The Lake Resources NL’s [ASX:LKE] share price jumped 6% in early trade after stating it possesses the ‘world’s cleanest lithium’ in an investor presentation.

LKE’s presentation referenced Lake’s 99.97% high-purity lithium carbonate product, which has ‘far lower’ impurities than the 99.5% battery-grade lithium carbonate of some rivals.

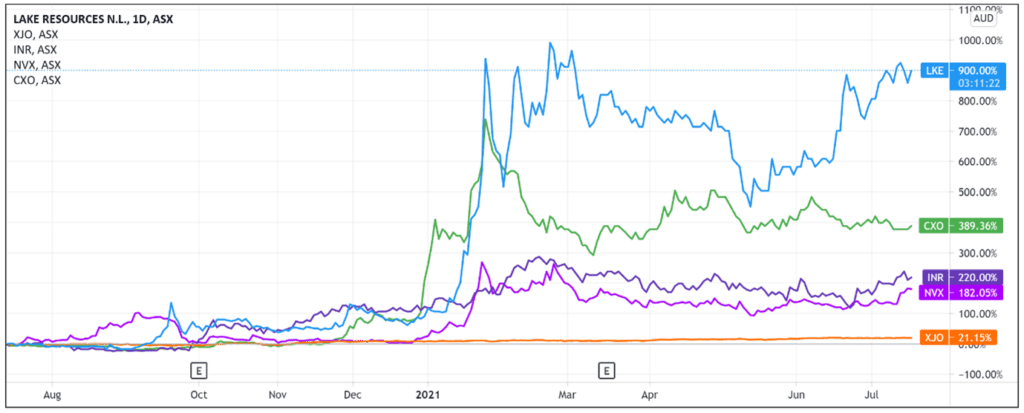

LKE shares were exchanging hands for 39 cents at time of writing, up 870% over the last 12 months.

High purity = Higher battery performance

One of the main points of Lake’s presentation was its argument that the higher the purity of lithium, the higher the battery performance.

Higher performing batteries will play a major role in electric vehicles seeking to topple the current dominance of internal combustion engine (ICE) cars.

By supplying high-purity lithium, LKE hopes to attract manufacturers on the hunt for quality inputs.

The company also stated that only 50–60% of lithium production is battery quality.

So a company with more efficient lithium production is also one with fewer costs. This can improve margins or make it easier to compete on price.

Cleaner technology, lower environmental impact

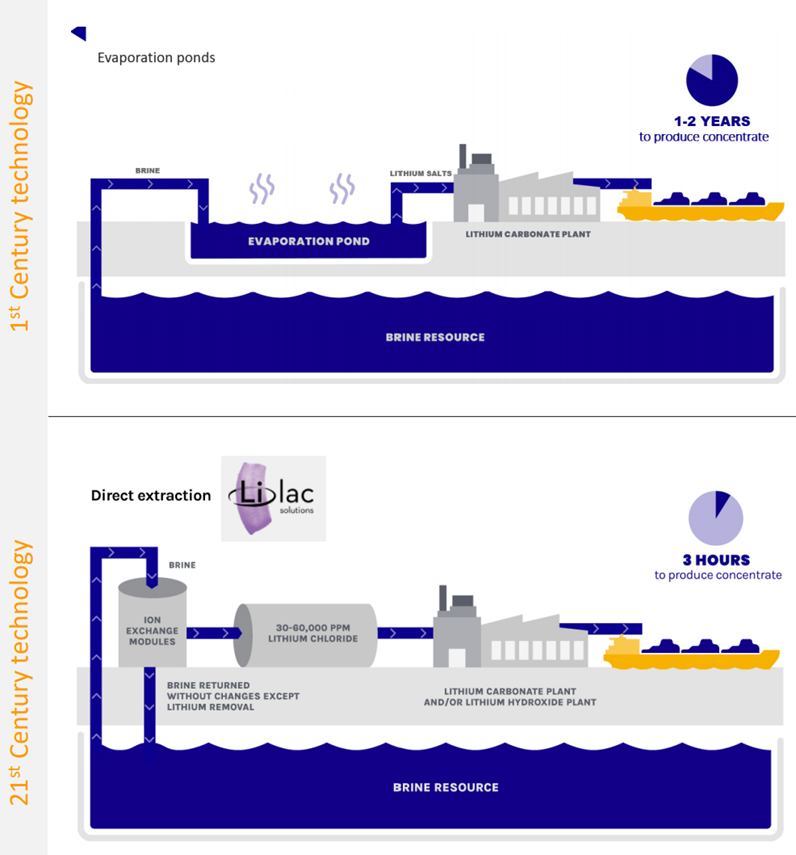

In its presentation, Lake Resources also highlighted the ‘significant ESG benefits’ of its direct lithium extraction process, supported by Breakthrough Energy Fund, an organisation led by Bill Gates.

Lake highlighted the lower environmental impacts of its Kachi Project in Argentina, referring to the project as the ‘world’s cleanest lithium.’

How does this ESG trend relate to lithium mining?

As we’ve covered this year, investor demand for environmental, social, and governance projects is surging.

While lithium is a vital material for a sustainable future, extracting lithium is often not environmentally friendly.

BloombergNEF estimates, for example, that ‘each ton of lithium extracted from brine requires 70,000 liters of fresh water. Making matters worse, much of lithium mining happens in regions that are already water-stressed.’

Just last week, German automaker giants Daimler AG and Volkswagen AG launched a study into the environmental impact of lithium mining in Chile — the second largest supplier of the white metal.

But LKE is not alone in emphasising its ESG credentials.

Renascor Resources Ltd [ASX:RNU] — supplying raw materials key for lithium-ion batteries — was earlier this year scouting green financing options for its battery anode project.

And one of the ASX’s largest lithium stocks — Vulcan Energy Resources Ltd [ASX:VUL] — is building what it calls a world-first lithium plant with a zero-carbon footprint at its geothermal lithium brine project in Germany.

LKE Share Price ASX outlook

One question investors may have is this: Is the difference between 99.97% and 99.5% battery-grade lithium carbonate commercially significant?

Can Lake quantify the commercial benefits for manufactures acquiring its 99.97% purity lithium over the 99.5% purity lithium of its rivals?

While Lake’s presentation didn’t include data to answer these questions, LKE did say that its ‘premium battery quality product … strengthens Lake’s quality benefits and assists offtake discussions.’

Additionally, while the commercial benefits for battery manufacturers of using Lake’s premium lithium were not elaborated upon, one consequence of Lake’s high-purity product is premium pricing.

LKE’s presentation included estimates suggesting Lake can fetch US$13,000–16,000/t for its premium-grade LCE on direct extraction costs of US$4,100/t.

Lake Resource classified this as equating to a ‘very high margin’ that compares favourably to companies using brine evaporation or hard rock extraction.

The estimated price for its premium lithium carbonate was also higher than the estimated prices charged for lithium carbonate extracted from brine evaporation or hard rock.

LKE ended the presentation by arguing its prospects have ‘significant upside’, citing analyst price targets from Roth Capital, Lodge, and Orior Capital in the range of 79 cents to $1.89 per share.

Lake Resource’s presentation comes when lithium stocks are riding a strong wave of interest recently.

Governments are eyeing off a greener future while enterprises are eyeing off profitable ways to accelerate this future.

Lithium is at the core of this as the white metal is a key part of the global EV supply chain.

Therefore, if you want more information on a sector enjoying resurgence, I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report