Get amongst it.

Don’t get caught up in predictions. Nobody really knows what’s coming.

Know that a lot of excellent risk versus reward stocks are out there still.

The small-cap sector, especially, has ‘heaps of opportunities’.

Don’t despair you’ve missed anything. Get revved up. And get amongst it.

That was the gist of Callum Newman’s message on the first episode of What’s Not Priced In for 2024.

And it was a cracker.

Here’s what else we discussed:

- 2023 market lessons and reflections

- Outlook for 2024

- Why Callum thinks the Fed may cut earlier than the market thinks

- Why Aussie stocks can hit all-time highs this year

- Why Bitcoin and gold can attack all-time highs

- Dogs of 2023 that can rebound in 2024

- Does the lithium sector look interesting now or still too risky?

- Impact of SEC’s approval of Bitcoin ETFs

- How investors should approach advent of AI

- Callum’s five small caps to watch in 2024

Let’s talk more about Bitcoin and AI below.

2023 reflections

New year, new season, same old markets, same old me.

Welcome back to a new ‘season’ of What’s Not Priced In.

The podcast asking the most productive question in finance — what information is already reflected in prices and what information is yet to be.

I wrote my prediction for 2024 last week. So here’s a brief reflection on 2023.

I have diagnosed in me a developing apathy to macroeconomic questions.

Yield curves. Interest rate paths. Rate cut bets. Inflation expectations.

All interesting. Important, even.

But how much do they really influence individual stocks?

If you’re not a macro trader playing with exotic financial instruments — how much of that macro stuff matters?

How much of this macro stuff is fluff?

I’m not saying things like interest rates are immaterial to stocks.

But they are not as material as I thought.

It’s more productive sweating over the micro stuff.

A stock’s business model. Its balance sheet. Its return on capital. Its competition. Its industry dynamics.

If you seek out businesses who can sustain competitive advantages for years and grow earnings consistently, what’s the use of scouring Fed statements?

But maybe this is a pessimistic overreaction. We’ll see how my prognosis evolves.

How big is the approval of Bitcoin ETFs?

The US Securities and Exchange Commission (SEC) approved 11 spot Bitcoin exchange-traded funds on Thursday.

A huge development, albeit one widely expected.

Reuters reported today US$4.6 billion worth of those Bitcoin ETF shares traded hands already.

It’s a big development for Bitcoin’s mainstream reputation.

Scoffed at for years by the financial industry at large, the SEC’s imprimatur brings Bitcoin into the institutional fold.

Is that a good thing?

Bloomberg’s Matt Levine summed up the conflicting mood well in his piece on Monday:

‘If your interest in crypto is “number go up,” this is good. If your interest in crypto is “this is the financial system of the future and will increasingly be adopted by big institutions and ordinary people,” this is a mixed bag: On the one hand, there is a lot of optimism about ETF approval driving retail and institutional adoption; on the other hand, “everyone owns Bitcoin through a BlackRock ETF in their Fidelity brokerage account” is not quite proof that crypto is the financial system of the future. If your interest in crypto is “crypto keeps coming up with fun new ways to do finance,” though, this is pretty boring. Crypto’s fun new way to do finance is to put Bitcoin in a box and sell you shares of the box; the goal is to transmute Bitcoin — this decentralized disintermediated trustless novel form of money that was meant to replace the banks and brokerages — into regular stocks.’

Ideologically, it’s a mixed bag.

What about financially?

Will Bitcoin ETFs have a positive effect on Bitcoin’s price long-term?

I’m unsure.

Would Bitcoin ETFs singlehandedly create more demand for Bitcoin?

You could argue the lack of Bitcoin ETFs sidelined some investors and institutions from buying. With Bitcoin ETFs approved, these investors can act on their interest.

The question is how significant the number of those previously sidelined investors is.

Is it material?

We’re about to find out.

Investing intelligently in AI

AI was the biggest theme in 2023. It will remain so in 2024, I think.

But how should investors approach the AI space?

Those of us without computer science degrees are AI novices. We get lost in AI’s conceptual flora and fauna.

So how do we go about investing in the space intelligently?

With care, diligence, and caution.

AI is transformative.

And has been for years. ChatGPT is the first global AI superstar. But AI technology has been transforming economic activity for years.

Yet ChatGPT did show the age of AI is really here.

Everyone has seen AI’s power.

Now businesses want to harness it. Customers want to use it. And everyone wants to benefit.

AI has set off an entrepreneurial frenzy.

And it will be investors’ jobs to sift the wheat from the chaff.

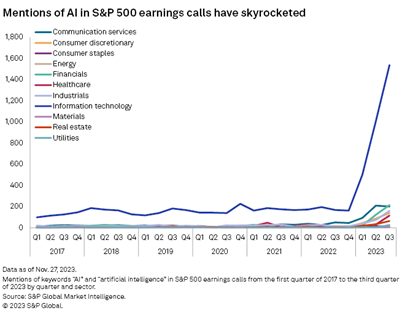

A Market Intelligence review of S&P 500 transcripts found ~2,500 mentions of AI during earnings calls in 2023. Nearly 10 times the amount in 2022.

|

Source: S&P Global |

All sorts of companies will be touting their AI integrations and capabilities.

Some will be of merit.

Consider Yum! Brands, operator of KFC, Pizza Hut, and Taco Bell. This week, S&P Global wrote:

‘Following its 2021 acquisition of AI company Dragontail, Yum! Brands Inc., which operates fast food brands KFC, Pizza Hut and Taco Bell, has implemented an AI-driven production and delivery sequencing platform at nearly 1,400 US Pizza Hut stores and is using AI to manage inventories across 7,000 restaurants.

‘The latter application "predicts and suggests the quantity of each product a restaurant general manager should order," CFO Christopher Lee Turner said on a Nov. 1 earnings call.’

But some will lack merit.

2024 will be the year of AI and the year of triage. Markets will have to distinguish companies who live up to the AI hype from those simply seeking to exploit it.

Regards,

|

Kiryll Prakapenka,

Analyst and host of What’s Not Priced In

Kiryll Prakapenka is a research analyst with a passion and focus on investigating the big trends in the investment market. Kiryll brings sound analytical skills to his work, courtesy of his Philosophy degree from the University of Melbourne. A student of legendary investors and their strategies, Kiryll likes to synthesise macroeconomic narratives with a keen understanding of the fundamentals behind companies. He’s the host of our weekly podcast What’s Not Priced In, where he and a new guest figure out the story (and risks and opportunities) the market is missing to give you an advantage. Follow via your preferred channel and check it out!

Comments