Lake Resources [ASX:LKE] plummeted on Wednesday following a dispute with its key technology partner, Lilac Solutions.

It appears the partners were struggling to agree on certain specifics regarding milestones, which should’ve been outlined in the Pilot Project Agreement signed by both parties last September.

Under the partnership agreement, Lilac will contribute its Direct Lithium Extraction (DLE) technology, engineering teams, and an on-site demo plant, earning a maximum 25% stake in LKE’s Kachi project.

However, Lilac and Lake Resources are now disputing the timing of certain milestones, with LKE stating they were meant to be completed by the end of September.

Lilac thinks it has until 30 November.

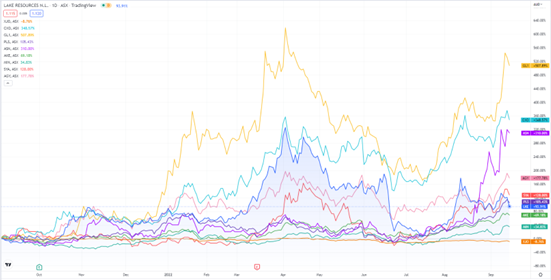

Investors are worried by the development, sending the lithium stock’s shares 15% lower on what was already a red day for markets following an alarming CPI print in the US.

Source: www.tradingview.com

Lake and Lilac at odds over Kachi milestone dates

Both LKE and Lilac seemed to have had different ideas on key dates for milestone delivery for their shared Kachi project.

Lilac is expected to deliver the following milestones in order to achieve its 25% stake in Kachi:

- ‘Completing at least 1,000 hours of operations (including uptime, maintenance, monitoring, and other work that constitutes operations as determined by Lilac in its reasonable discretion) of the Lilac Pilot Unit onsite at Kachi provided; and

- ‘producing a Lithium carbonate feed totalling at least 2,500 kg of lithium carbonate equivalents from onsite operations’

LKE believes these milestones must be achieved by 30 September. As stated above, Lilac believes it has until 30 November.

How can the two parties — working so closely together — come to a disagreement over dates?

Wouldn’t the schedule be one of the first things nailed down in any contract?

Lake said the milestone terms were outlined in the Pilot Project Agreement ‘dated on or about 21 September 2021’.

However, investors weren’t privy to the details of this agreement, at least not the details about strict timelines.

In a release about the partnership, Lilac did sketch out the key commercial terms (emphasis added):

‘Lilac can earn up to a 25 percent interest in Lake Resource’s Kachi Lithium Project in Argentina through a shareholding in Lake’s subsidiary, Kachi Lithium Pty Ltd, which is the 100 percent indirect owner of the Kachi Lithium Project), in the following stages:

‘Stage 1

‘Lilac will earn 10 percent on committing to fund at its cost the completion of testing of its technology for the Kachi project in accordance with an agreed timeline.

‘Stage 2

‘Lilac will earn a further 10 percent on satisfying all agreed testing criteria using the demonstration plant at the Kachi Project in accordance with an agreed timeline.

‘Stage 3

‘Lilac may earn a further five percent on refined lithium chemical product from Kachi achieving the highest agreed qualification standards with certain potential offtake partners.’

How can a dispute arise over an ‘agreed timeline’?

Did exogenous delays create a misunderstanding about the enforcement of the timeline? After all, the pandemic has jolted supply chains.

Amended agreement or arbitration?

Lake Resources said it’ll be seeking to resolve the dispute by either drawing up another agreement with Lilac, or, if that doesn’t work, by seeking a resolution via arbitration.

It was also stated that if ‘milestones are not achieved by the required date’, Lake may utilise ‘certain buy back rights’, and has expressed the consideration of exercising this option.

The lithium miner also added that the project’s DFS is continuing, and that further updates on both matters will be released as and when the time arises.

The difference between 30 September and 30 November doesn’t sound like much.

What are two months worth, really?

For Lilac, millions.

If LKE is successful in enforcing the 30 September deadline, Lilac may stand to lose a big chunk of its earn in rights…and the prospective payoff that entails.

Conversely, LKE stands to benefit if it can claw back a larger equity share of the Kachi project.

Time is of the essence.

Overlooked ASX lithium stocks

In 2021, lithium stocks dominated the ASX — eight of the 10 ten best-performing stocks on the All Ordinaries in 2021 were lithium stocks.

But lithium stocks haven’t fared as well in 2022, with many of last year’s high-flyers trading well below their 52-week highs.

The easy money has already been made; it seems.

So does that make it too late to consider the lithium sector?

Two of our top analysts wouldn’t say that’s the case.

In fact, they have recently profiled three Australian lithium stocks they think are being overlooked by the wider market.

Regards,

Kiryll Prakapenka,

For Money Morning