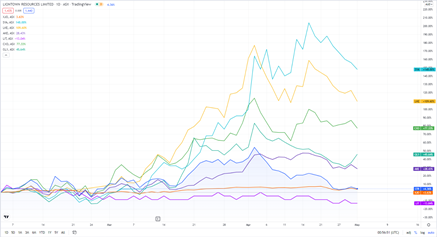

Liontown Resources [ASX:LTR] was up 2.45%, trading at $1.46 a share this morning.

This result followed an update on completed offtake negotiations with LG Energy Solutions.

While LTR has risen 318% in the last 12 months, the lithium mining company deescalated in April, down 24.68% — and nearly 7% in the last week. Has news of the finalised offtake with LG Energy assured investor opinion for now?

By contrast, high-flying competitors Sayona Mining [ASX:SYA], Lake Resources [ASX:LKE], and Core Lithium [ASX:CXO] are down today: SYA -3.12%, LKE -5.84%, and CXO -4.64%. While junior lithium company Global Lithium Resources [ASX:GL1] shot up 6.94%.

Lithium stocks are jumping like Mexican beans right now, what could be causing the disarray?

Source: Tradingview.com

LTR offtake with LG Energy is finalised

Liontown’s announcement today detailed the closure of its offtake agreement with LG Energy Solution (LGES), a leading lithium-ion battery manufacturer in South Korea.

LGES is to claim spodumene concentrate from LTR’s 100%-owned flagship Kathleen Valley Lithium Project, to take effect in 2024 and span a five-year period, with opportunity to extend all the way to 2034.

Terms were first discussed on 12 January, LGES deciding to offtake 100,000 dry metric tonnes (DMT) spodumene within the first contracted year, with an annual increase of 150,000 DMT each year thereafter.

Prices will be subject to a ‘formula-based mechanism referencing market prices for battery-grade Lithium Hydroxide Monohydrate.’

Liontown CEO Tony Ottaviano said:

‘We are delighted to have concluded negotiations with LG Energy Solution allowing us to execute our first full form Spodumene Concentrate Offtake Agreement for up to 30% of our production. This establishes the foundation for a long-term partnership and we are proud that we will be supplying lithium from the Kathleen Valley Project to LGES, a respected global leader in the lithium battery value chain.’

LG Energy Solution’s Vice President, Strategic Procurement, KY Lee added:

‘The Offtake Agreement with Liontown provides for a long-term supply partnership, with Kathleen Valley representing the opportunity to diversify our sources of Lithium with spodumene concentrate from a Tier-1 project in a world-class mining jurisdiction. We look forward to continuing to work with Liontown through project development and operation.’

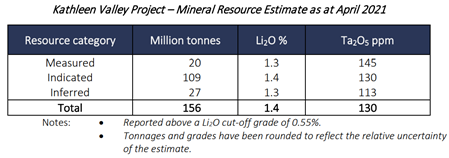

Source: Liontown

Building on Kathleen Valley prospects

Liontown’s agreement with LGES marks another milestone for the company’s flagship project, following an earlier off-take agreement with Tesla in February.

Like with LGES, Tesla had signed on for a five-year term, agreeing to purchase 100,000 DMT spodumene in the first year, with the amount increasing 150,000 DMT each year after that — taking 30% of Kathleen Valley’s start-up production capacity.

Tesla’s offtake is to be finalised this month, ensuring everything is kosher for its 2025 commencement.

Source: The Kathleen Valley Project. Liontown

LTR share price outlook

Liontown is a favourite in the share market today, as the company cements a clear plan for a profitable future in off-take agreements with both Tesla and LG Energy.

That said, with peers SYA, LKE, and CXO declining, and junior GL1 on the incline with LTR today, lithium stocks have been erratic.

This could be a result of internal company politics, or it could have something to do with Elon Musk tweeting about getting into lithium mining himself due to out-of-control pricing.

Sometimes we don’t know what the method behind the madness is, we just have to roll with the punches.

At times like this, it’s the perfect opportunity to evaluate which lithium stocks are likely to do well and which might be best left alone.

It can be tricky to work this out yourself, so you might like to check out our free research report ‘Three Overlooked ASX Lithium Stocks that Could Soon Rocket Higher on the Fast-Growing EV Revolution’ to get yourself started!

Regards,

Kiryll Prakapenka,