Three Fat Tail Investment Research market experts contemplated these questions in a special roundtable on the lithium sector, which you can watch below.

The roundtable also featured a potential lithium play to buy and hold for the next 10 years…and one to avoid with your life.

ASX lithium stocks were hot in 2021

ASX lithium stocks were some of the top performers in 2021.

In fact, eight of the top 10 best-performing stocks on the All Ordinaries in 2021 were lithium stocks.

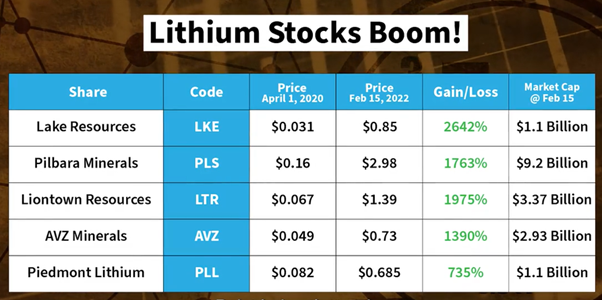

And while the boom hit fever pitch in 2021, it started even earlier, as you can see from the table below:

Source: Money Morning

Lake Resources [ASX:LKE], for instance, is up over 2,500% since April 2020.

In fact, after a slow start to 2022, LKE is up a further 25% in the last five days alone.

So does the lithium boom still have legs? How long can this theme run? Where is the top and are we nearing it?

Simon Moores — CEO of Benchmark Intelligence — said just last month that we are still ‘comfortably 17 months into this new lithium bull market’ with ‘no sign of it running out of steam’.

But the stock market is forward-looking.

Rising EV sales, escalating spodumene spot prices, earnest government policies pushing the battery tech agenda…none of this is new to the market.

As always, the question is, how much of the lithium story is already priced in?

These questions were just some of the ones examined by our experts in a special roundtable focused exclusively on the lithium sector.

Fat Tail Investment Research lithium roundtable

The roundtable featured three of Fat Tail’s market experts, each discussing the key questions about the current state and the future of the lithium industry.

One of them was small stock trader and investor Callum Newman — someone who closely follows the sector.

In fact, Callum first wrote an extensive report on the first lithium mega-boom back in 2016.

During the roundtable, Callum profiled one lithium stock he thinks is best to avoid at all costs…and one you could buy and hold on to the for next 10 years.

Then we had Selva Freigedo joining. Selva is our analyst who focuses on the green transition underway in the energy markets.

As readers know, battery technology is a key part of the pivot to cleaner energy…and lithium is an essential battery input.

Finally, we had Greg Canavan in the mix. Greg is the Editorial Director here at Fat Tail Investment Research.

And while he’s not necessarily an expert of the lithium sector, he is an expert in markets and valuations.

ASX lithium sector: the pressing questions

Here are some of the questions that were discussed in the roundtable:

- Why is the market booming?

- How far can this boom go?

- Can the stocks in this sector go any further? Or is the rug likely to pulled?

- Who has more upside in 2022 and beyond: lithium producers, explorers, or developers?

- Does the recent lithium boom have parallels? And what can be learned from those parallels?

- Famed investment strategist Russell Napier once said that investors spend 90% of their time thinking about demand, and only 10% of their time thinking about supply.

- So when will supply likely meet demand? Will supply outstrip demand in 10 years? In five years?

- EV automakers need raw materials like lithium, cobalt, nickel, copper, and graphite for their batteries.

- Are investments in nickel, copper, graphite more attractive in 2022 than investments in lithium?

It’s not all about lithium

The aim of the lithium roundtable was to give you some insight into where it might be headed next…and some ideas for why to navigate it and what to do about it.

But lithium is not the only game in town.

While lithium is now a prominent investment theme, there are other ideas out there yet to make their way from the fringes to the mainstream.

If you’re interested in learning more about these ideas, I recommend checking out the latest research report on seven ASX stocks to watch like a hawk.

The report details seven Aussie stocks with the potential to become stock market superstars soon.

These companies operate in all kinds of different markets…

Clean energy generation (which relates directly to our conversation today)…cutting-edge microchip tech…‘smart’ plastic that biodegrades automatically…new battery technology…even ‘remote working’ systems…

Regards,

Kiryll Prakapenka,

For Money Morning