At time of writing, the share price of Liontown Resources Ltd [ASX:LTR] is up more than 11%, trading at 24.5 cents.

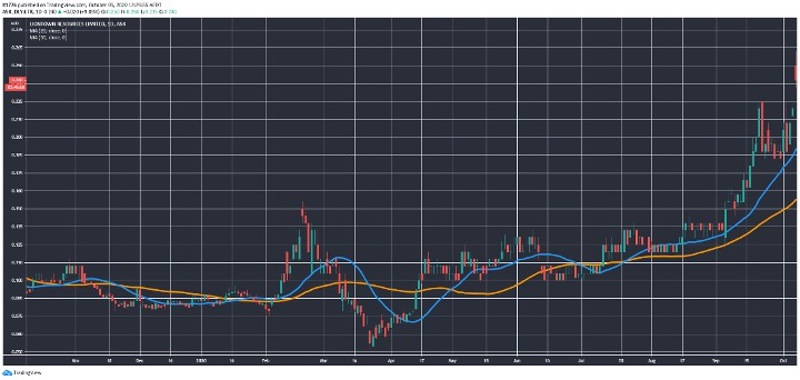

From the March market low, the LTR share price went on an immense run:

Source: Tradingview.com

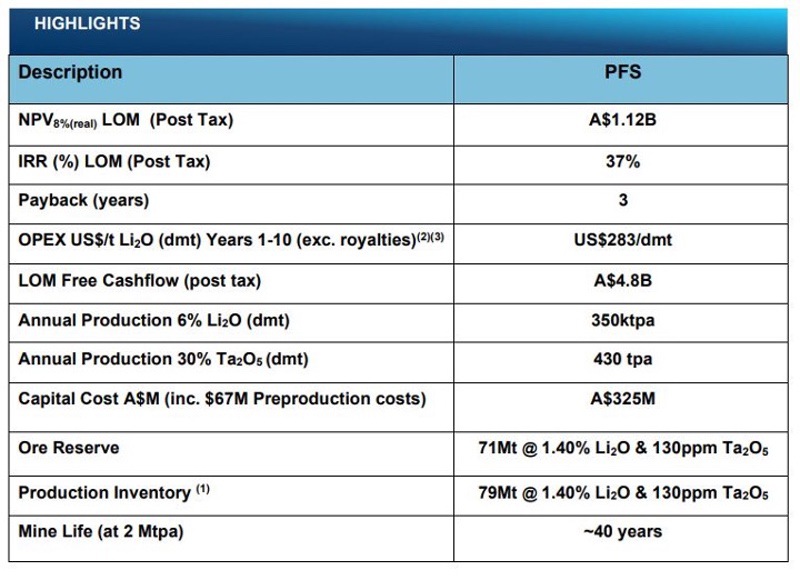

Today, Liontown released an update to the Kathleen Valley PFS that improves its economics further.

New Kathleen Valley PFS shows improved NPV and mine life

Here’s a breakdown of the new metrics for the Kathleen Valley project:

Source: Company Presentation

By anyone’s standards 40 years is a long mine, and an NPV of $1.12 billion and IRR of 37% make it an attractive project.

According to their annual report, their Tier 1 asset at Kathleen Valley is now ‘the world’s 4th largest hard rock (spodumene) lithium resource base, by ownership.’

So, a potential lithium giant in the making.

Outlook for LTR share price

After such a steep rise, it’s possible investors may take money off the table in the short term.

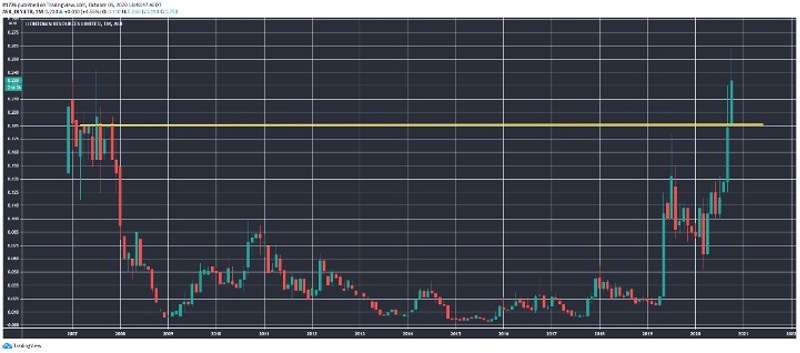

You can see on the monthly chart, some resistance dating back to when they listed in December 2006 — which the LTR share price has punched through:

Source: Tradinview.com

Or alternatively, the run could keep going in a sky’s the limit scenario.

A lot would depend on news flow after a series of positive announcements.

Kathleen Valley is still uncommitted, meaning no offtake partners are in place.

Should they get favourable terms from a future offtake partner, then there is a future catalyst out there.

It’s even possible the lithium price has bottomed, as per a recent Canaccord report which we discussed in relation to the Piedmont Lithium Ltd [ASX:PLL] share price.

If we see a big breakout in the share prices of big lithium miners like Pilbara Minerals Ltd [ASX:PLS], then they could be right.

Time will tell, but I’m definitely noticing some big speculative moves already taking place.

For a breakdown of why lithium could be set for a big finish to 2020, download this free report.

Regards,

Lachlann Tierney,

For Money Morning

Comments