California-based American information technology company Life360 [ASX:360] has proven a fruitful quarter for the first three months of FY23, declaring a 34% year-on-year increase in revenue of US$68.1 million.

Life360’s core subscription revenue also went up a huge 66% year-on-year to $46.2 million.

The group said that net losses and positive adjusted EBITDA were achieved a quarter ahead of expectations, and the group looks forward more growth for the rest of the year.

These results saw the tech stock’s share price increasing 10% by the early afternoon.

A 360 share could be bought for $6.37 at the time of writing, and the stock has also moved further into the green by 27% in the last month and 75% over the last 12 months:

Source: marketindex.com

Life360’s 34% YoY revenue increase

Life360 today reported unaudited financial results for the quarter ended 31 March, in which the group revealed a year-on-year (YoY) revenue increase of 34% with a total of US$68.1 million.

Core Life360 subscription revenue also went up 66% YoY with $46.2 million.

The family safety and communications app posted an achievement of annualised monthly revenue (AMR) of $239.5 million, yet another increase of 44% YoY.

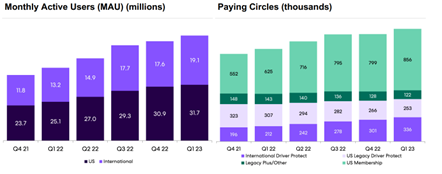

Paying circles rose 22% YoY with net quarterly additions of 73,000 versus 69,000 the same time last year, even despite price increases over the last three months.

On that score, the group did say that there was a 43% YoY increase in US average revenue per paying circle (ARPPC) of $140, which was put down to the benefits of higher pricing.

The group rolled out price increases for existing monthly US Android subscribers last month.

Life360 said that it incurred a net loss of US$14.1 million and said that its positive Adjusted EBITDA of US$0.5 million was achieved one quarter ahead of its initial expectations.

Life360 ended the quarter with cash and equivalents of US$76.1 million.

The group reiterated its full-year guidance for 2023 is aimed at more than 50% YoY growth for core Life360 subscription revenue, and also said that it expects consolidated revenue in the range of $300 million — $310 million.

Life also expects to see positive Adjusted EBITDA and operating cash flow of $5 million — $10 million for the full year.

Life360’s CEO Chris Hulls said:

‘The Life360 business has continued to deliver impressive growth metrics, with Global MAU (monthly active users) up 33% YoY and AMR up 44% to $239.5 million. Paying Circles returned to growth in Q1’23, with Global net subscriber additions of 73 thousand, ahead of the 69 thousand achieved in Q1’22, a very positive result given the size of the price increases implemented in Q4’22. International Paying Circles increased 50% YoY, with net adds at close to all-time record levels. UK Paying Circles increased 64% YoY, a very encouraging sign ahead of our Membership launch later this year.’

Source: 360

In other news, Life360 also announced that it has appointed a new chief operating officer, with Lauren Antonoff to step up from product and technology leader, to fill the new role.

Ms Antonoff was said to have a track record for driving growth through customer-focused value and has worked with entrepreneurs throughout software services in the past, including 18 years at Microsoft.

Mr Hulls commented:

‘Lauren’s experience leading successful product and technology teams, and her commitment to customer value makes her the perfect fit for the Life360 team. We are excited to have her on board, and look forward to her impact on our mission to bring families together and keep them safe.’

Australia’s evolving economy

The global supply chain is twisting.

Australian trade isn’t what it once was.

The change is all around us, but what is it all pointing to?

Jim Rickards, financial and geopolitical analyst, has pieced certain puzzle pieces together.

He says ‘no one is talking about how this could end the Australian economy as we know it’, as soon as within the next 12 months.

Learning the patterns and getting ready for change could put you ahead of the curve.

If you want to know more about one of the biggest geoeconomic shifts in our lifetime click here.

Regards,

Mahlia Stewart,

For Money Morning