The Bryah Resources Ltd [ASX:BYH] has acquired a new exploration project — the Lake Johnston Lithium-Nickel Project.

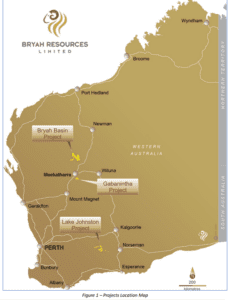

BYH’s new addition to its portfolio of projects is 400 km east of Perth, consisting of eight exploration licence applications covering 690km2.

Bryah says Lake Johnston enhances its strategy of exploring for the energy metals of the future ‘in a proven geological environment.’

Bryah Resources Ltd [ASX:BYH] share price is currently up 14%.

Having underperformed the ASX 200 this year, Bryah is likely angling toward the hot lithium sector in a move to regain momentum.

Bryah acquires lithium-nickel project

Bryah Resources acquired the Lake Johnston Lithium-Nickel Project. The project consists of eight exploration licence applications.

BYH said the acquired project extends to within 10 km east of the Mount Holland lithium mine being developed under the Wesfarmers and SQM joint venture.

The Mt Holland project included a lithium deposit with a reported mineral resource of 189 million tonnes grading 1.5% Li2O.

Bryah Managing Director Neil Marston said:

‘Bryah is an energy metals’ focused company with copper, lithium, nickel, gold and manganese assets in Western Australia. This acquisition broadens our exploration reach.

‘The tenements Bryah will be exploring shortly are within a region which has been proven to be highly prospective for lithium as well as nickel and copper — all vital commodities in the EV/energy storage revolution.

‘Recent exploration work for lithium and nickel on our Lake Johnston tenements has been limited, however the region has huge potential for new discoveries using modern exploration techniques.’

BYH share price outlook

To know which way the prevailing wind is blowing, see what the opportunity-hungry junior explorers are doing.

In BYH’s case, it is branching out from exploring copper, gold, and manganese to prospecting for nickel and lithium.

Lithium is one of the hottest sectors right now, seeing the likes of Vulcan Energy Resources Ltd [ASX:VUL] and Lake Resources NL [ASX:LKE] gain over 1,000% in the last 12 months.

It’s likely BYH has seen an opportunity it does not wish to pass up, ending today’s update with research on the outlook for the white metal.

Citing the latest Resources and Energy quarterly from the Department of Industry, Science, Energy and Resources, BYH pointed to the rising spot lithium prices and growing EV sales.

According to the Department’s report, demand for EVs is expected to rise to around 30% of annual vehicle sales by 2030.

If you want to learn more about the lithium industry, I suggest checking out this report.

And if you want an in-depth tour of investing in lithium, I suggest going over this guide we published last month.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here