Lithium Australia NL’s [ASX:LIT] 100%-owned subsidiary VSPC is now producing commercial quality lithium titanium oxide (LTO) anode powder.

The production of LTO anode powder adds to VSPC’s existing capability to develop advanced battery materials like lithium ferro phosphate (LFP) and lithium manganese ferro phosphate (LMFP) cathode powders.

Today’s update helped LIT’s share price rise 8.70% to 12 cents a share.

Despite trading relatively flat for the last few months, the LIT stock is still trading up for the year, buoyed by hot interest in the broader lithium sector.

Year to date, the Lithium Australia share price is up 90%.

VSPC now producing battery anode powders

Lithium Australia today announced that apart from producing advanced LFP and LFMP cathode powders, VSPC’s pilot plant has now manufactured high-quality LTO — a required anode material for high-performance lithium-ion battery cells.

As LIT explained:

‘Conventionally, LTO is prepared via a solid-state reaction, with titanium dioxide (rutile or anatase) and lithium carbonate or lithium hydroxide as the raw materials. The materials are calcined at temperatures above 800° Celsius for a prolonged period (from 12 to 24 hours) to ensure high-phase purity.

‘Because VSPC’s patented, slurry-based process reduces calcination time and ensures consistent phase- and end-product quality, it is ideal for producing LTO.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

How does VSPC’s LTO stack up against the competition?

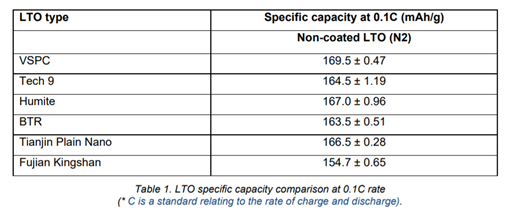

LIT said when VSPC’s LTO was benchmarked against five commercial LTO products, it achieved a specific capacity of 169 milliampere hours per gram (mAh/g) at 0.1C°.

According to LIT, overall, VSPC achieved ‘superior specific capacity’ to other commercially available materials.

That said, one of the peers compared was Hombitec LTO, actually acquired by VSPC prior to 2013.

LIT did not disclose further details on Hombitec or what role, if any, it will play in VSPC’s LTO plans.

What next for the Lithium Australia Share Price?

Lithium Australia noted that VSPC’s success with LTO prompted it to expand research into other anode battery materials.

These materials include titanium niobium oxide and other niobium-based anode materials often used in space and defence applications.

LIT said VSPC is now developing an anode materials work programme with other firms leading research in the field.

Lithium Australia Managing Director Adrian Griffin commented:

‘To achieve the performance desired for next-generation LIBs, improved anodes are also required. VSPC’s patented technologies are applicable to the production of both anode and cathode materials.

‘Currently, VSPC produces the world’s highest performing LFP cathode powder and is among only a handful of companies capable of producing high-energy-density LMFP.

‘Market demand for advanced nickel- and cobalt-free batteries puts VSPC in a unique position to deliver precursors that meet more exacting performance requirements.

‘VSPC’s successful production of high-performance LTO is an Australian first, as well as a global necessity.’

If you want extra information on evaluating and comparing lithium miners, I suggest reading our lithium guide released last week.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector.

Additionally, if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here