Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Down, US CPI Higher Than Expected, Bitcoin ETFs Start Trading

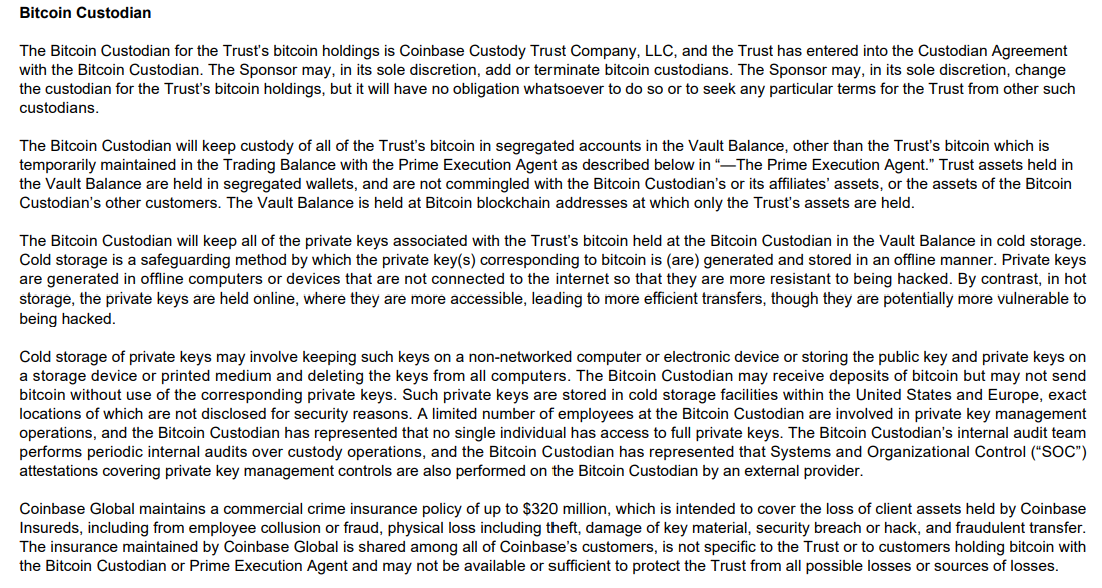

BlackRock’s spot Bitcoin ETF: the prospectus

The weekend is nearly upon us.

If you’re looking to do some reading, how about the 116-page prospectus for BlackRock’s new spot Bitcoin ETF?

An interesting snippet about the ETF’s Bitcoin custodian — Coinbase:

Hertz dumps Teslas for ICE cars as EV demand gets re-appraised

Here’s a twist.

Rental giant Hertz will sell about 20,000 electric vehicles (EVs), including a lot of Teslas it bought just two years ago from Elon Musk’s automaker.

Reuters reports:

‘Hertz will instead opt for gas-powered vehicles, it said on Thursday, citing higher expenses related to collision and damage for EVs even though it had aimed to convert 25% of its fleet to electric by 2024 end.

‘CEO Stephen Scherr had last year at the JPMorgan Auto Conference flagged headwinds from higher expenses for its EVs, particularly Teslas.

‘Hertz even limited the torque and speed on the EVs and offered it to experienced users on the platform to make them easier to adapt after certain users had front-end collisions, he said.’

It’s been a disappointing 6-12 months for EVs.

If you remember, I mentioned earlier this week in another live blog that the share of EVs in the UK stalled last year for the very first time.

Obviously, we’ve also had precipitous falls in lithium prices to boot. Price drops so big it was enough for Core Lithium to suspend mining operations.

Has the market overestimated EV demand? And is it slowly coming to terms with this now? What will the prevailing narrative on EVs be this year?

Let's check the morning news ☕ pic.twitter.com/VWQUq159NJ

— Emanuel Ajay Datt (@eadatt) January 11, 2024

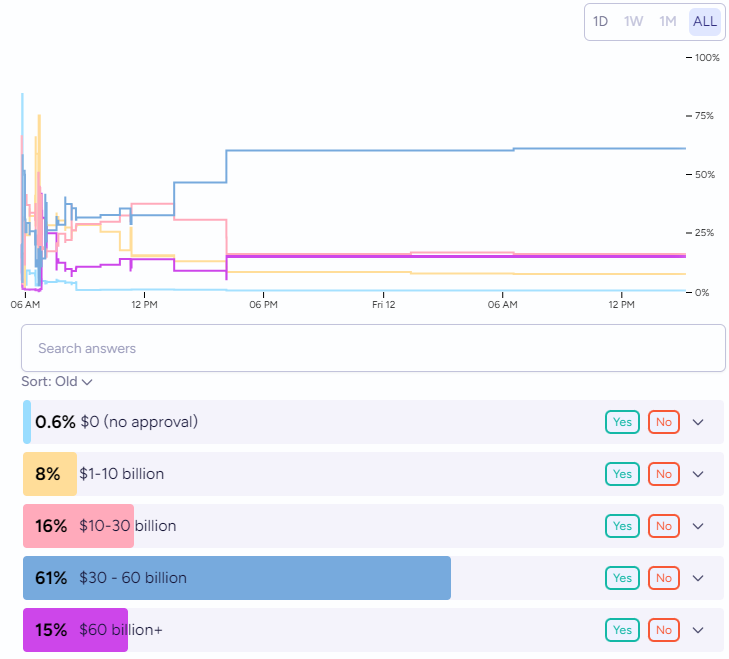

Prediction markets have combined AUM of all US-traded spot Bitcoin ETFs at US$30-60B by next week

Quite the long title, sorry!

But the Manifold prediction market has a live question.

What will the combined AUM of all US-traded spot Bitcoin ETFs be at the end of January 19th, 2024?

So far, traders are assigning a 61% of AUM being between US$30-60 billion.

~700,000 trades in first day of spot Bitcoin ETFs

Bloomberg’s senior ETF analyst Eric Balchunas did everyone a solid with this table chasing up all the trades made across all the new spot Bitcoin ETFs.

All told there were 700,000 individual trades today in and out of the 11 spot ETFs. For context, that is double the number of trades for $QQQ (altho it sees much bigger $ volume bc bigger fish use it) So a lot more grassroots action (vs big seed buys) than I expected which is… pic.twitter.com/syUGfjHQpr

— Eric Balchunas (@EricBalchunas) January 11, 2024

First What’s Not Priced In episode of 2024 out now!

The first What’s Not Priced In episode of 2024 is out now!

Have a listen and let me know what you think!

Topics covered:

- 2023 market lessons and reflections

- Outlook for 2024

- Why Callum thinks the Fed may cut earlier than the market thinks

- Why Aussie stocks can hit all-time highs this year

- Why Bitcoin and gold can attack all-time highs

- Dogs of 2023 that can rebound in 2024

- Does the lithium sector look interesting now or still too risky?

- Impact of SEC’s approval of Bitcoin ETFs

- How investors should approach advent of AI

- Callum’s five small caps to watch in 2024

‘Get Amongst It’: Callum Newman’s Five Small Caps to Watch in 2024

Vanguard won’t offer spot Bitcoin ETFs on its platform

Vanguard won’t offer spot Bitcoin ETFs on its brokerage platform.

In a statement, Vanguard said a Bitcoin ETF does not ‘align with our offer’:

“Our perspective is that these products do not align with our offer focused on asset classes such as equities, bonds, and cash, which Vanguard views as the building blocks of a well-balanced, long-term investment portfolio.”

Customers spammed Vanguard’s Twitter with questions about buying Bitcoin ETFs on its platform. Each such question received its generic response.

Spot Bitcoin ETF trades hit US$4.6 billion in first day

The reaction was immediate.

A day after the US SEC approved spot Bitcoin ETFs, trading commenced in earnest.

Reuters reported a few hours ago that spot Bitcoin ETFs saw US$4.6 billion worth of shares traded.

The activity hasn’t seen an explosion in the price of the underlying cryptocurrency. Largely because the ETF approval was overwhelmingly expected for months.

Currently, Bitcoin is hovering at around US$45,960.

Syrah Resources up 6% on Vidalia production update

Struggling graphite producer Syrah Resources [ASX:SYR] is up 6% after a production update for its active anode material (AAM) US facility in Vidalia, Louisiana.

Syrah now expects AAM production at Vidalia by the end of this month.

SYR stock is down 75% over the past 12 months as falling graphite prices and high mining costs at its Mozambique mine have hit coffers.

Late last year, Syrah decided to pause graphite production and wait for market conditions to improve.

It hopes the Vidalia AAM facility will improve margins by turning Syrah into a vertically integrated operator.

Nuix continues to burn cash

In a 1H24 trading update today, Nuix said it ended the half with cash on hand of $24 million and no debt.

In 1H23, Nuix reported a cash balance of $37.1 million, down from $46.8 million in FY22.

The firm is still burning cash, which complicates its ‘strategy of funding software development costs from free cash flow’.

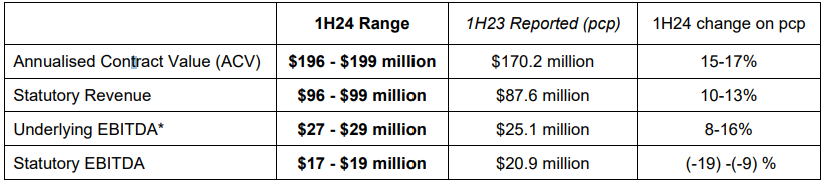

Nuix down 15%, expects 1H24 earnings to fall

Data analytics firm Nuix [ASX:NXL] is down ~15% after releasing a 1H24 trading update.

Nuix expects statutory EBITDA for the half-year ended 31 December 2023 to be in the range of $17 to $19 million. Nuix booked $20.9 million in statutory earnings in 1H23.

The fall in earnings was blamed on non-operational legal costs related to Nuix’s ongoing case with ASIC.

The regulator has taken Nuix to court over allegations of governance issues and missed sales forecasts.

These non-operational legal costs amounted to $10 million in 1H24, compared to $2.4 million in the prior corresponding half.

Nuix said it was ‘underlying cash flow positive’ in the half but did not reveal hard numbers. It also didn’t say if it was cash flow positive on a statutory basis.

Good morning!

Good morning, Kiryll here!

Plenty of news to discuss today. Spot Bitcoin ETFs are now trading, with billions exchanging hands already.

US headline CPI was higher than expected.

Nuix is down 15% after a trading update. And more…

Let’s get to it!

Key Posts

-

5:10 pm — January 12, 2024

-

4:44 pm — January 12, 2024

-

3:20 pm — January 12, 2024

-

1:06 pm — January 12, 2024

-

12:53 pm — January 12, 2024

-

12:45 pm — January 12, 2024

-

12:34 pm — January 12, 2024

-

12:23 pm — January 12, 2024

-

11:38 am — January 12, 2024

-

11:27 am — January 12, 2024

-

11:18 am — January 12, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988