Limited and its subsidiaries would have been unable to continue as a going concern. The Board is disappointed that the process has not resulted in a solution that ensures that Farfetch Limited, the listed entity, remains a going concern. However, the Board is pleased to see that FF PLC has successfully secured a solution that ensures the continued operations of its business and that it will continue to serve the network of brands, boutiques and consumers depending on the FARFETCH Marketplace every day.’

Here’s the kicker:

‘There can be no assurance that the conditions to the Sale will be satisfied. Should the Sale fail to close or fail to close in a timely manner, there is substantial doubt about Farfetch Limited’s ability to continue as a going concern.

‘Upon consummation of the Sale, Farfetch Limited expects that holders of its Class A and B ordinary shares and its convertible notes will not recover any of their outstanding investments in Farfetch. Farfetch Limited is also expected to be delisted from the NYSE and to be liquidated.’

Over the last five years, Google search results put Cettire well behind Farfetch and Ssense.

Is Cettire overvalued?

I posed the question on Twitter. Let’s see what the Aussie fintwit community thinks.

$CTT 1H24 net profit rose 60% to $12.8m at a net profit margin of ~3.6%. In 1H23 it was 4.3%.$CTT.AX's 2H23 net income was ~$8m so its LTM earnings are ~$20.8m. Cettire is thus trading at ~70x LTM.

Is that too high? Or is that justified by the sales growth?

— Fat Tail Daily (@FatTailDaily) February 7, 2024

Emanuel Ajay Datt, who runs Datt Capital, thinks Cettire is overvalued when compared to Myer’s online division.

$CTT does less online sales than $MYR but valued at 2.4x the relative market cap 😏$CTT.AX $MYR.AX pic.twitter.com/HA17TbaBbi

— Emanuel Ajay Datt (@eadatt) February 6, 2024

And Jeremy Raper, who runs Raper Capital, pointed out the falling margins. Why are margins down when sales are up 90%?

why are EBITDA margins going down when revs are +80%…isnt this a capital light drop-shipper? shouldnt incremental margins be much higher?

— Jeremy Raper (@puppyeh1) February 7, 2024

Myer rose 14% in a day | Callum Newman unpacks the significance of the jump

How would you like to make 14%…in a day?

Perhaps you don’t believe me. Sound crazy? It isn’t.

Myer [ASX:MYR] shares rose this much yesterday.

Yep — the old department store warhorse outperformed the latest hot thing in AI, green metal tech or whatever market meme you care to latch on to…at least in the last 24 hours.

I’d like to think you were watching for a move like this — after all, I wrote about the potential opportunity in Myer this time last week.

I called it the ‘share market shopper’s delight’.

You didn’t even have to pay for the idea!

Did Myer come out with a barnstorming update?

No!

Management said its sales were about the same as the first half of last year.

The market loved this news.

What’s going on?

It’s all about expectations. I suggested the following in Fat Tail Daily last week…

‘A lot of the listed retailers were hammered, in terms of share price.

‘Things only need to get ‘less bad’ for them to potentially start rallying.

‘Remember that the share market is not pricing in what’s happening now…but what will be happening in 9–12 months.’

Now, put Myer’s result in recent context too. They’ve held their sales steady in a declining retail market.

That’s a good effort!

The trump card is that the stock is so cheap. It still looks that way even after the rally yesterday.

Myer has $120 million in net cash. It’s on track for about $50 million in profit for the first half.

Most of this should flow black to shareholders via a juicy dividend or even a buyback.

Tax and rate cuts will be in play next year. So will consumer confidence and the ‘wealth effect’ of rising house prices.

That’s enough for the market to keep pushing Myer shares along.

Here’s another reason Myer shares were able to kick up a lot.

It’s a small-cap stock!

For such a well-known and trusted brand, Myer only has a market cap of $650 million.

I doubt many analysts follow it anymore — or even the wider investor community. It’s a bit ‘old hat’.

But therein lies the opportunity!

The only way to rip alpha out of the market is to find information and situations most aren’t following…and therefore are not reflected in the price.

If you do what everybody else does, you’ll struggle to make a buck, and run the risk of buying at a ‘top’.

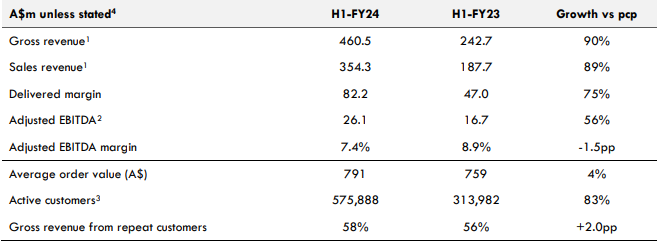

Why is Cettire stock surging?

Luxury retailer Cettire [ASX:CTT], operating in the grey market, has also been a somewhat grey stock.

Investors are unsure about it.

How should you value it?

What does it actually do?

Does it actually generate cashflows or just adjusted earnings?

It’s a bit grey.

But the market was unabashedly positive about Cettire’s 1H24 results.

Here they are in a nutshell.

These are some stellar numbers off the bat.

Sales revenue up 89% year on year? In this economy??

Active customers up 83%? When others are struggling to find new customers?

Interestingly, the ‘adjusted EBITDA marging’ didn’t improve but devolved 1.5% to 7.4%. Cettire is churning out sales but the margin is still slim.

Slim but positive. And with big volume, that’s enough to generate cash. Right?

1H24 net profit rose 60% to $12.8 million. Meaning that CTT’s net profit margin was ~3.6%. In 1H23 it was 4.3%.

Cettire’s 2H23 net income was ~$8 million so its LTM earnings are ~$20.8 million. That means Cettire is trading at 70x trailing earnings.

Is that too high? Is that justified by the sales growth?

The market’s reaction today seems to suggest the multiple is fine, given the projected growth. But as I like to say, high expectations make for high ledges.

Should investors be hunting for cheap lithium and nickel stocks yet?

Colleague Callum Newman had a great chat with Hedley Widdup, fund manager at Lion Selection, a specialist mining investment company.

They talked lithium, uranium, nickel, and more.

A fun chat if you’re interested in resource stocks, especially at the junior end of town.

Resources expert Hedley Widdup joined @CalNewmanFT to talk about #gold, #lithium, and #uranium.

✅Should we be hunting for cheap lithium and nickel stocks yet?

✅What to make of the recent uranium bull run?

✅Mining juniors to watch https://t.co/g6rHnDmpfB— Fat Tail Daily (@FatTailDaily) February 6, 2024

RBA’s Michele Bullock knows all about Taylor Swift inflation

The Reserve Bank’s Michele Bullock fronted her first conference post the Board’s monetary policy decision.

And the questions didn’t really impress.

A senior journo from the Sydney Morning Herald centred his question about services inflation on Taylor Swift.

The Taylor Swift question was posed and RBA's Michele Bullock did answer. @swrighteconomy: "How do interest rate rises affect services inflation, be it insurance, legal fees, or Taylor Swift tickets?"

Bullock: "Yes, I know all about Taylor Swift inflation." https://t.co/ISKrPRoXjv

— Fat Tail Daily (@FatTailDaily) February 6, 2024

Shane Wright seems very interested in Swiftonomics.

He appeared last year on The Project, talking about the economic impact of Swift’s upcoming tour in Australia.

Is he a Swiftie?

After Beyoncé got blamed by the Swedes for higher-than-expected inflation, could Taylor Swift worsen Australia's as fans clamour for tickets? Economics correspondent @swrighteconomy explains. pic.twitter.com/f8ku4Nt7UK

— The Project (@theprojecttv) June 27, 2023

iShares Bitcoin ETF has more YTD inflows than 99% of ETFs

Bloomberg’s ETF expert Eric Balchunas reported this crazy stat: the iShares Bitcoin ETF is now in the top five in terms of year to date inflows. Meaning it’s taken in more investor capital than 99.98% of ETFs.

As Balchunas said, ‘not bad for 17 days old’.

Also $IBIT now in Top 5 in YTD flows, which means it's taken in more cash than 99.98% of ETFs. Not bad for 17 days old. pic.twitter.com/ehAsZWRoqK

— Eric Balchunas (@EricBalchunas) February 6, 2024

Chinese investors rushing to US ETFs, despite mammoth premiums

Craziness: Chinese investors are stampeding out of local mkt (chart) and into US-focused ETFs, creating record volumes (chart). Problem is there's a quota so they buying in at premiums of up to 43% which has govt issuing warnings but no one cares bc the US FOMO is that bad via… pic.twitter.com/CZTTO5oKXZ

— Eric Balchunas (@EricBalchunas) February 6, 2024

Good morning, Australia

Good morning! Kiryll here.

Another day helming this ASX Live blog for Fat Tail Daily. Let’s make the most of it!

Like, for instance, the huge Cettire rally on strong sales growth.

What is going on with that stock?

Key Posts

-

4:36 pm — February 7, 2024

-

4:27 pm — February 7, 2024

-

3:39 pm — February 7, 2024

-

2:16 pm — February 7, 2024

-

1:47 pm — February 7, 2024

-

12:57 pm — February 7, 2024

-

12:55 pm — February 7, 2024

-

12:26 pm — February 7, 2024

-

11:18 am — February 7, 2024

-

10:58 am — February 7, 2024

-

10:50 am — February 7, 2024

-

10:42 am — February 7, 2024

-

10:40 am — February 7, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988