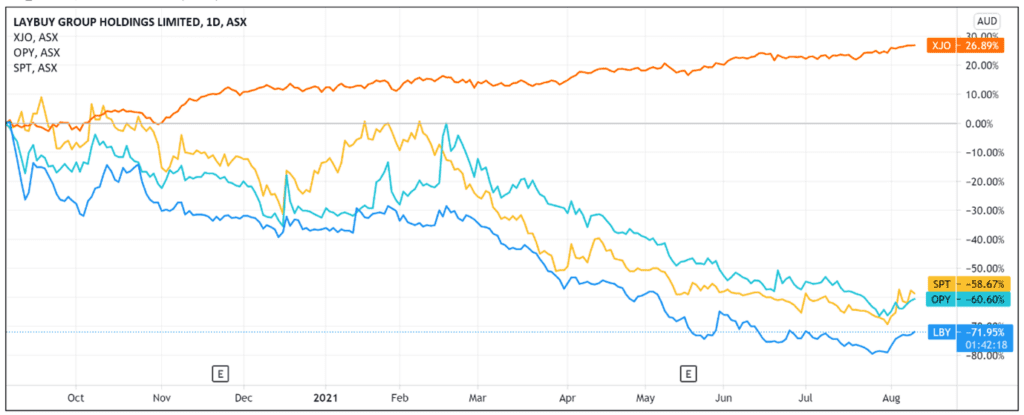

The Laybuy Holdings Ltd [ASX:LBY] share price shot up this morning by nearly 5%.

It is currently trading hands at 59 cents per share.

Today’s price action comes after a material announcement to the ASX today.

Laybuy revealed it has signed a partnership agreement with the UK’s largest independent fragrance retailer, The Fragrance Shop.

The Fragrance Shop has 200 stores across the UK and retails 6,000 products.

Laybuy is a payment provider that allows customers to make a purchase and then pay the cost off gradually over six weeks.

Through choosing to buy via Laybuy, customers can get their hands on goods immediately and pay the price in smaller increments. This is all without incurring interest.

Notably, the share price of similar payment services provider Afterpay Ltd [ASX:APT] is also on the up today, showing nearly a 4% increase at time of writing.

This comes after Jack Dorsey’s Square is set to acquire Afterpay in an all-stock deal.

The Afterpay acquisition has spotlighted the ASX BNPL sector, with some saying the Square deal validates the wider industry, and others thinking this could spark more mergers or acquisitions.

Considering all this, does Laybuy have what it takes to compete with its rivals globally? Can it go out on its own? Or can it make an attractive acquisition target for a larger firm wishing to enter BNPL?

Top three provider in the UK

Aside from Laybuy’s partnership agreement with The Fragrance Shop, there were other developments.

LBY revealed it is now recognised as one of the top three BNLP providers in the UK.

Consolidating its position, the company signed a further 222 new UK merchants in July.

Further, UK Gross Merchandise Value (GMV) more than doubled in the past quarter along with annualised GMV reaching NZ$398 million.

This metric is up 107% for Q1 FY22 compared to Q1 FY21.

But Laybuy certainly isn’t resting on its laurels overseas. The company is persisting with an aggressive acquisition strategy domestically in tandem with its global partnerships.

In Australia and NZ, agreements have been signed off with House of Travel, Adore Beauty, Sanity, Wittner, Ksubi, Max Fashions, Colette, Culture Kings, EB Games, and more.

Only a few days ago, LBY also released their Q1 results.

Active customers are up 356,000 year-on-year (reaching 829,000) while active merchants are up 4,800 year-on-year (reaching over 10,000).

The company made record income of NZ$10.4 million.

The company also successfully completed a capital raise of AU$40 million during the quarter to further propel growth in the UK.

Continuing to grow at this rate could attract more investors as the Square-Afterpay deal raises international awareness of BNPL.

What’s the outlook for LBY shares?

While it’s impressive that Laybuy has a growing customer base, plenty of retailers are already using (and continue to use) other BNPL providers.

The growing acceptance of BNPL is likely to make competition tougher for BNPL providers. It could be a constant fight just to keep one’s market share in a rapidly-changing retail world.

Laybuy will be hosting a webinar for investors tomorrow on Wednesday, 11 August 2021, at 9:00 am AEST/11:00 am NZT — so make a note in your schedule if you’d like to take part and learn more details.

In the meantime, if the changing nature of our financial system interests you or you wish to read up on the fintech industry looking for investment ideas, then you might enjoy reading our free 2021 fintech report.

The report discusses three fintechs with potential for growth in 2021.

There’s a lot happening in the fintech space, no doubt.

So to discover the full details of the report, simply click here.

Regards,

Lachlan Tierney,

For Money Morning

PS: Along with your report on fintech stocks, you’ll also get a free subscription to Money Morning, an e-letter that has been designed to deliver the most exciting investing opportunities straight to your inbox seven days a week. Click here to subscribe now.