Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise; OPEC+ Extends Oil Cuts; Iron Ore Hangs on Key Chinese Meetings

Market close update

The ASX 200 closed the day with little movement, down -0.13% at 7,735.8 after spending much of the morning up slightly.

Real Estate (+1.34%) and Tech (+0.92%) remained the major two sectors gaining today, while seven sectors were in the red.

Today’s worst performers were Health Care (-0.78%) and Utilities (-0.77%), with slight falls in their large caps.

The major miner’s BHP and Rio both fell around 1.5%, while the Big Four banks all gained under a 1%.

Fortescue fell -3.17% as iron ore futures remained under pressure amidst weak demand.

Life360 continued its positive momentum from last week, gaining over 8% as the company takes its first major step into advertising on its app.

Gold miners saw a strong day of gains, with Genesis Minerals, Perseus Mining, and Northern Star Resources all gaining over 5% in trading today.

Meanwhile, the biggest loser on the ASX 200 today was Cettire, which fell -6% after the company’s founder and CEO, Dean Mintz, sold 7.2% of the company’s issued capital.

Lake Resources also saw heavy losses, falling over -7% as the company announced it is laying off 50% of its staff as part of cost-cutting measures in the face of low lithium prices.

Bitcoin tries to breakthrough US$64k

Bitcoin’s [BTC] recent rise has hit a clear resistance line of US$64,000 in the past week.

Once again, the major cryptocurrency attempted to break through the valuation, only to drop down again.

However, many analysts think it’s just a matter of time before BTC surpasses that and challenges its all-time high of around US$69k.

Is this blindly bullish, or are we really in the middle of a market run similar to 2021?

Currently, the market is in ‘extreme greed’ or 82, according to the Fear & Greed Index.

How does this compare to points in the past? Here are some examples of past highs and lows:

Source: Cointree

The magnificent seven have a new leader

The ‘Magnificent Seven’ tech stocks have led the US indices for some time now, but last month’s data shows just how skewered that is now starting to look.

Nvidia accounted for an incredible 26.3% of the S&P500s gains, after its incredible earnings beat that reviatlised the market.

Meanwhile, Apple continues to drag, costing the index 23 points.

Through February, NVIDIA $NVDA accounted for 26.3% of the S&P’s YTD gain, adding 92 index points. Apple $AAPL has cost the index 23 points. pic.twitter.com/4M56PMwBiU

— Bespoke (@bespokeinvest) March 3, 2024

OPEC+ Extends Oil Cuts Through Mid-Year

The Organisation of the Petroleum Exporting Countries and its allies (OPEC+) have decided to extend their oil production cuts through the first half of 2024, aiming to prevent a global oil surplus and support prices.

Maintaining the Cutbacks:

The group will maintain curbs of roughly 2 million barrels per day until the end of June, with Saudi Arabia contributing half of the pledged reduction.

Russia, a key member with a unique exemption to split its cuts between production and exports, has pledged to shift its focus towards production cuts, addressing a previous concern raised by Saudi Arabia regarding compliance.

Balancing a Complex Market:

This move is a strategic response to several factors affecting the oil market such as:

A seasonal dip in global fuel consumption.

Rising production from US shale drillers.

Uncertainty surrounding China’s economic outlook, a major consumer of oil.

Price Considerations:

While the current oil price of around US$80 per barrel offers some relief for consumers after a period of high inflation, it may not be sufficient for some OPEC+ members.

Saudi Arabia, for instance, reportedly needs oil prices to exceed US$90 per barrel to support its economic transformation plans. Russia, facing war-related expenses, also seeks higher revenue from oil sales.

Gradual Adjustment and Compliance Challenges:

The production cuts will be gradually lifted after June, with adjustments based on prevailing market conditions.

However, full compliance remains a challenge for some OPEC+ members, as evidenced by past instances where countries like Russia and others exceeded their quotas.

Future Policy Decisions and Market Outlook:

The group’s next meeting in June is likely to involve a more complex decision regarding production policy for the second half of the year.

The International Energy Agency predicts that continued production cuts might be necessary throughout 2024 due to slowing global oil demand growth and increasing supply from the Americas.

Weaker inflation data pushes expectation of cut

According to the RBA rate indicator, the market is starting to bring forward its expectation of earlier cuts as data points towards continued disinflation.

After some concerns through Jan-Feb of re-accelerating inflation, the newest (albeit volatile) data points in the right direction.

Here are some great charts from IMF Economist Alex Joiner for February.

Weak inflation gauge outcome for February underpins the expectation of further disinflationary progress pic.twitter.com/eOhMMwi5Fo

— Alex Joiner 🇦🇺 (@IFM_Economist) March 4, 2024

Midday market update

The ASX 200 remains flat at midday, trading at 7,745.9 as the sectors remain split.

Real Estate (+1.64%) and Tech (+0.94%) remain the biggest two gainers as interest rate-sensitive sectors renew hopes of earlier cuts.

Meanwhile, Healthcare (-0.84%) and Utilities (-0.61%) drag on the indcies as market cap giants fall under a percent at midday.

In individual news, small-cap Genex Power [ASX:GNX] is up ~30% in trading this morning as Japanese utility giant J-Power lobbed a $375 million bid for the renewables developer.

Fletcher Building [ASX:FBU] is down by -2.3% as chairman Bruce Hassall brings forward his exit from the struggling building materials company.

Downer EDI has released its defence against its pending shareholder class action lawsuit, blaming its ‘accounting irregularities‘ on auditor KPMG. The prior announcement of these accounting errors saw Downer’s stock plummet -20% in one day.

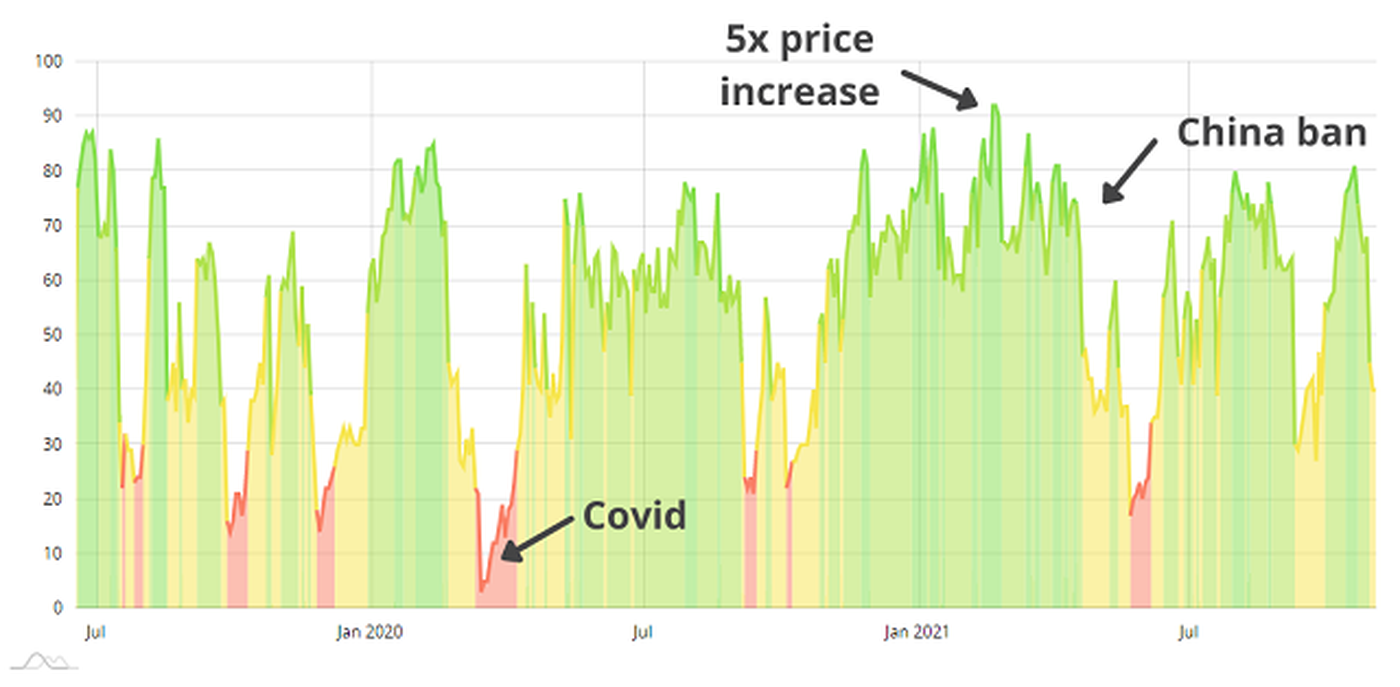

Lake Resources halves staff

Lithium developer Lake Resources [ASX:LKE] shares are down by -5.5% in trading this morning as the company announced a hefty round of staff cuts.

‘Lake is now implementing further cost-saving measures through reducing global headcount by approximately 50 per cent across its non-core operational and administrative workforce and additional streamlining of other general and administrative expenditures,’ the company said today.

The company had previously pushed for a series of cost-cutting initiatives in an attempt to withstand the collapsing price of lithium.

Lithium and other battery metals saw a marked bounce on Friday, with many lithium producers jumping ~10% by the end of the week.

It seems hope has re-entered the market for many, with stocks like Liontown [ASX:LTR], up +5.06%, and Pilbara Minerals [ASX:PLS], up 3% today.

Caution should remain for traders as not all signs point to a clear recovery from here. EV sales remain subdued.

CEO David Dickson tried to remain positive today, saying:

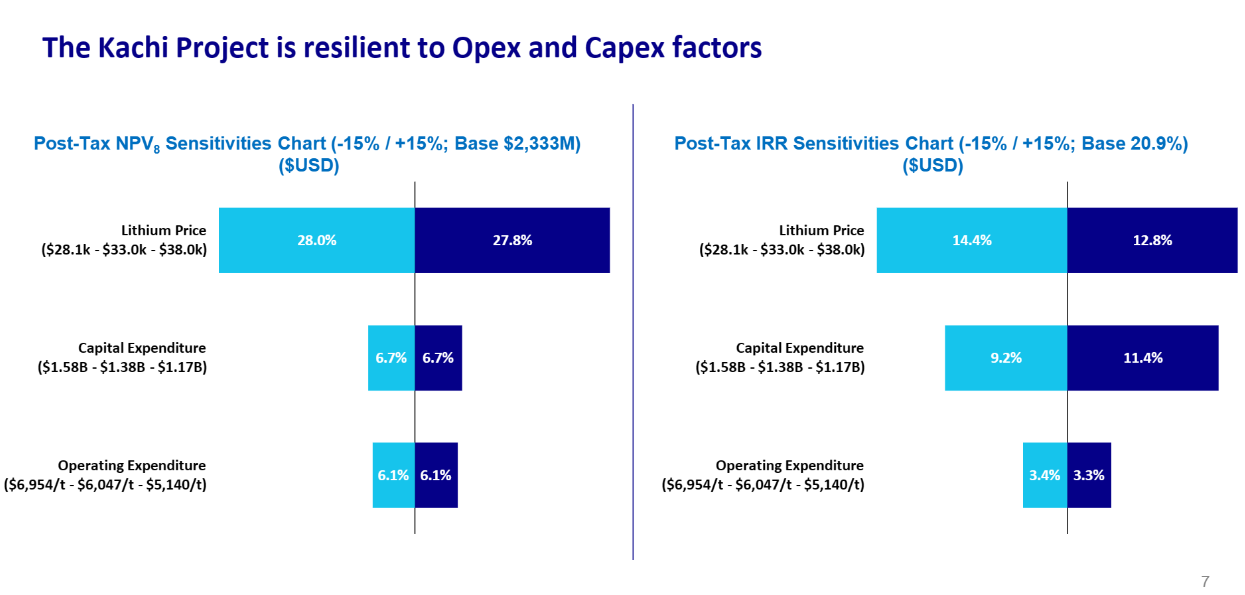

‘Despite the current backdrop of depressed short–term lithium pricing, we remain very enthusiastic about the Kachi Project, and its potential to deliver long–term value.’

Investors remain more sceptical, especially since prior promises from the company were that the Kachi Project remained ‘resilient to Opex and Capex factors’.

Source: LKE – Bell Potter Conference Presentation 14-02-24

The company has Goldman Sachs acting as a financial advisor in its quest to find a strategic partner for the Kachi Project. The outreach includes car and battery manufacturers, oil and gas companies and sovereign wealth funds.

Iron ore futures eye China’s next move

On Friday, iron ore futures on the Singapore exchange dropped to their lowest levels since October 2023 at $114 a tonne.

Bids have improved slightly this morning to US$115.20 as the market puts its hopes in the upcoming Chinese leader meetings.

The annual parliamentary meetings, known as the ‘Two Sessions’ are at the government, instead of party level and typically release details of the upcoming policy plans.

These should include GDP targets and clearer signals of upcoming economic stimulus.

Last year, China’s GDP growth was 5.2% after a slower-than-expected recovery from the pandemic.

While the ongoing property slump continues, for much of 2023, analysts were surprised by the depth of demand for Iron ore within China.

Assumptions had been as construction continues to falter, iron ore would be hurt. It seems China’s pivot to manufacturing included easing restrictions on Steel mill’s quotas, which ran hot last year, producing around 1 billion tons of steel.

China Steel Production (tonnes)

Source: TradingEconomics

High prices finally caught up with many of these mills in December, which cut production. But at the same time, the first signs of some small recovery in the property sector are showing and production has picked up.

For many the thing to be watching closely this week will be speeches from the Minister of Industry and Information Technology, Minister of Science and Technology, and Minister of Housing and Urban-Rural Development.

These speeches will likely hint at the next policy moves for the year. Early guesses are taking a queue from prior speeches that focus on ‘new productive forces‘ in China.

This is in the realm of ‘green tech’ like solar cells, EVs, and lithium-ion batteries, as well as huge stimulus into less sophisticated semiconductors for general products.

What this all means for Iron ore is still unknown, but for now the likelihood that Iron ore will regain its prior high’s looks shaky.

Morning market update

Good morning. Charlie here,

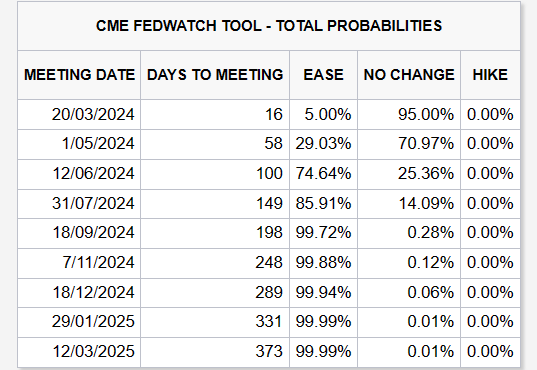

The ASX 200 opened flat at 7,746.3 as US markets reset their record highs last week. The latest rounds of economic data have given traders some confidence that interest rate cuts are likely to come this year, although when is still a moving target.

Here are the latest probabilities from the CME FedWatch Tool:

Source: CME FedWatch

So far, it looks like the bets are on for the Fed to cut rates at its June Meeting.

While in Australia, the market continues to remain bearish on the Aussie dollar as it breaks over US 65 cents. Real money funds held close to a record number of short positions against the AUD at the end of February.

That comes even as the RBA’s latest minutes showed some members considering raising rates rather than cutting.

Senior economist at Commonwealth Bank, Kristina Clifton, said risks remain:

‘Over the next month we see the risk of the Australian dollar easing back to around 0.64c.’

‘We expect the RBA to cut its cash rate much more than the market expects, and we are forecasting 150 basis points of cuts by around mid-2025.’

Wall Street: S&P 500 +0.80%, Dow +0.23%, Nasdaq +1.14%.

Overseas: FTSE +0.69%, STOXX +0.35%, Nikkei +1.90%, SSE +0.39%.

The Aussie dollar rose over the weekend, then fell -0.04% to US 65.22 cents.

US 10-year bond yields -7bps to 4.18%.

Australian 10-year bond yields -4bps to 4.10%.

Gold is up +0.10% to US$2,085.40, while Silver is down -0.15% to US$23.13.

Bitcoin rose +1.49% to US$62,780, while Ethereum rose +1.71% to US$3,470.

Oil Brent rose +1.96% at US$79.79, while WTI Crude fell -0.11% to US$83.46.

Iron ore fell -1.6% to US$114 a tonne, its lowest since October 2023.

Key Posts

-

4:34 pm — March 4, 2024

-

3:54 pm — March 4, 2024

-

2:38 pm — March 4, 2024

-

2:34 pm — March 4, 2024

-

12:35 pm — March 4, 2024

-

12:29 pm — March 4, 2024

-

12:10 pm — March 4, 2024

-

11:54 am — March 4, 2024

-

10:16 am — March 4, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988