The Lithium Australia NL’s [ASX:LIT] share price is up 15.9% today after detailing the high-value potential of its LFP battery materials.

Lithium stocks are the talk of the town this week.

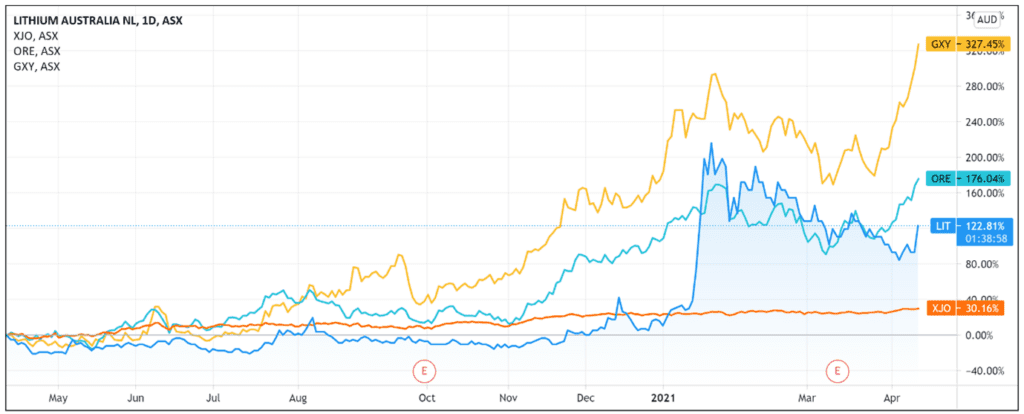

Stocks like Galaxy Resources Ltd [ASX:GXY], Orocobre Ltd [ASX:ORE], and Vulcan Energy Resources Ltd [ASX:VUL] saw their shares rise in recent days.

LIT joined the party, with the stock up as much as 18% in early trade.

Year-to-date, LIT shares are up 90% and up 135% over the last 12 months.

LIT’s subsidiary demonstrates ‘high-value performance’

Lithium Australia announced today that its subsidiary VSPC has completed a prefeasibility study (PFS) for the proposed production of VSPC’s lithium ferro phosphate (LFP) cathode powder.

According to LIT, VSPC’s LFP is ‘superior in quality and performance to most of the other LFP cathode powders currently available.’

Lithium Australia reported that the PFS confirmed ‘robust project economics for the manufacture of VSPC’s LFP cathode powder.’

LIT expects production to ramp up to 10,000 tonnes per annum (tpa) over a three-year period, reaching nameplate capacity in 2026.

The PFS considered Australia, Vietnam, and India as potential jurisdictions to produce VSPC’s LFP.

India was selected to host the plant as the country presented the ‘best financial outcome’ with a net present value (NPV) of US$253 million at an internal rate of return (IRR) of 33%.

Additionally, the base case to locate the plant in India includes a payback period of five years and annual LFP sales revenue of US$140 million.

Finally, the base case included EBITDA of US$66 million per annum and free cash flow of US$56 million per annum.

According to Lithium Australia Managing Director Adrian Griffin, the completed PFS ‘clearly demonstrates the value of establishing an alternative cathode powder supply chain using VSPC’s proprietary technology.’

Three Ways to Invest in the Renewable Energy Boom

LIT share price outlook

The prominent shift to electric vehicles is creating additional demand for commodities like lithium, copper, nickel, cobalt, and rare earths.

In turn, lithium stocks are benefiting from investors buying resource companies to gain exposure to the electric vehicle theme.

Consider the Solactive Global Lithium Index, which tracks the performance of the ‘largest and most liquid listed companies’ active in exploration of lithium and production of lithium batteries.

Source: Solactive

The index is up 145% over the last 12 months.

And with demand expected to grow, some expect supply to become squeezed.

As Argonaut Funds Management Chief Investment Officer David Franklyn told the Australian Financial Review that:

‘It is unlikely that supply will keep pace with demand, given the long lead times involved in bringing a new mine into production, so prices are likely to move higher.’

In Mr Franklyn’s judgement, this is a ‘multi-decade transition and Australia is perhaps best placed to capitalise, given its huge resource endowment, its strong legal and financial systems and strong ESG frameworks.’

And Perennial Value Management Portfolio Manager Samuel Berridge believes that the electric vehicle ‘revolution has achieved critical mass.’

In Mr Berridge’s view, there might be ‘some short-term concerns but longer term, this is a rising tide.’

This, also with Mr Griffin’s comment today that ‘major battery producers worldwide are racing to expand their LFP production to meet demand as LFP becomes the fastest growing sector of the battery industry.’

But while there is a plenty of momentum behind lithium stocks, producers like LIT must still execute to meet the growing demand.

Investors will now likely price in high expectations for lithium producers so LIT may well have to focus hard on executing its production targets.

If lithium stocks like LIT interest you or you want to find out more about the lithium industry and the related investment opportunities, it’s worth checking out our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

Comments