Link Group [ASX:LNK], the troubled superannuation and share registry administrator, navigated a tough financial landscape for the past few years.

Four suitors explored acquisition, only to encounter roadblocks. This has left shareholders in a state of suspended animation, with shares creeping down.

Today, financial services giant Mitsubishi UFJ Financial Group (MUFG) emerged as the victor. Offering a $1.2 billion lifeline and bringing the uncertainty to a close.

Shares have skyrocketed in trading today, up 27.35% at $2.16 per share. Today’s movements reverse six months of losses to finish the past 12 months up 26.30%.

Will this latest deal end a disappointing 8-year run for Link after listing at $6.37 a share in 2015?

Source: TradingView

A Series of False Starts

The $2.10-per-share offer and a 16-cent dividend represent a 32.9% premium over Link’s last closing price.

While it may not match the dizzying heights of earlier bids, it signifies a welcome return to solid ground.

The M&A turbulence began in late 2020 with a flurry of potential suitors. US private equity firms Carlyle Group and Pacific Equity Partners joined forces.

Initially dangling an enticing $5.40 per share, SS&C Technologies — another American contender — entered the fray with a $3 billion proposal.

Both eventually failed after due diligence revealed difficulties within Link’s troubled UK arm.

In December 2022, Canadian company Dye & Durham entered the game, securing a $2.9 billion deal.

However, Link’s UK struggles and a revised, scaled-down offer of $2.5 billion ultimately led Dye & Durham to withdraw.

One of the biggest obstacles for potential acquirers was the Link Fund Solutions debacle in the UK.

The company’s involvement in the high-profile collapse of the £3.7 billion Woodford Equity Income Fund in 2019 led to severe financial losses and reputational damage.

MUFG’s offer, while not as rich as its predecessors, holds significant value for Link and its shareholders. The board agreed today, unanimously recommending the offer.

Link’s Group Chair, Michael Carapiet, reiterated this today, saying:

‘While the Link Group Board has and remains confident about the company’s future, we acknowledge that the Scheme provides shareholders with the opportunity to receive cash value at a significant premium.’

The deal will be subject to various regulatory approvals and is planned for completion in June 2024.

Outlook for Link Group

The deal marks the end of Link’s 8-year journey on the ASX. The bittersweet exit at $1.2 billion is a far cry from its 2015 listing price of $6.37 per share.

While the MUFG takeover closes the chapter on Link Group’s ASX listing, it also opens new doors.

Link’s reach and capabilities may expand as part of a larger, global financial entity. This could offer clients access to a broader range of services and opportunities.

The Japanese banking giant also brings stability and global reach, which Link’s CEO Vivek Bhatia believes will benefit all.

‘Joining forces with a global leader like MUFG and The Trust Bank will be significantly beneficial to our clients and employees,’ Mr Bhatia said today.

However, questions remain about how MUFG will integrate Link’s operations and address the challenges in the UK.

On 14 December, shareholders of the UK arm voted to approve a £230 million redress scheme. This would pay back some of the £1 billion lawsuits claimed. But investigations and grumbling remain unresolved.

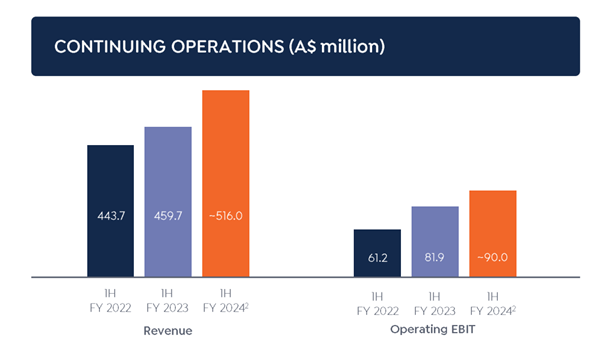

Overall, the MUFG takeover signifies a turning point for Link Group. Guidance for FY24 before the offer was a 12.2% increase in revenue to $516 million and a 9.9% increase in EBIT.

Source: Link Group FY23 AGM Presentation

In total, shareholders are expected to receive $2.26 per Link Group share in cash if the deal goes through.

While shareholders may not reap the windfall they once hoped for, they can find solace in the security that a well-established financial giant like MUFG brings.

With the turbulence subsiding, what the future holds for Link under its new ownership remains to be seen.

Solutions for an uncertain future

With the uncertain state of the market, growth isn’t many people’s priority.

Stocks have roared into the end of the year but are now looking out of gas.

But despite the ASX 200 benchmark only gaining +3.95% for the year, people are still making money.

That income is from dividend companies that don’t require you to speculate on ‘the next big thing’.

Dividend stocks are the ‘Stealth Wealth’ makers of a market going sideways — simple, safer, and stress-free.

But finding the right ones takes more than just finding the best dividend payers.

Editorial Director Greg Canavan has written a simple guide to helping people find the right ones.

Click here to find out how to access the report.

Regards,

Charlie Ormond

For Fat Tail Daily