The Lithium Energy Ltd [ASX:LEL] share price is rising on progress with LEL’s Solaroz Project following the arrival of geophysical equipment.

At time of writing, LEL share price were trading at 73.5 cents per share, up 13% from the last trading session.

The stock has been in a consistent uptrend since listing in May, gaining more than 250%.

Geophysical equipment & the preparation for exploration on Solaroz Project

The arrival of geophysical equipment is a major step in the company’s goal to commence work on its Solaroz Project in Argentina.

The company announced today as part of its plan to ‘expedite’ its exploration programme, it ordered and now received into Argentina a range of geophysical testing equipment.

This equipment will be mobilised into the field upon approval of the Environmental Impact Assessment (IEA).

As we covered last week, Lithium Energy reported last Thursday that the IEA is entering its final evaluation stages regarding LEL’s Solaroz Project.

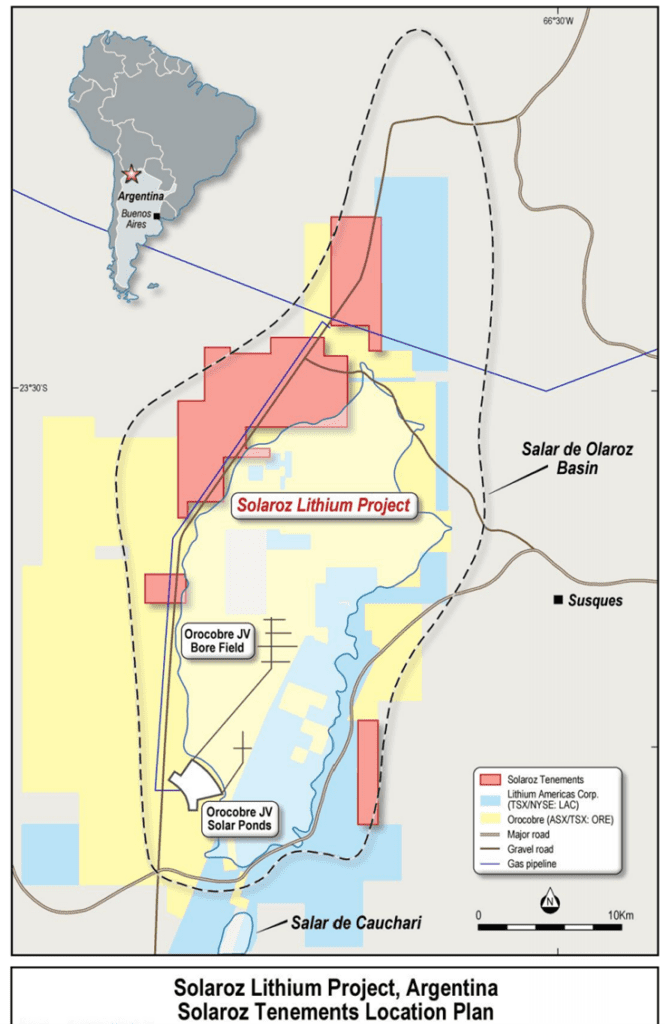

For reference, the project is located within South America’s famed ‘Lithium Triangle’ in North-West Argentina in the Salar de Olaroz basin.

This basin hosts two mature lithium brine projects: the production assets of Orocobre Ltd [ASX:ORE] and the advanced lithium brine development project held by Lithium Americas.

Bullish investors will find in this proximity a promising sign.

As of now, the geophysical testing equipment is being configured and tested for deployment.

Once this phase is successfully accomplished, LEL will deploy and initiate the process.

The recently acquired equipment will form a crucial part of the geophysical testing program at Solaroz to both support the previously published exploration targets and optimise the location of drill holes that will seek to underpin the next phase of exploration.

Let’s talk a little about the previous exploration targets to get a better idea of the future targets the company may aim for.

The previously published exploration target was between 1.5 to 8.7 million tonnes (Mt) of contained Lithium Carbonate Equivalent (LCE).

This is based on a range of lithium concentrations of between circa 500 mg/L Lithium (Li) and 700 mg/L Li.

So, once the geophysical testing equipment is deployed, LEL could record an exploration target greater than the current one.

Outlook for LEL shares

Lithium Energy is investing heavily in its Solaroz Project as they are likely aware of the importance of leveraging favourable market conditions.

These conditions have in part led to LEL shares gaining 50% over the last week.

And today’s jump of 13% suggests investors are bullish on LEL making the most of its Solaroz assets.

It is clear governments are eyeing off a greener future while enterprises are eyeing off ways to profit.

Lithium is at the core of this as the white metal is a key part in the global EV supply chain.

So if you want more information on a sector enjoying resurgence, I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report