Lake Resources [ASX:LKE] released its March quarter results on Thursday.

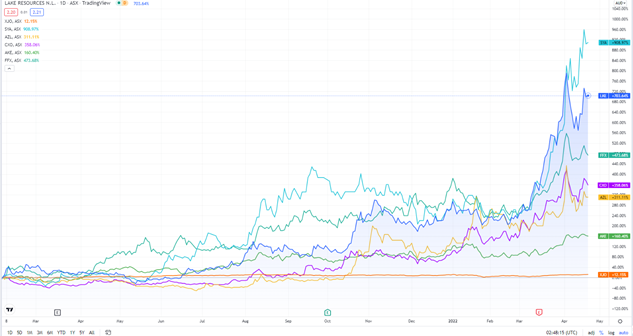

Lake continues to demonstrate the strong interest in the lithium sector, with the lithium developer up 670% in the last 12 months.

In the last month alone, LKE shares gained 35%.

Other lithium juniors are enjoying strong runs, too. Sayona Mining [ASX:SYA], for instance, is up 780% in the last 12 months.

But how long can the lithium boom last?

Source: Tradingview.com

Lake’s March quarter update

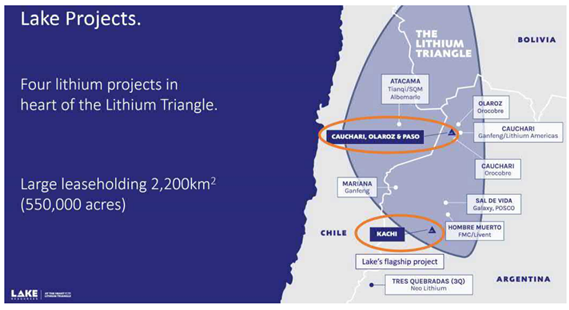

In the March quarter report, LKE took the opportunity to summarise recent developments associated with its flagship lithium project in Argentina.

The non-binding Kachi memorandum of understanding (MOU) between Lake and Japan-owned Hanwa still stands with 25,000 annual tonnes lithium carbonate to be taken over a 10-year term.

Equity investing and further financial support has been proposed in strengthening the new partnership.

Ford had also signed an MOU with LKE earlier this month for an offtake of around 25,000 annual tonnes of lithium from the Kachi Project.

General construction will receive funding of AU$111million (US$82million) in cash, which was reported for final investment decisions in the update.

AU$39 million was raised this quarter by means of its at-the-market facility, supported by lithium prices rising above benchmarks figures — rising from US$70,000 to US$79,000 a tonne.

Additionally, the Definitive Feasibility Study now supports 50,000 tonnes of lithium carbonate to be produced by the Kachi Project.

And UK and Canadian Export Finance have agreed to support around 70% of Kachi’s expanded production targets.

Lake aims to develop Kachi Project production to 50,000 annual tones of battery quality lithium carbonate to market in 2024.

Project value has been calculated at US$1.6 billion with an annual EBITDA of US$260 million.

Capital cost estimates came to US$544 million, calculated at US$4,178 per tonne of lithium.

Olaroz, Cauchari, and Paso lithium-brine drilling have also been brought forward to maximise lithium asset expansion in Argentina.

100,000 tonnes of lithium a year is expected to reach the market by 2030 thanks to LKE’s TARGET 100 Program which supports the Argentina projects.

Solar hybrid power will now be utilised so that a low carbon footprint and lower operating costs might be achieved.

Argentina projects. Source: Lake Resources

Lake Resources share price outlook

Now that the EV revolution is firmly afoot and the demand for lithium-ion batteries well established, investors will likely start expecting Lake Resources to turn attention from aspiration to execution.

That will involve securing financing for the project and signing binding offtakes to cinch forward sales.

The recent agreements with Ford and Hanwa are positive in that regard, so, too, the financing discussions with export finance agencies.

The lithium era does not appear to be dissipating just yet.

With prices reaching record highs, the biggest worry is supply.

Even Tesla’s Elon Musk has been flirting with the idea of lithium mining, showing just how sparse the supply is right now.

If you are interested in lithium stocks, you may want to read Money Morning’s latest research report identifying three overlooked stocks in the sector.

Access the report — freely available — here.

Regards,

Kiryll Prakapenka,

For Money Morning